[ad_1]

Investors have been debating for a long time. Tesla (TSLA 5.50%) It should be considered like a car stock or a technology stock. While Tesla’s primary products are electric vehicles (EVs), many aspects of the business — such as self-driving cars and connected subscriptions — give it a technological flavor. Plus, if you look at Tesla’s margins, they don’t look like traditional automakers at all.

However, recently there has been a change in one of these factors, and it may indicate that Tesla has turned into a part of the debate.

Tesla’s profit margin is slipping.

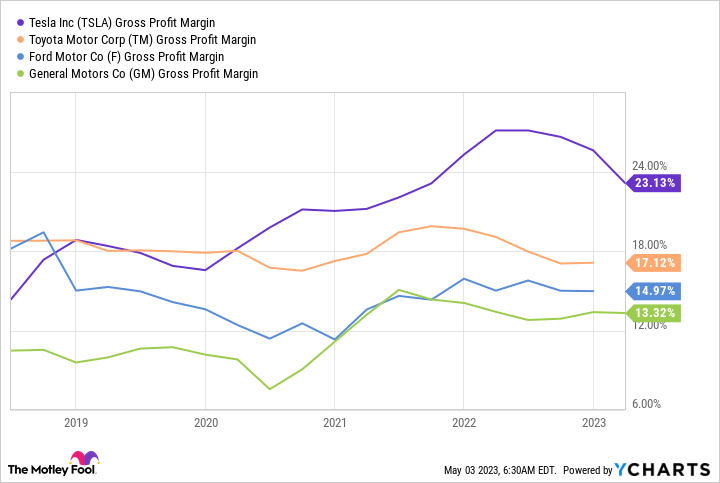

Over the past few years, Tesla’s margins have grown to the same level as most older automakers (except for the ultra-premium ones). Ferrari) can only dream.

TSLA’s gross profit margin data at YCharts.

However, that overall marginal advantage is beginning to erode. Tesla has been embroiled in a pricing war in the EV market as older automakers began mass-producing EVs. In fact, it recently made a sixth rate cut in 2023.

A pricing war at Tesla missed its forecast for gross margins in the first quarter. On Tesla’s Q4 conference call, CFO Zach Kirkhorn guided for at least a 20% automotive margin. However, Tesla only posted an 18% automotive and 19% gross margin in Q1, disappointing analysts who were expecting at least 21% overall.

Another example of this pricing war was the US government’s 2011 It’s a tax credit that kicks in as early as 2023. Tesla’s cheapest model, the standard rear-wheel drive Model 3, now costs just under $40,000. But because Tesla doesn’t meet the battery source requirements for the tax credit, consumers only get half of the $7,500 credit. The Chevy Bolt EV, on the other hand, qualifies for the same credit and starts at a much lower price than the Tesla Model 3.

As Tesla loses its pricing power in EVs, its gross margins are closer to average. However, by not using a dealer network and avoiding other costs incurred by older automobiles, it can maintain some advantage.

Tech stocks, in particular, have much higher margins than their manufacturing peers, and as Tesla starts to lose that advantage, it makes the stock look more like an auto. But it still features some tech stocks.

Tesla’s use of AI gives it the feel of a tech stock

Tesla invests heavily in artificial intelligence (AI) in a way that few others can. Its engineers have developed proprietary chips to help train the AI models and enable full self-driving (FSD) capabilities in the vehicles.

And the neural network gives Tesla massive amounts of data to train its AI models. The vehicles take in all the data they see as they drive and feed it into the company’s AI system to train it. In this way, a vehicle can respond to all situations it may encounter on the road because the network may have already encountered them.

There is one aspect in which Tesla is completely considered a tech stock: its valuation.

The stock trades at a premium (even for a technology stock) at 47 times earnings, much higher than other automakers. Ford (5.2) and General Motors (5.1) Even when Tesla’s marginal benefits are stripped away and the price-to-sales ratio is analyzed, Tesla is a valued technology stock.

| Company | Price-to-sales ratio |

|---|---|

| Tesla | 6.5 |

| Ford | 0.3 |

| General Motors | 0.3 |

| Toyota Motor |

0.7 |

Data source: YCharts.

So what should investors do? Tesla’s margins are trending towards traditional automakers, but valuations are close to those of tech stocks. That doesn’t seem like a very good combination and could lead to some valuation drops. However, Tesla is growing faster than its peers, its automotive revenue increased by 18% in the first quarter.

I don’t think owning the stock is a bad idea as long as investors can make sure Tesla isn’t an excessive position in their portfolio. But with AI technology and FSD’s potential, tech-stock upside remains.

Keithen Drury has positions in Tesla. The Motley Fool has positions and recommends Tesla. The Motley Fool recommends General Motors and the following options: Long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

[ad_2]

Source link