[ad_1]

In recent months, there have been many news reports suggesting that the cruise industry is in for some tough times. Those sentiments aren’t exactly unexpected with a looming recession and inflation around the world.

However, according to recent research by HunddX, an innovative real-time market share strategy platform, the cruise industry may be stronger than previously expected. The industry may soon show more significant recovery numbers than other travel segments, setting the stage for leaps and bounds ahead of pre-pandemic numbers.

Inflation and recession could overtake the cruise industry.

with Stock prices at all time lows, the cruise industry is definitely not the first place investors look to get a good return on investment. Although Carnival’s stock topped $11 last week, the world’s largest cruise operator is back to $9 today.

Similar examples can be seen at Royal Caribbean and Norwegian Cruise Line, although these two are doing better because debt has not weighed heavily on their finances. Even then, confidence in shipping companies appears weak, with prices expected to fall further as inflation and recession begin to take hold in households around the world.

However, this feeling is outdated Market share strategy platform. In a study released on data collected from more than 35,000 cruise lines, the company is leading a stronger recovery than other travel segments such as airlines, hotels and car rentals.

As vacationers increase their desire to cruise again before the end of 2022, the industry is expected to continue its upward trajectory, building significantly from March 2022.

The methodology behind the research conducted by Hundred X, looking at the desire to book a cruise, found that customers would, yes, book a cruise this year, unless they didn’t want to. While the numbers were at -25% in 2020, the numbers rose to +20% in the first quarter of 2021.

These numbers fell in March 2022, but the three months to June 2022 showed continued improvement. The level of growth this summer shouldn’t have come as a surprise to investors, with “the crowd” making it clear they plan to keep going.

The fear of recession and inflation may be big news in the media, but so far, the impact on cruise companies is small, and this is not surprising when we look at what is happening in the industry itself.

After the epidemic, many people return to the boat every day

In the first days of the global strike, shipping executives could not contain their excitement. Bookings were sky high, and the industry will soon bounce back. However, that may be appearing more to investors than it actually is.

With billions in debt, the cruise industry needed people, and nothing would get people on board more than saying that everyone is doing it. However, with Covid-19 still a real threat, vaccination in its early stages, 30-40% occupancy rates, and drastic measures, not many people are taking cruises.

Currently, the situation presents a very different reality. People are returning to sailing in droves. Because ships have proven to be a healthy and safe vacation option with vaccination obligations and pre-cruise testing.

Add to that the issues that airlines and airports seem to face with the influx of passengers, and suddenly a cruise is a great option.

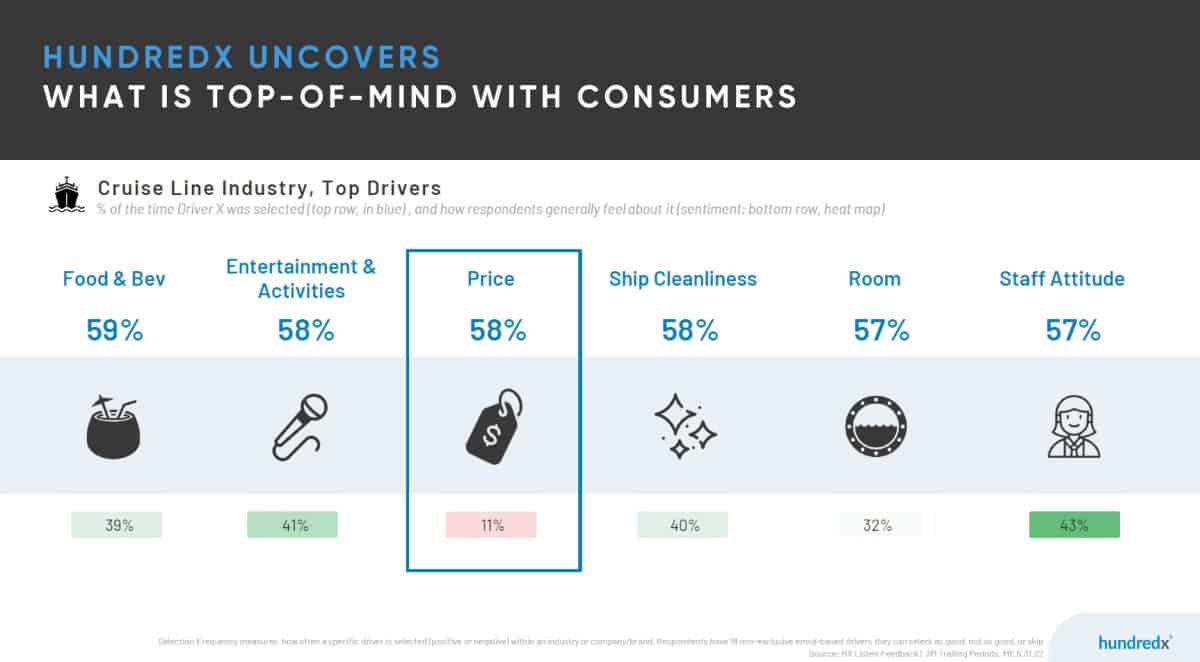

Cruise buyers point their top booking drivers to HundredX, and here, too, what many other vacations can’t offer, are good food and beverage quality, low prices, ship cleanliness, entertainment, staff service, health and safety focus, and comfort. Government departments.

Yes, cruise companies are struggling to keep up. The huge debt they accumulated during the pandemic. However, with cruise companies closing their fuel early, higher fuel prices did not affect prices.

Yes, Cruz shares are still very low. But this may be due to misplaced sentiment from investors. The numbers show that cruise travel is very popular or more popular than ever.

[ad_2]

Source link