[ad_1]

For most of the EU, the economic outlook is clouded by fears of a deepening recession and constrained public finances. Then there is Ireland.

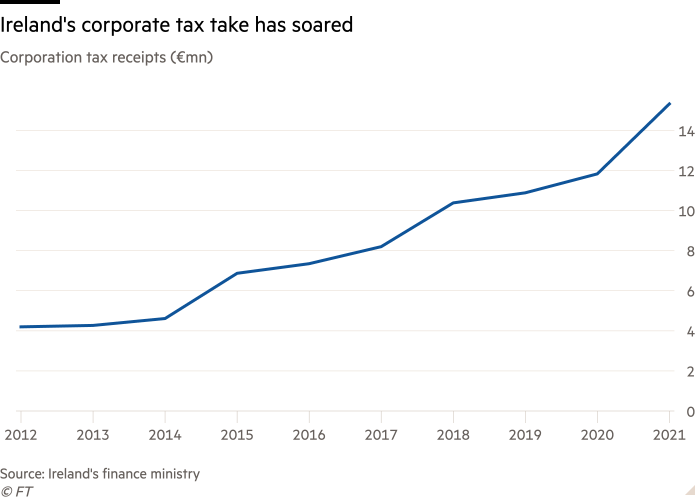

The republic is enjoying an €8bn corporate tax fall after the pandemic boosted revenues from tech and pharmaceutical companies. Ireland’s 12.5 per cent corporate rate tax levied on companies has increased since 2015 and by 2020 is up more than 30 per cent from last year.

Ireland’s economy grew by 6.3% in the second quarter, just 0.6% below the EU average. Despite having 5.1mn for a country with less than 3% of the region’s economy, the impact of multinationals was so large that Ireland’s figure skewed the EU figure.

With employment and foreign investment peaking, “the economy is hotter than the weather,” said Ebeck, head of the employers’ confederation, pointing to recent record temperatures.

But Ireland is not without problems. Prices increased by 9.1 percent in June. Ordinary families feel undervalued from the housing market in Dublin and other cities.

Mark Murphy, 39, a regional manager at the charity, who is delaying marriage and starting a family with his wife in West Cork, said: “We don’t pay bad wages” to save on a “very modest” house around the area. €300,000 mark. But now the same houses are €400,000 – we can’t get the credit.

Consumer spending contracted by 1.3 percent in the first quarter compared with the previous three months. Improved domestic demand, a measure of economic activity that excludes spending by some multinationals and is considered a better indicator than GDP, fell 1 percent in the first quarter.

Officials warn that corporate taxes are subject to change. Half of the €15.3 billion in corporate tax receipts last year came from just 10 companies – including Apple, Google, Intel, Meta, Amazon and Pfizer.

For now, healthy tax receipts provide a comfortable cushion for Ireland, with a very modest fiscal surplus expected if spending levels are maintained, although Ireland is following some EU neighbors including Spain in now considering higher taxes on energy companies in the 2023 budget. September 27.

Dermot O’Leary, chief economist at brokerage Goodboy, said Ireland did not need to go down the “Robin Hood road” because it could use a corporate tax windfall to cover the nearly €7bn of spending already announced for the budget.

Even after excluding the multinational sector, Ireland’s domestic economy will slow in 2020 and return to the EU average pace in 2021, according to ratings agency DBRS Morningstar.

Deputy Prime Minister Leo Varadkar said at an event last month to present record investment data: “Jobs and incomes created in many countries helped us avoid recession during the pandemic and are now giving us the financial firepower to ease the cost.” Avoid life crisis and relapse.

But Ireland’s multinational sector could become an Achilles’ heel in the face of a global economic downturn. Risks of recession in the EU and the US are rising. Any downturn would hurt the profits of companies investing in Ireland and feed into lower tax rates.

The central bank said corporate tax receipts, which have been higher than expected for the past seven years, were €8bn higher than expected last year and brought in nearly €9bn in the first half of this year alone.

The central bank and the Fiscal Advisory Council of Ireland have warned against relying on the variable tax levy, although the government is reluctant to say whether or not it will use the tax windfall in the budget.

“There is nothing to suggest that corporate tax revenues will fall any faster,” said Seamus Coffey, a lecturer at University College Cork and a corporate tax expert. But five, six years ago, there was nothing on the horizon to suggest that they would riseHe said.

John Fitzgerald, a professor of economics at Trinity College, said the worst-case scenario for corporate tax receipts would be a loss of 3 to 4 percent of national income – a huge hit to public finances.

Ebeck warned that the Irish economy was facing a “tipping point” and that “for Ireland as a small open economy, the changing flow of capital in the global economy could have a significant impact on our growth model”.

The central bank has also warned that housing construction is on the rise to address Ireland’s chronic housing shortage. Varadkar calls Ireland a “home-owning democracy” but the Institute for Economic and Social Research think tank recently predicted that one in three people aged between 35 and 44 will not own a home by the time they retire.

Ireland may remain lucky. Although the government’s decision to join the OECD’s global corporate tax treaty of at least 15 per cent could reduce revenues by €2bn, implementation has been delayed.

Foreign direct investment continues to grow, with investment volumes up 9% in the first half of 2021, including an 18% jump in new names in Ireland. Conal McCoyle, chief economist at Brokerage Davie, saw “no real reason” that taxes on foreign companies investing in Ireland would be “collapsed any time soon”.

Ireland is currently facing a problem of over-management. “We’re like a family that wins the lottery,” McCoy said. “Are we our family mature enough to say, ‘Surely this good luck can work for the next generation’?” Or do we regret half of this generation?

[ad_2]

Source link