[ad_1]

Ten years ago, commodity markets were reaching the peak exuberance of supercycles, as commodity trader Glencore was preparing for a $ 60 billion overproduction on the London Stock Exchange.

A decade later, a sharp rise in the price of key commodities revives the discussion on a commodity commodity structural “structural market” driven by strong demand from China, government spending on post-recovery programs pandemic and the bets on the “greening” ”of the global economy.

“If we hope we can see a relatively quick resolution in the [pandemic] the situation in India, then in our lives we have not seen a macroeconomic configuration like this, ”said Saad Rahim, chief economist at Trafigura, one of the world’s leading independent commodity traders.

“We have gone from China to be the only commodity history of the last ten years so far in the rest of the world to picking up the reins and being true contributors alongside the demand for the equation.”

Last week, iron ore, the key ingredient needed to make steel, palladium, used by vehicle manufacturers to limit harmful emissions, and wood, have reached all-time highs. Agricultural commodities, such as cereals, oilseeds, sugar and dairy products, have also risen, with wheat prices above $ 7 per bushel for the first time in eight years.

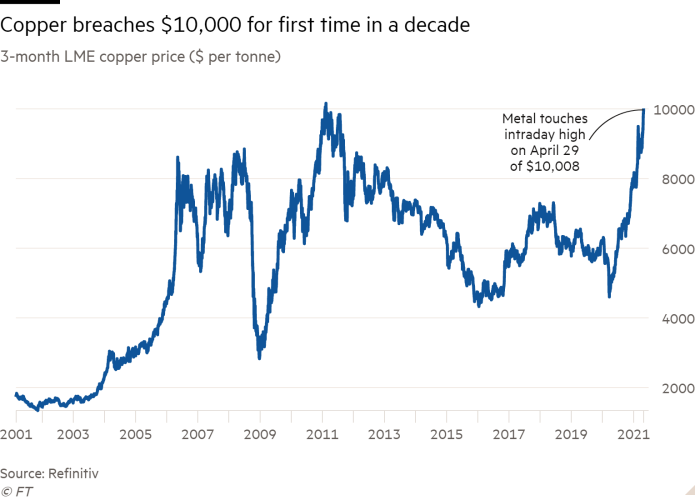

At the same time, copper, the world’s largest industrial metal, was trading above $ 10,000 for the first time since 2011, while soybeans hit a eight-year high. The S&P GSCI spot index, which tracks price movements in 24 commodities, is now up 21% this year.

After wasting most of the past decade, industry specialists ’predictions about another supercycle (a prolonged period of high prices as demand outstrips supply) have attracted investors.

The sector has also had the support of fund managers looking for assets that will benefit as the global economy speeds up after the pandemic and can also act as a hedge against rising inflation.

“President Biden has proposed two additional stimulus plans to the one he has already approved. If any of that happens, you’re just overfeeding all of that. This is just beginning,” Rahim said.

The rapid recovery of China, which is the world’s largest consumer of raw materials, and increasingly Europe and the United States, where the real estate market is booming, have fueled demand. Covid-related low inventories and supply chain disruptions have added more fuel to the fire.

“I don’t know if we’ve seen anything like this before,” said Ulf Larsson, executive director of Swedish pulp and wood company SCA, which on Friday announced a 66% increase in first-quarter net profit. “We’re in a kind of perfect storm.”

A set of raw materials needed for electric vehicle batteries and electric motors, from lithium to rare earths, has also been ravaged by euphoria.

China’s hunger has driven lithium carbonate and lithium hydroxide prices up more than 100% this year, according to Benchmark Mineral Intelligence, after nearly three years of decline. Rare earth neodymium-praseodymium (NdPr) oxide, used in electric motors, increases by almost 40%, as does cobalt, a battery metal.

“You have an EV supercycle and add a commodity supercycle, plus it’s a game for miners,” said Simon Moores, CEO of Benchmark Mineral Intelligence.

Commodities tied to gasoline cars are also being concentrated. The price of palladium, a metal used in catalytic converters to filter exhaust gases, hit a record above $ 3,000 an ounce on Friday, while Europe and China make up emissions standards stricter.

This is likely to outpace the slowdown in global car sales of internal combustion engines, according to Jefferies analysts.

Oil prices have also been strong, recovering to pre-pandemic levels above $ 65 a barrel since the start of the year. While demand is still depressed by the limitation of international travel, it has increased as economies have reopened. Opec and allies like Russia continue to restrict supplies, only slowly adding barrels to the market to bolster the price.

Goldman Sachs said this week that it expected oil prices to reach $ 80 a barrel during the second half of this year, and warned that there would be a significant supply deficit this summer as launches accelerate. of vaccines and people go on vacation, which will increase demand by more than 5% worldwide.

While the Opec + group could restore production if prices rise too much, some analysts are concerned about the long-term supply prospects as major energy companies move away from fossil fuels.

Christyan Malek, an analyst at JPMorgan, has argued that a serious supply gap could emerge in the coming years, with a deficit of approximately $ 600 billion projected in capital expenditures by 2030. There is a “risk of overcoming oil prices as a non-OPEC supply falls short, ”Malek said.

However, how long the commodity frenzy will last needs to be debated. “It’s a mini supercycle,” said Alex Sanfeliu, head of Cargill’s global trading group, about the rise in agricultural commodities. “I do not think it will last as long as the last one. Supply and demand are reacting faster now. ”

A Shekar at Olam International, a major Singapore-based agricultural trader, said he did not see a steady rise in food commodities. However, he predicted that underlying demand will remain strong over the next six to twelve months as consumers eat out of a lockout year. “This can raise prices,” he said.

Some doubt the idea that we are entering a supercycle. “We think the price hike is likely to continue for a while, but it’s more of a business cycle hike than a supercycle,” said Jumana Saleheen, chief economist at CRU.

[ad_2]

Source link