[ad_1]

Since the coronavirus pandemic began, consumers around the world have amassed an additional $ 5.4 million in savings and are increasingly confident in the economic outlook, paving the way for a sharp rise in spending as it unfolds. that companies reopen.

Households around the world accumulated the excess, defined as additional savings compared to the 2019 spending pattern, which equates to more than 6% of global gross domestic product, at the end of the first quarter of this year, according to estimates by credit rating agency Moody’s.

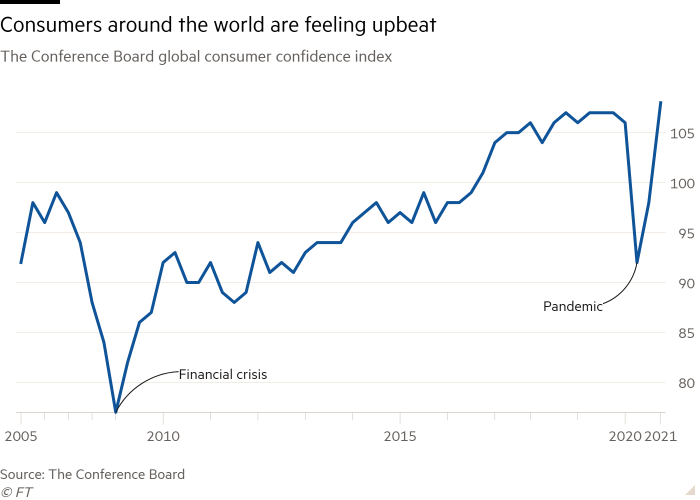

And growing global consumer confidence suggests shoppers will be willing to spend again as soon as shops, bars and restaurants reopen when restrictions are eased to control the spread of the virus. In the first quarter of this year, the Conference Board’s global consumer confidence index reached its highest level since registrations began in 2005, with significant rises in all regions of the world.

Mark Zandi, chief economist at Moody’s Analytics, said: “The combination of a trigger for significant cumulative demand and an overflowing surplus of savings will lead to increased consumer spending worldwide as countries move up. bring the herd immunity closer and open up “.

If consumers spend about a third of their excess savings, they would increase world production by just over 2 percentage points, both this year and next, according to Moody’s.

Although the world economy suffered the biggest drop in modern production in modern history last year, household incomes have been largely protected by unprecedented government stimulus plans in most advanced economies. . Consumers also reduced spending in the face of great uncertainty about jobs and income, and because many service companies were closed or restricted.

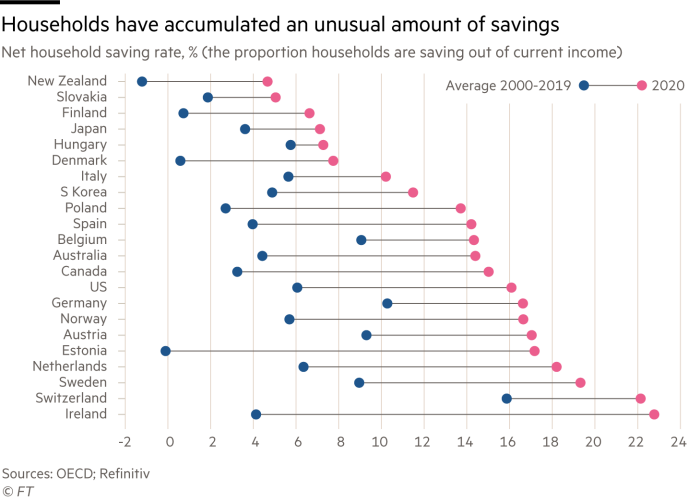

As a result, by 2020 household savings rates in many advanced economies reached the highest levels this century, according to OECD data, and bank deposits rose rapidly in many countries.

Zandi said the excess savings were higher in developed economies, particularly in North America and Europe, where blockades have been widely implemented and government spending has been high.

In the United States alone, households have amassed more than $ 2 million in additional savings, according to Moody’s. That’s before giant transfers from President Joe Biden’s $ 1.9 million stimulus program kick off. Together they are enough to potentially fuel “extended consumption savings,” said Krishna Guha, an economist at investment banking advisor Evercore ISI.

Silvia Ardagna, an economist at Barclays, expects “a fairly rapid acceleration in household spending this year” in the US and “To a lesser extent” in the UK, although he warned that “a slower deployment of vaccines could mean that no cumulative demand will be made in the euro area” in the next two quarters.

Some countries in the Middle East where government support has been generous also have significant excess savings, while in Asia the accumulated excess savings was lower than in other regions, as the pandemic has been content and the impact on family behavior was less pronounced.

In South America and Eastern Europe, savings were lower as a result of the strong success of the pandemic and lower government support.

However, the impact of the pandemic has been very uneven and savings have largely accumulated in the richest households in all regions.

Morning Consult’s consumer confidence index showed steady overall improvements between January and April in 15 major economies, but a higher proportion of lower-income households reported that their financial conditions had worsened compared to a year ago. .

More than a third of the richest households in many countries, including China, Australia, Italy, Russia and the United States, said it was now a good time to make big purchases, but that was not the case with households. poorer, according to data from Morning Consult.

Jan Hatzius, an economist at Goldman Sachs, estimated that nearly two-thirds of the U.S. surplus savings were held by 40% of the richest population and suggested that this could slow the scale of economic momentum because “High-income households [rather than spend] the bulk of the excess savings ”.

Adam Slater, chief economist at Oxford Economics, said: “If the excess savings are mostly in the hands of wealthier families and are treated as an increase in wealth rather than an addition of income, we would expect a much lower level of [additional] expenditure “.

Nearly three-quarters of British households reported that they increased their savings plan to continue to keep them in their bank accounts, according to the Bank of England. Others plan to use their savings to pay off debts, invest or recharge their pensions.

This is in line with the Conference Board’s findings that showed spot double-digit increases in the proportion of consumers who increased savings and equity investments in the first quarter of 2021 compared to the same period last year .

[ad_2]

Source link