[ad_1]

Hello, and welcome to the Protocol Apocalypse. Err, climate. Sorry, we got carried away. Guess there’s something in the air. Anyway! Today, we examine the tech winners of the Manchin-Schumer deal and the future of the oil industry, bringing you news on how to stop the apocalypse. Hang up.

Announcing the winners of the Inflation Act…

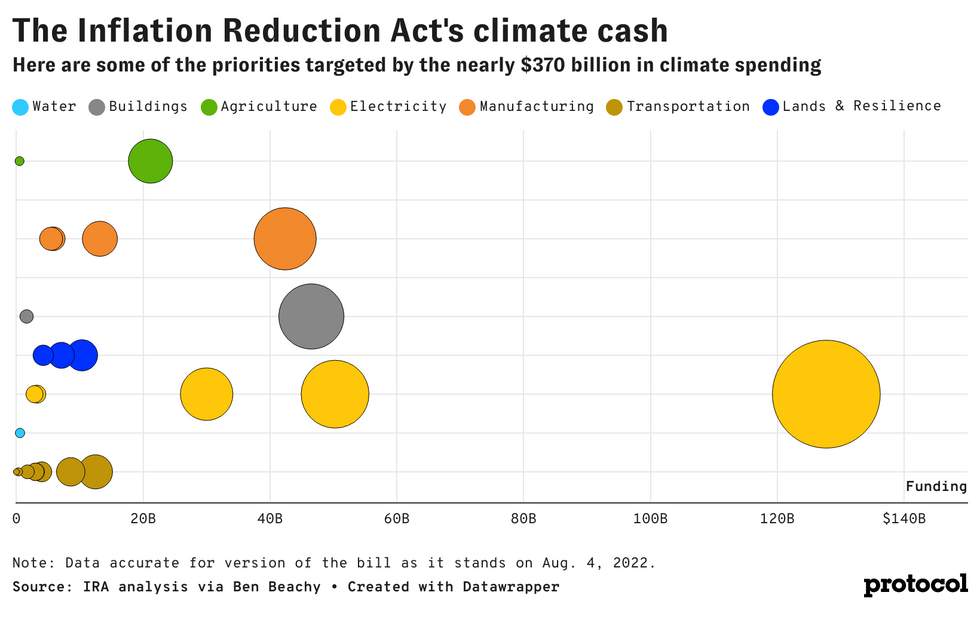

At 725 pages and $369 billion in climate investments, from direct investments to tax credits to research funding, the Inflationary Reduction Act is ambiguous.

How it is distributed and distributed has huge implications for startups working on on-the-ground solutions. This week, fellow newspaper Climate Tech VC published a tracker detailing which sub-sectors will benefit most from the bill. I sat down with the paper’s co-founders, Sophie Purdom and Kim Zhu, to find out who the biggest winners would be if this bill passes.

Protocol

There are certainly some sectors that could see transformational investments. That can make them attractive places for tech startups to focus their efforts. And private climate capital is like industries that can help unlock even more carbon savings.

- The built environment is one of these big winners, with nearly $9 billion allocated. That money supports everything from consumer home energy rebate programs (for home electricity and energy-efficient retrofits) to tax credits for heat pumps.

- Startups working in that space, such as BlocPower, Sealed and Dandelion Energy, could reap the rewards, Zoe and Purdom said.

- Agtech could see growth with $20 billion allocated to encourage smart farming practices and reforestation. While this directly affects farmers and ranchers participating in voluntary conservation programs that can store carbon in the soil, it also has perverse effects on initiatives that support regenerative agricultural practices.

- There is also a lot of funding earmarked for local manufacturing. Interestingly, many of the product investment tax credits target historically underfunded clean technology, Zhu said.

- Batteries, critical minerals processing, and electric vehicle manufacturing are among the industries that will experience significant growth at a time when supply chain and national defense priorities are driving them forward.

- It’s interesting to see investments in building a domestic battery supply chain, “with the current renewables price curve,” Zhou said. Startups lined up to acquire include everything from SPAC’d EV companies like Rivian to existing GM and LG Chem venture Ultium, which has just received $2.5 billion in conditional approval from the Office of Energy Loan Programs.

Perhaps the most surprising winner? Environmental justice initiatives. Zhu pointed to the problem of the “green premium,” a term coined by Bill Gates to describe the high costs associated with new climate technologies that could exclude low-income households from the clean energy transition.

- “The bill seems to be making a real effort to have a fair and just transfer of power,” Zhu said.

- Among the investments are $5 billion for the Environmental Protection Agency to reduce climate pollution and $6 billion for community-led environmental health initiatives.

- Tech and environmental justice don’t seem to go together right away, but the potential is clearly there. Aclima, a start-up that monitors air pollution, and platforms such as GreenWorks, which help hire highly skilled workers for green jobs, can benefit from this funding.

In short, everyone benefits from historical IRA investments. The surprising thing about the law is the breadth and diversity of the sectors it will benefit from. The bill isn’t just focused on solar and wind, the traditional heroes of clean tech. (Even if they reap the benefits of the clean electricity portion of the bill.) “There are benefits to the landscape of climate capital, and it’s important in itself because it’s connected to climate technology,” Zhu said.

Of course, the benefits would have to be passed by Congress for them to be realized.

– Michelle Ma (email | Twitter)

The future may not be a gas station.

Jonathan Levy spends a lot of time thinking about the future of the gas station. Or, rather, how car charging in the future may have nothing to do with gas stations.

Levy is the Chief Commercial Officer of EVGO, one of the largest electric vehicle charging companies in the US. A station model that has ruled America’s roads since the early 1900s.

Charging companies are innovating. “EVgo has agreements with Whole Foods, Albertsons and Kroger to make sure there are charging stations wherever you go,” Levy said. Competitors like Flo have partnered with utilities like ConEd to install chargers on city streets.

- A growing charging model is based on accessibility rather than speed — charging an EV still takes longer than pumping gas — to make things more convenient for drivers.

- The Biden administration will provide $7.5 billion in funding to states to build charging infrastructure as part of a bipartisan infrastructure bill. That could further spread the decentralized charging model.

- “Unlike a gas station that’s been fixed for 100 years, the charging station is going to be this flexible, dynamic type of construction from day one,” said Los Angeles design officer and USC professor Christopher Hawthorne. .

… But they’re also borrowing from old gas stations. And there are more than 116,000 gas stations today. Those 100 years of history have something to offer EV charging companies as they plan for the next 100 years.

- Evigo last month announced a partnership with General Motors to build a network of 2,000 fast chargers at 500 Pilot and Flying J travel centers.

- Earlier this year, Electrify America revealed plans for its own charging stations that look an awful lot like their gas station counterparts.

- These stations are located near places like shopping malls – if drivers want to run errands – and include lounges if they want to relax, which means that even a quick battery charge takes less time than filling a tank. .

- Although gas stations have negative environmental impacts on their neighborhoods, in some places—especially communities of color where other retailers are rare—gas stations are an important part of the social fabric.

The Biden administration has committed 40 percent of federal climate and energy investments to benefit disadvantaged communities. It’s a big credit to Levy, but fair enough, for ensuring that the EVGO charging stations are deployed in a way that’s convenient for drivers. “Many communities of color were in food deserts. [been] Levy said, citing racist lending practices. “If you only follow those places, you’ll accidentally repeat those mistakes.”

– Kwasi Gyamfi Asiedu (2010)email)

Sponsored content from Micron

Chip shortages could affect national security: A global shortage of semiconductors has halted production of everything from pickup trucks to PlayStations. But there are far more serious implications than shortages of consumables. Experts say our national security could suffer if the United States does not ensure continued domestic access to leading-edge semiconductor manufacturing.

Read more from Micron

Let it rain

British nuclear fusion company First Light Fusion It raised $486 million in its last funding round, the largest round ever by an energy startup in the country.

Nothing screams “future” like robo-renewables: Terabase Energy With $44 million in Series B funding from Breakthrough Energy Ventures and Prelude Ventures, it has gained a lot of faith in its vision to automate solar panel installations.

VoltStorageThe German energy storage company has received an investment of 24 million dollars from Cummins Energy Technology Company.

Aurora HydrogenA Canadian startup using a microwave-based technique to produce hydrogen from methane gas without carbon emissions has raised $10 million in Series A funding led by Energy Innovation Capital.

The VC arm of printing giant Xerox has made a $7 million investment in a lithium-ion battery recycling company. Lee Industries As part of a Series A financing round.

Consumer-focused climate fund Regeneration.VC has invested $7 million Smart sortingA data company focused on sharing chemical and ingredient information on consumer products to promote sustainability.

The beginning of Puerto Rico Rain coatAnthemis, which aims to provide customizable insurance to protect individuals against climate risks, has raised $4.5 million in its seed funding round.

Meanwhile, a private equity firm Acts It will have a controlling stake in the Dubai Solar Platform Yellow door energyIt already has over 100 MW of solar capacity and 100 MW more under development.

Sponsored content from Micron

Chip shortages could affect national security: To ensure America’s security, prosperity and technological leadership, he said, the U.S. should encourage domestic chip production to reduce our dependence on East Asian manufacturers for critical electronics.

Read more from Micron

Thanks for reading! As always, you can send any and all feedback. weather@protocol.com. See you next week!

[ad_2]

Source link