[ad_1]

Shareholders at Salzgitter AG (ETR:SZG) may be pleased to know that analysts have made a major revision to their recent forecast. Consensus estimates suggest investors can expect statutory earnings and earnings per share, with analysts predicting a real improvement in business performance.

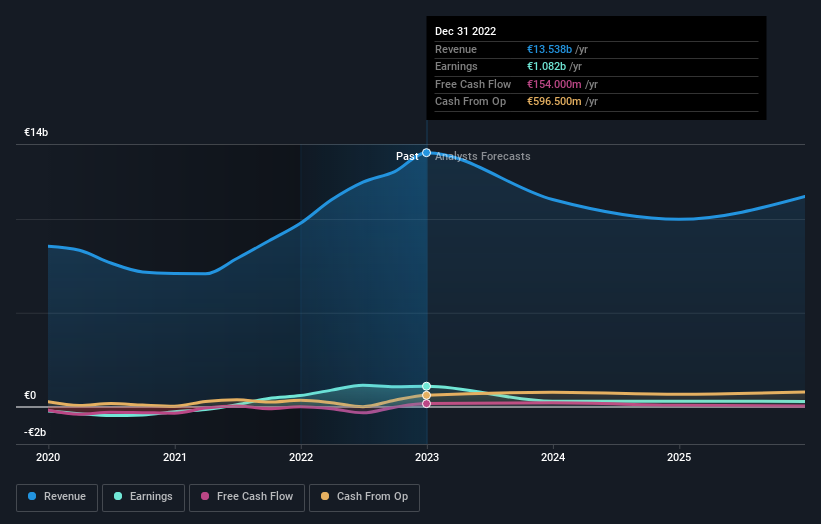

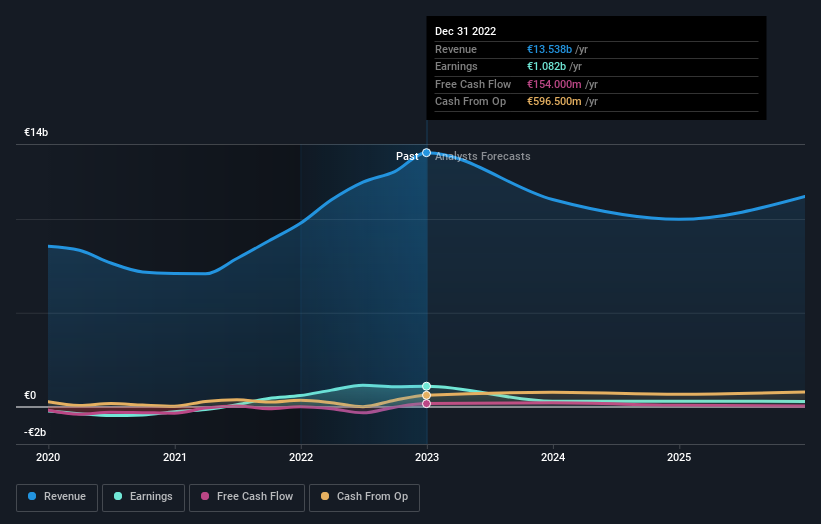

Following the update, the consensus among nine analysts covering Salzgitter is for €11b in revenue by 2023, indicating an 18% decline in sales compared to the previous 12 months. Statutory earnings per share are expected to rise 70% to €6.05 in the same period. Previously, analysts were modeling revenue of €9.7b and earnings per share (EPS) of €4.83 in 2023.

Check out our latest analysis of Salzgitter

Although analysts revised up their earnings estimates, there was no change to the consensus estimate of €35.41, suggesting that the forecast performance will not have a long-term impact on the company’s valuation. This is not the only conclusion we can draw from this data, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Salzgitter analyst has a price target of €45.00 per share, while the most pessimistic one is €21.20. Notice the wide gap in analysts’ price targets? This indicates that there are very wide possibilities for the main business.

Of course, another way to look at these predictions is to put them in context against the industry. These estimates indicate that sales will continue to decline, with the forecast showing an 18% annual revenue decline by the end of 2023. However, overall analyst estimates for other companies in the industry suggest that industry revenues will decline by 1.5% annually. The forecasts look bleak for Salzgitter as he expects it to slow faster than the industry.

Bottom line

Analysts who take the biggest advantage of these new estimates for us have revised their earnings per share estimates in anticipation of improved earnings power this year. They also revised up their earnings estimates, saying sales have performed well this year despite revenue growth slowing relative to the broader market. Some investors may be disappointed to see the price target unchanged, but we feel that improving fundamentals are usually positive – we think these predictions have been met! Therefore, Salzgitter may be a good candidate for further research.

Still, the long-term prospects of the business are more important than next year’s earnings. We have estimates – from several Salzgitter analysts – that it will come out to 2025, and you can see them here on our forum.

Of course, looking at company management Invest a lot of money It can also be useful to know if analysts are revising their estimates in a stock. So you might want to check this out free A list of stocks that insiders buy.

Have a comment on this article? Concerned about the content? Connect directly with us. Alternatively, email editor-team (at) simplywallst.com.

This Simply Wall St article is general in nature. We only provide opinions based on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to be financial advice. It does not provide advice to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide you with long-term analysis driven by fundamental data. Note that our analysis may not include recent price-sensitive company ads or quality material. Simply put, Wall St has no position in any of the listed stocks.

Join a paid user research session

They receive a. $30 Amazon gift card 1 hour of your time helping us build great investment tools for individual investors like yourself. Register here

[ad_2]

Source link