[ad_1]

Tech stocks have regained some of their mojo — at least for now. Some technology-related names have rebounded since the market’s close on June 16.

In our series “What to do in a bear market“ Yahoo Finance examines Wall Street analysts’ recommendations on technology-related holdings — against a backdrop of a slowing economy and the Federal Reserve’s move to lower inflation.

On Wednesday, the central bank announced a rate hike of 75 basis points. Federal Reserve Chairman Jerome Powell has thrown forward guidance out the window, saying that interest rates have reached neutral levels and that the Fed will be “data-driven” going forward. Risk assets piled up during Powell’s unscripted comments.

“This week’s risk rally shows that investors are betting that future moves from the Fed will be more dovish,” said Yahoo Finance’s Jared Blickre.

Despite recent improvements, communications services and technology stocks are two of the biggest laggards in the S&P 500 year-to-date (behind consumer sentiment.)

So what should investors do if they own tech-related stocks? We asked the experts.

“The big, big bet on technology is basically that real rates and longer-term real rates in the US are going to stay pretty, really low,” Max Kettner, HSBC’s chief multi-asset strategist, told Yahoo Finance Live.

“It is also our basic issue. So that means the environment we’re in right now is far from pricey and conducive to growth — from such a short-term, [for example ] Financials – For more types of stock growth,

“At the end of the day, it’s really about the assessment there, and the assessment there is really a function of what’s happening with real rates over a longer period of time, and as we know, it’s a function of federal policy,” he continued. .

“If the Fed can’t push rates that high, technology seems like a great place to hide, in conjunction with the broader growth universe,” Kettner added.

Which tech stocks are safe to put in your portfolio?

“Investors need to be selective when picking stocks in the technology sector. The strongest types of stocks are those where cash flows are strong and valuations underestimate the company’s ability to generate future cash flows,” said New Construction CEO David Coach.

He said the companies’ favorite tech stocks include Microsoft ( MSFT ), Alphabet ( GOOGL ), Cisco ( CSCO ) and Oracle ( ORCL ). “Our advice to investors when it comes to technology stocks is to know what you’re buying and to fully understand the company’s ability to generate cash flow,” he said.

“It’s important for investors to do their homework – due diligence matters. Betting on stocks just because they’ve gone up in the past is not a safe strategy,” Coach said.

What about social media platforms like Meta (META), which is down 52% year-to-date?

Brent Till, an equity research analyst at Jefferies, has joined Yahoo Finance Live after Meta’s quarterly earnings. “The stock is cheap. The downside is crazy,” he said.

“There’s really no motivation for the ads,” Till said. “As long as the broader macro environment is difficult, these names will not work in the short term.”

Patient long-term investors will benefit from this multiple, he added. “In the short term, I think technology is going to be in a very difficult place for the next six months until we have clarity on what the ’23 numbers are going to look like,” he said.

Social media platform CEO Mark Zuckerberg recently warned that “the economic downturn will have a big impact on the digital advertising business.” Meta, commonly known as Facebook, has already faced challenges due to iPhone maker Apple’s ( AAPL ) iOS privacy changes. Targeting ads for the company is more difficult.

“It’s very difficult for advertising-driven names,” Thiel said. “Over time, I think the dollars will continue to go to Google on companies with big cash flow on big platform stories.”

Do some tech stocks do better than others in slow periods?

For John Freeman, vice president of equity research at CFRA, the answer is clear. “If you have at least a four-year horizon…software screams yes. It’s the place to be,” he told Yahoo Finance.

“Software is eating the world,” the analyst added.

“Economically, you go more digital, you get to it. We’ve seen it happen before. And I don’t see why this time would be any different,” Freeman said.

Here’s the other thing about all these cloud businesses, they are intrinsically very profitable.

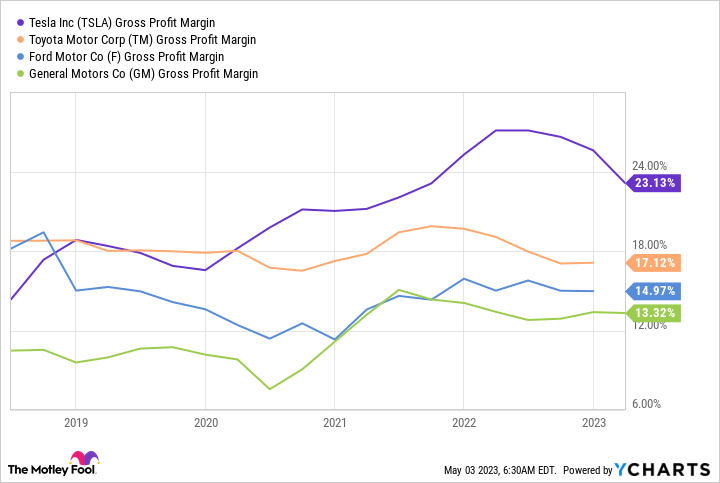

He also favors software over hardware — or EV giant Tesla ( TSLA ), which some investors consider a tech company.

“[Tesla] It has a lot of software in there…but it sells cars. There is a huge margin for that. There is a material bill,” he added. “I think Tesla is a great company. I’m not calling the stock, but … software companies are doing much better right now.”

Is it wise to hang on to unprofitable tech companies during Fed tightening cycles?

Many not-for-profit technology companies They did well in 2020 and 2021, but only as their epidemic growth evaporated.

“Fed tightening cycles are not friendly to speculative tech names,” QuantInsight head of analysis Huey Roberts told Yahoo Finance. “Qi has become bolder against unprofitable technology throughout 2022.”

Roberts highlighted Cathy Wood’s ARK Innovation ETF ( ARKK ). Among the holdings in the exchange-traded fund are unprofitable technology companies that have outperformed during the pandemic.

“The chart below shows ARKK as a benchmark for the sector. The red line shows the Qi macro guaranteed model price. It’s trending throughout the year. Macro conditions have been declining,” Roberts said.

“This week, the market interpreted the Fed as turning ambivalent. As financial conditions eased (low real yields, tight credit spreads), that helped push ARKK higher. But we’d like to see the red line make a new high to break the downtrend to clear everything up.” Roberts said.

Innes is a market reporter who covers stocks. Follow her on Twitter @ines_ferre

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app Apple Or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedInAnd YouTube

[ad_2]

Source link