[ad_1]

Although financial groups eventually controlled the budgets in their companies, investment in technology was limited by the chief financial officer – at least until recently. Terlosio CEO Carlos Vega confirms that most financial transactions were carried out in spreadsheets and word documents prior to the outbreak.

“Cash is becoming a priority for all organizations. The main competitor of the industry is manual, prone to error and incompetent, but unable to work the old way… Suddenly, [tools like automation] It goes from vitamin to painkiller, ”Vega told Tech Crunch in an email. “With the current inflation, companies are losing more than 2% of their deposits every 90 days. That may not seem like much, but for a mid-market business with an unpaid $ 10 million balance, that would cost them $ 210 a quarter or two for a year.”

Vega, of course, has a promotional product – Tesorio sells automation solutions designed to help its customers manage bills. But at least one source supports the question of whether automation can change accounting processes better. A.D. In April 2022, a study published by American Express and Pimns.com reported that two-thirds of automated accounts had benefited from improved sales (the average number of days it takes for the company to collect post-sales payments).

“Historically, the accounting process has been based on ethnicity in the accounting team,” Vega said. “They know from personal experience that one customer will always pay ‘X’ late and another day will be canceled. ‘

Tesorio tries to capture this knowledge by using AI models that look at customer payment history and predict when to pay. Vega founded the company in He met Fabio Fleetas in 2015 while studying business at Worton School in Pennsylvania.

Tesorio initially focused on supply chain finance, helping businesses save money by paying their small and medium-sized suppliers in advance. But a year later, the start was in Vega’s words “to serve the companies directly.”

Investors seem to support the move. Today, Tessorio closes the $ 17 million Series B round BAMCAP Ventures with Participating with Madrona Venture Group, First Round Capital, and YouTube CEO Susan Wojchiki and her sister, 23andMe co-founder and CEO Anne Wojchiki. Floodgate, FundersClub, Hillsven, Mango Capital, Carao Ventures and Xplorer Capital also contributed, bringing Tessorio’s total to $ 37.6 million.

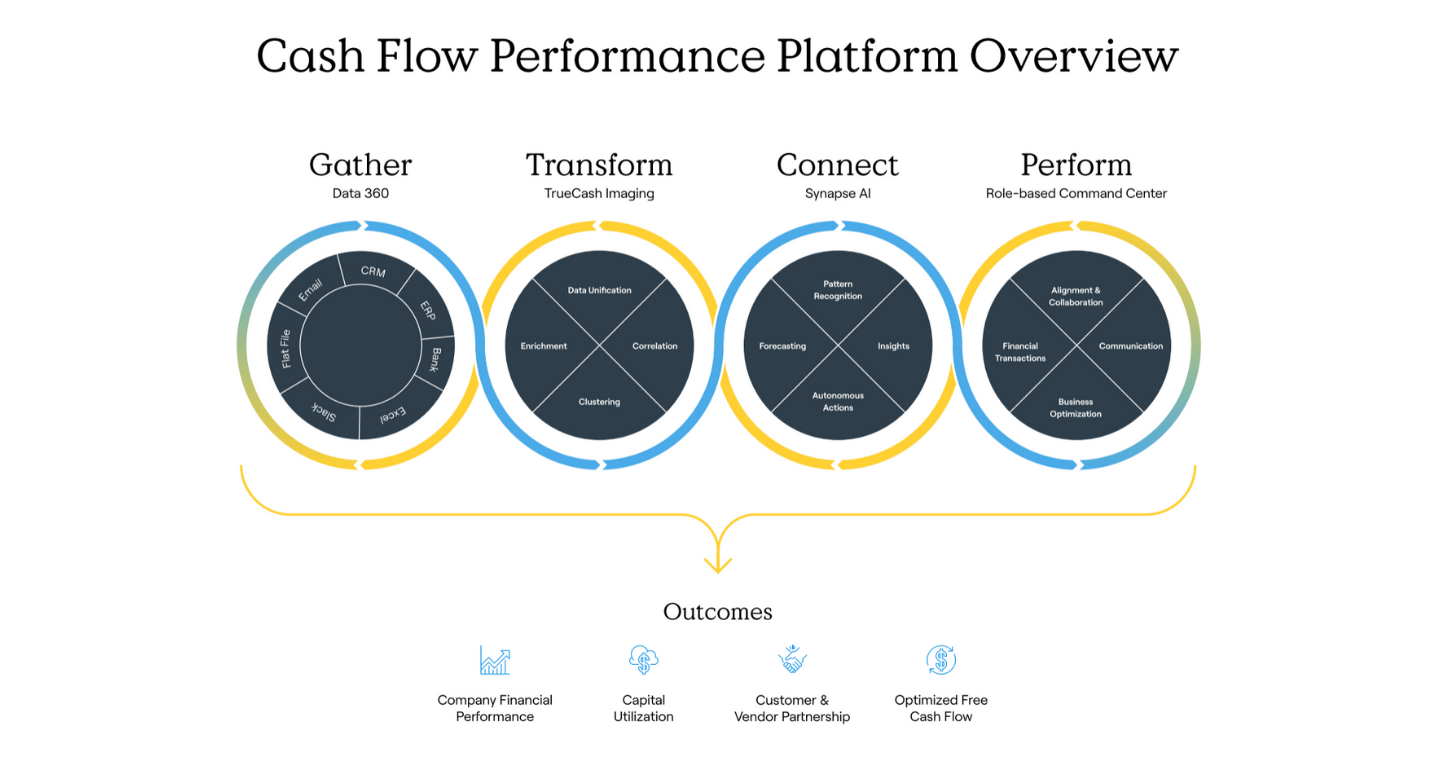

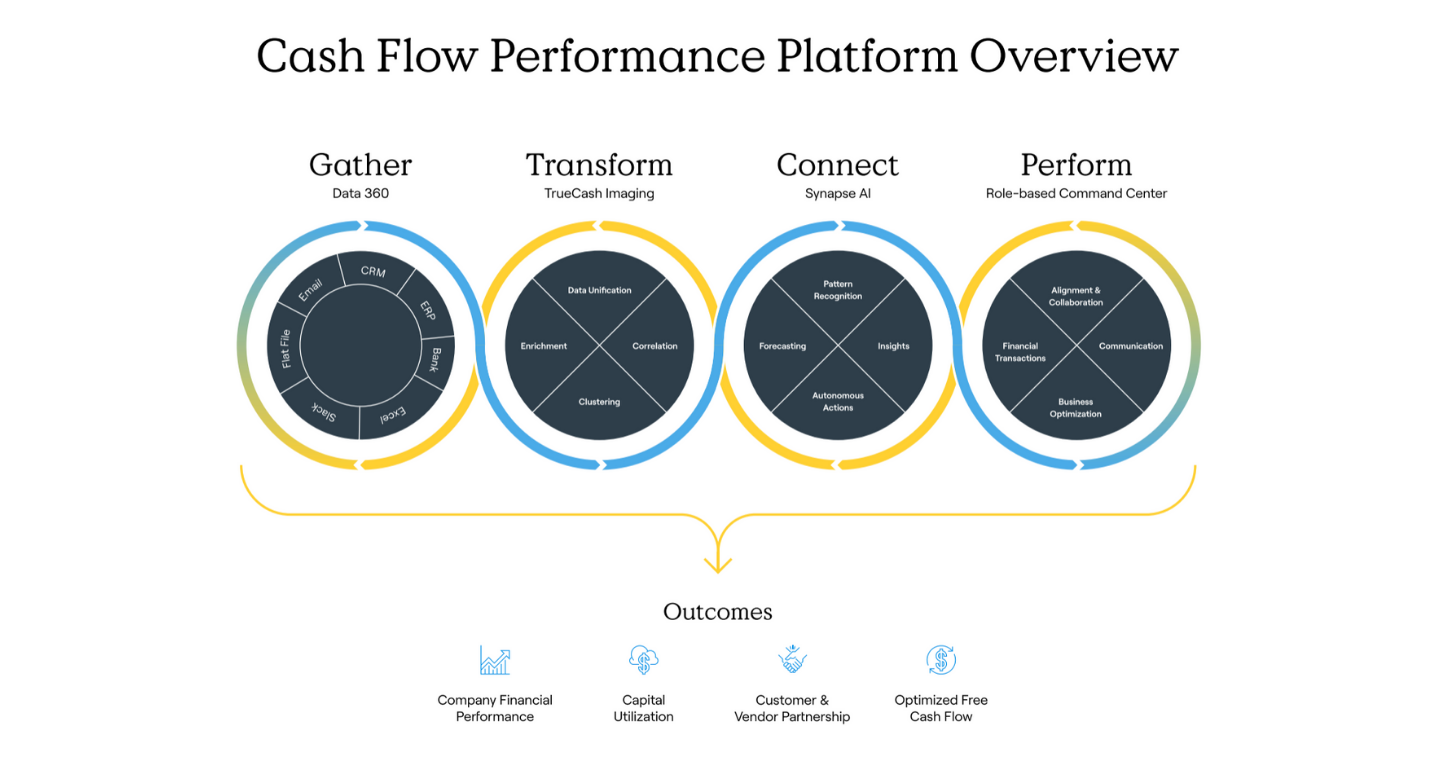

Businesses will be able to automate the receipt of their accounts using the Tessorio platform. Image thanks Treasury

“I’ve worked in finance for ten years, most recently at Lazard Investment Bank in Latin America. I set up a one-sided business to support small and medium-sized business receipts. He wanted to find out, ”Vega said. [the modern] Tessorio was reborn with Couchbase and Veeva Systems, one of our first three clients.

Tessorio customers can connect their enterprise asset management and customer relationship management systems to the platform to train the above payment forecast AI models. Training takes about 30 days, with an average of 5 days, says Vega.

“The models የሚችሉ can train themselves by looking at our anonymous billing history and cover billions of transactions to further refine and improve the accuracy of forecasts,” Vega added. “Companies can be better able to plan their growth, be stronger, and be able to carry out their own mission without having to rely on external capital sources.”

Tesorio allows customers to create email reminder templates and self-service login credentials. And at the end of the day, the platform hosts digital workspaces that allow teams to share notes and collect received data in one place. From workplaces, teams can monitor metrics and cash flow performance, use out-of-the-box reports or build their own from scratch.

Many vendors compete for business in the remittance management space. Software As-Service: Upflow, Tipalti and Quadient-owned IPPIs, which offer products focused on collecting money from advanced receipts. It is intended to simplify the collection of Yaidu. Another startup, Purpei, recently raised $ 1 million to help enterprises reconcile and control payments across Africa.

A daunting challenge for Tessorio and its competitors is convincing companies that they need the software. It is an obstacle in any industry, but especially finance, where teams are able to modernize their processes. According to a study by Billstrest, 86% of accounting groups consider their department to be “too” or “to some extent” modernized, 40% do not provide self-service capabilities, and more than 60% do not digitize their receipts.

Vega believes that the economic wind could help the Tessorion issue. While startups have not had a positive cash flow, Vega has more than 130 customers, including Slack, Box, Twilio, GitLab and Bank of America.

“For the third year in a row, the money follows a three-digit revenue growth. We expect strong growth momentum over the next two years, especially given the new focus on cash flow, ”said Vega. Although the current inflation and high interest rates have slowed down decision-makers in terms of spending, there is a big, positive, focus on Tessorio prices. In a world where cash is the king and capital is not a name, the existence of a product like Tessorio is more important than ever before.

Vega said the proceeds from Tessorio’s latest financing will be used to expand the company’s marketing efforts and product development and increase the team from “50 northern” employees to about 90 next year.

[ad_2]

Source link