[ad_1]

ATLANTA — Most economists agree the U.S. faces some sort of recession in 2023, but hotel industry analysts say continued job growth, strong hotel rates and demand, and an as-yet-unexplored wave of international travelers will help the industry keep its head above water. .

Adam Sachs, president of Tourism Economics, told attendees at the Hunter Hotel Investment Conference that continued inflation is a cause for “worry.”

“It is the center of inflation. “The latest data shows prices are 6% higher than a year ago, and the average household is spending $400 more per month on goods and services this year. It’s certainly leaving a mark.”

This week, the Federal Reserve raised interest rates in the US by a quarter of a percentage point, and the Fed has indicated that another similar increase may still be in the cards later this year.

“The housing market is already in a recession,” Sachs said. “And so is manufacturing. The cracks in the facade become more apparent when you look at how households take on debt.

That’s mostly due to credit card debt, and Sacks says inflation has affected the way people spend and take on debt.

However, Sachs reminded the audience that despite the reduction in costs to the consumer, he is coming from a strong position.

“This decline will be mild due to liquidity,” he said. Even with all the clamor for financial turmoil, families still have an incredible amount of cash on hand.

Here’s a summary of why Sachs thinks this downturn won’t have a catastrophic impact on hotel room demand – including those triggered by black-swan events –

- Consumer savings: Despite more debt and a recession, he said, U.S. households are “in a strong position,” citing the $1.6 trillion more people have in savings today than they did before the pandemic. “The hotel’s core customers are where these savings live,” he said. Although the unemployment rate has risen slightly in the post-recession, job growth is still sustainable, allowing people to maintain savings.

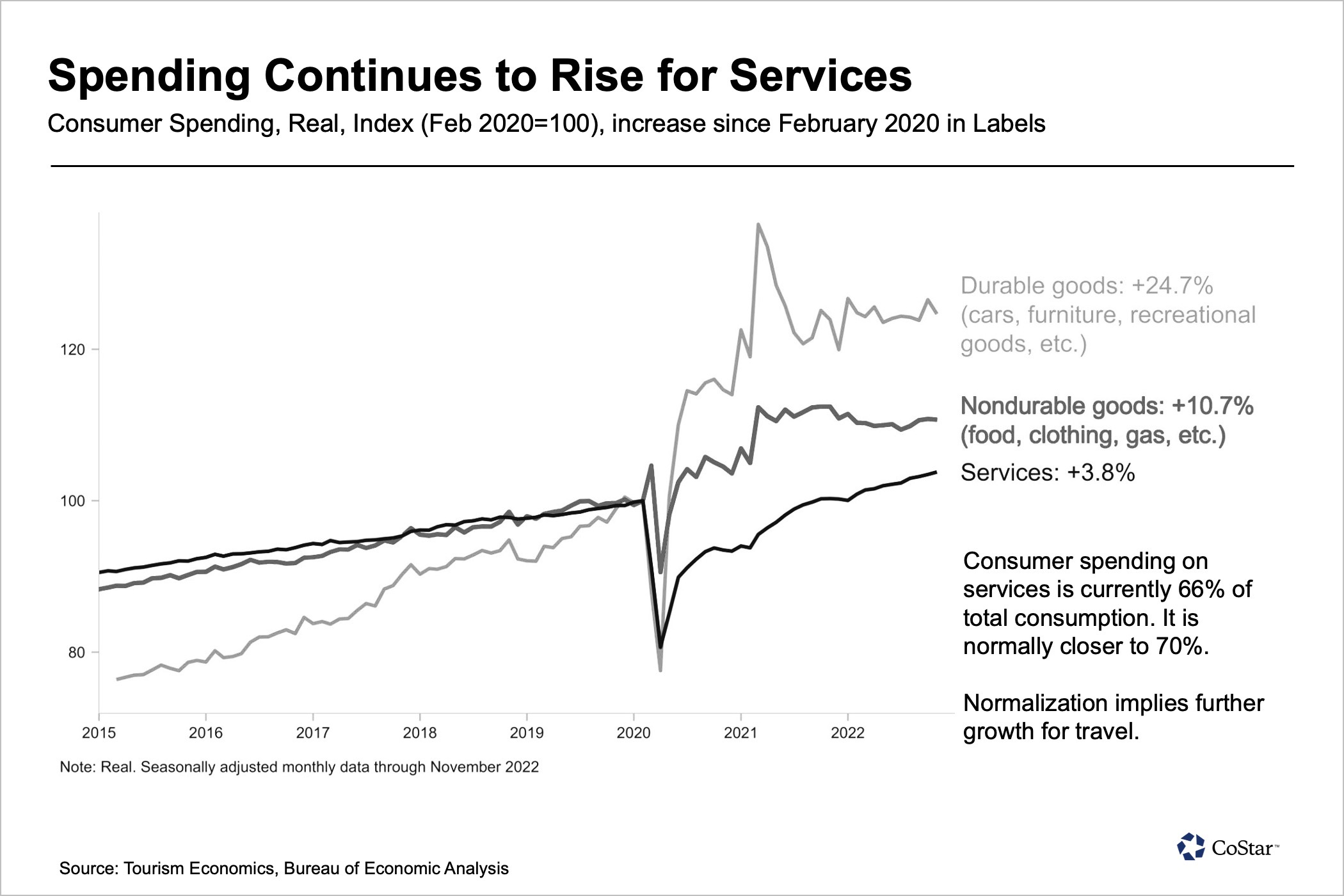

- Travel is a priority. Overall demand for travel remains high, Sachs said, and people continue to prioritize travel spending. “Today, consumers are spending 66% of their spending on services. Historically, it was 70%. In a way, we’re saying we’re expecting normalcy. Travel, that’s going to continue to take a share of the goods.”

- Business Travel on Upswing: According to data from Sacks Tourism Economics and JD Power, business travelers plan to surpass business travel levels in 2019 in the first months of 2023.

- International Introductory Journey Still Under Construction: Whatever travel demand the U.S. loses from domestic travelers in the second half of the year could be replaced by fall-related travel demand, and then some of it could be replaced by inbound travel that has not yet reached the level of the global pandemic. he said.

Hotel analysts dive into forecasts, booking channel trends, alternative hospitality sharing and more to share the rest of the year.

Adjusted for inflation, overall U.S. average daily rates were only about 1% below 2019 levels and revenue per unit was down 6%, said Vail Ross, senior vice president of sales and marketing for STR, CoStar’s hospitality analytics division.

Overall, demand continues to grow, and the country will “reach an all-new high by 2023,” she says. That continues to be driven by leisure demand, but team demand gains ground each month. Big convention cities like San Francisco still don’t have pre-pandemic levels, indicating that group travel still has room to grow.

Ross said the hotel supply was being strengthened but “remained under control”. About 50% of the hotel rooms in the final plan and under construction are in the select service segment, which was well established before the outbreak, especially in the upper middle class and high chain scale.

When it comes to travel booking behavior, Calibri Labs CEO Cindy Estes Green said Calibri’s data shows that “we’re back to that horse race between Brand.com and the OTA business.”

Corporate business — including group business — has been distributed through global distribution systems and is mostly coming to hotels through Brand.com, voice channels and others, he said. With so many third parties competing for share, it’s important for hoteliers to try to hang on to the lowest-cost channel, which is typically Brand.com, she says.

According to Robert Mandelbaum, Director of Research Information Services at CBRE Hotels Research, hotels are beginning to see contributions from other sources, particularly food and beverage, to profitability and revenue growth. As the group business returns to the hotels, the booking revenue will grow, increasing the division’s profitability.

He also noted continued strength in resort fees, with canceled fees in 2022 higher than 2019 levels, likely due to group-related violations. “If there’s no availability or if people decide not to attend at the last minute, hotels are getting those collection fees,” he said.

Jamie Lane, vice president of research at rDNA, which tracks data and analytics around alternative accommodations like Airbnb, shared trends in this sector that could have a big impact on travel and hotels.

Flexible travel jobs or temporary positions that accommodate work from any location are on the rise and demand for alternative hospitality is on the rise, Lane said. In the year By 2022, longer stays — such as 28 or more days — will account for more than 20% of nights booked on Airbnb, compared to 14% in 2019.

Lane said the rDNA data shows demand for alternative accommodation in small towns and rural areas is growing, but growth in supply in major entry markets in the US such as Boston and New York City is lagging.

Back to the hotel news now home page.

[ad_2]

Source link