[ad_1]

A rebound in tech stocks offers a strong buying opportunity. But with most tech stocks losing big, picking the right one is tough. This is where ETFs (exchange-traded funds) come in handy. There are some great sector-focused ETFs that can give you exposure to high-growth tech stocks and reduce overall risk. Among technology-focused ETFs, investors may want to consider investing in Invesco QQQ Trust (Invesco).QQQ).

Why invest in QQQ?

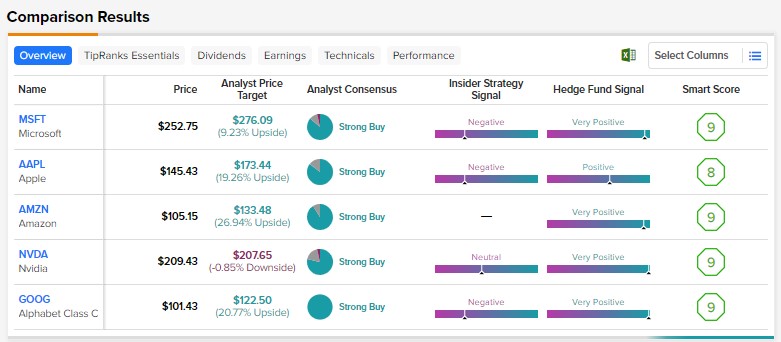

Invesco QQQ tracks Nasdaq-100 data (NDX) showing that investors can gain exposure to large tech stocks by investing in this ETF. With the help of TipRanks’ Stock Comparison tool, here’s a summary of QQQ’s top 5 holdings as of February 1st.

It holds 49.7% of the total holdings in the information technology sector. Meanwhile, communication services account for 16.46%.

Interestingly, this ETF beat the S&P 500 index.SPX) in nine of the last 10 years. Specifically, a $10,000 investment in Invesco QQQ has turned into $48,359 over the last 10 years (starting January 31, 2023). The S&P 500 index changed the same amount to $32,996.

QQQ has a low expense ratio of 0.20% (ETF management fee). Moreover, it has a P/E (price-to-earnings) ratio of 21.29%, which is attractive given its recent pullback.

Is Invesco QQQ a good long-term investment?

On TipRanks, the Invesco QQQ ETF has a SmartScore of eight, making it highly likely to beat the broad market average.

Additionally, Tipranks data shows that all five top holdings (accounting for 37.93 percent of total holdings) have a QQQ Smart Score of at least eight out of 10. It outperformed the benchmark index.

Overall, the Invesco QQQ ETF is a smart way to gain exposure to large tech stocks and reduce overall risk.

Disclosure

[ad_2]

Source link