[ad_1]

In recent years, mass disruption has changed the global workforce forever. Expecting more flexibility from employers will be more mobile.

Naturally, so many changes at once put enormous pressure on businesses with a global workforce, who expect employees to be able to work wherever they choose. For this reason, international mobility departments must now cope with the increased workload, as they must evaluate their policies and procedures to take into account the increased mobility of people, as well as the external economic, legislative and social factors that may affect these employees. And the wider business.

Understanding the pressures facing international mobility departments

As part of the review process, GM teams should validate their processes and quality control measures should be updated as appropriate. In recent years, technologies have begun to play a more significant role in helping teams manage change. However, many tasks and processes are still spreadsheets and manual intervention, which wastes resources and energy. Does this really have to be?

In general, tasks can be divided into two groups: manual and those that require human effort and can be automated. For example, tasks that are mostly data-heavy – and although they may require specialist knowledge, are usually in policy and process – can be automated, but those tasks that require some knowledge and experience – but often require intervention to make decisions – cannot. These activities require participation, energy and passion. These are usually procedures that people prefer to do rather than engage in repetitive, time-consuming manual tasks.

Of all GM activities, the most suitable area for automation is shadow payroll: payroll that does not physically pay the employee, but is a mechanism that allows the employer to meet their local payroll tax and reporting obligations at a host location. Duplicating or “shadowing” the take-home pay compensation report for workers assigned overseas or working remotely. However, for many companies, this area is still a time-consuming, stressful and largely manual task that conflicts with businesses every month. Shadow pay is a growing part of GM teams’ monthly work cycle due to the proliferation of a mobile workforce globally and the increasing need to keep up with legislative changes.

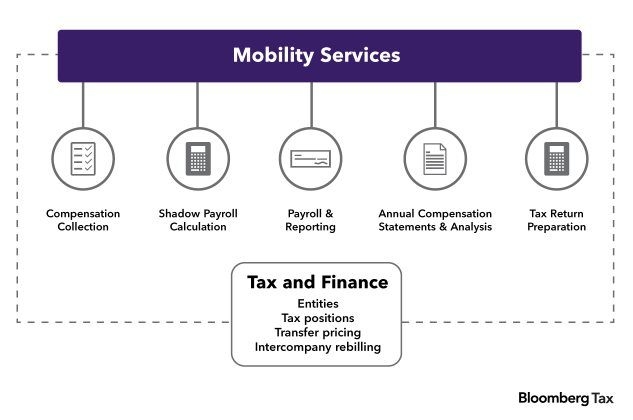

As shown in the figure below, the entire end-to-end global shadow payment process can be automated:

Of course, there will always be some jobs that require human intervention. These include staffing the system and investigating and resolving more complex issues. Providing face-to-face support for the global mobile workforce also remains paramount to ensure their experience is positive. Technology does not solve every problem; Instead, it provides an additional layer of support to help with most of the included functions.

This improved employee experience goes both ways. When teams are relieved of energy-draining tasks through automation, they’re free to focus on energizing tasks that require their resources. The result is a happier, more productive and more productive team.

Unfortunately, the idea of introducing such technologies is often rejected, because of the complexities of removing them from the ground. After all, for teams that are already overcrowded and overwhelmed, adding one more thing to the stress list is not a fun option. However, that concern simply does not reflect reality.

Using technology to simplify the complexity of international employment taxes

At first, adopting new technology can seem like a daunting task for management—where to start, which technology to use, and how to manage it?

Once those questions are answered, there is the added challenge of finding the skills, time and funding to move forward. All of this uncertainty can cause business management to step out of their comfort zone and question whether the solution is even worth the effort.

If this misconception of complexity can be released, GM and tax teams will see that there is an easy way to integrate technology to help business efficiency. This is the result of identifying which processes are manual and which require human effort and which can be automated.

The main assumptions

Rather than viewing technology as a stressful and complex investment, businesses should focus on three simple pillars when considering its adoption, as outlined below.

Cost: There will always be costs, it is important not to ignore the savings associated with the integration of technology and to consider how the two compare in the long term. Sometimes, these costs can be upfront and kept down, sometimes they can show savings (or lower cost penetration) immediately—as is often the case with software-as-a-service platforms.

SecuritySecurity continues to be a cornerstone of technology adoption. Today, it’s not enough to just think about your organization’s security; You should also consider the security of the third parties you work with, the level of compliance they maintain, and the potential impact on your organization if they experience a security lapse.

Ease of useWhen planning for technology adoption, start by assessing the key components you need, where they fit in your ecosystem, and what they solve. Once this plan is in place, adoption can quickly become an enjoyable experience, as businesses avoid difficult-to-use tools and instead prioritize those that plug directly into their stack.

Above all, businesses should ask themselves what problem they are trying to solve with the new technology. Remaining laser-focused on this helps them identify the technology that best meets the core business need. Flexibility should be a secondary consideration. It’s easy to fall for technology that provides a one-stop solution to many business challenges, but a better choice is to choose a flexible solution that has the ability to support the business as it evolves.

Finding the right tools

After considering the above points, tax teams can find the tools and technologies to automate their tasks, free up their teams, and stay ahead of the evolving GM landscape and payroll pressures.

Below are some of the technologies that can have an immediate impact on GM and tax teams.

Integrated application programming interface solutions: It’s critical that any solution a business gets can plug into their existing technology ecosystem and processes, without having to rebuild them. APIs make integration easier and help ensure that new tools and features don’t disrupt business continuity.

Low/no code devicesCodeless devices are breaking down barriers to entry for technological advancements. These allow business users to create their own simple tools—without the help of in-house technology teams—with the confidence that they won’t break anything in the creation process.

Case management toolsThese are often included in technology solutions to help business users organize their work and not miss anything. Examples include current state forms and specific tax calculators that help businesses stay on top of customer and employee tax requirements.

Collaboration tools: Any technology solution chosen by a business will be part of a comprehensive suite of third-party, best-in-class tools. This means that tools must be integrated and synchronized with each other, so that businesses can call it a “single source of truth” for all reporting.

The goal should not be to find a one-size-fits-all solution, but rather a set of tools that together provide the simplest, most secure, and most cost-effective solution to tax and payroll challenges.

By embracing technology and adopting best-in-class tools, mobility and tax teams can navigate the increasingly complex and evolving world of employment tax law. They will also benefit from automating their processes and reducing time, effort and energy wasted on tracking the world stage. Finally, these tax groups will have the support to avoid the problems of making mistakes by considering people and profit. This means they can take advantage of global opportunities and put invaluable resources—people-power and money—to better use elsewhere.

This article does not necessarily reflect the views of Bloomberg Industry Group, publisher of Bloomberg Law and Bloomberg Tax, or its owners.

Author information

Richard McBride is the founder and managing director of Certino.

The author can be reached at: enquiries@certino.com

[ad_2]

Source link