[ad_1]

Eurozone business activity expanded faster than expected in April, boosted by demand, easing inflationary pressures and faster job growth, prompting the European Central Bank to raise interest rates next month.

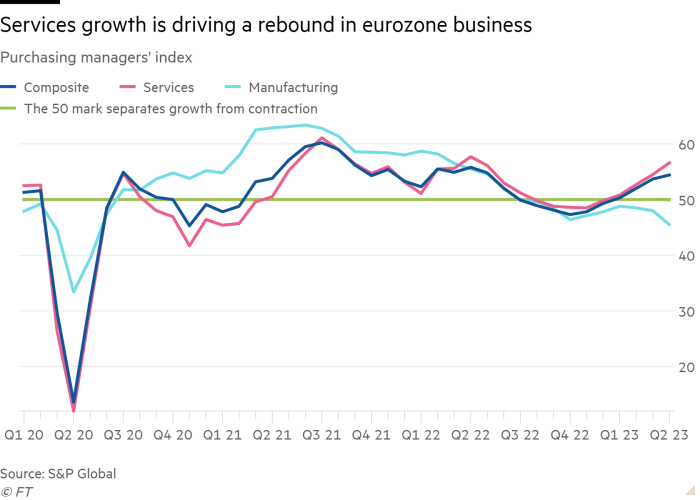

The HCOB flash eurozone composite purchasing managers’ index, a measure of manufacturing and services activity, rose for the sixth straight month to 54.4 from 53.7 in April.

The result was better than a Reuters forecast of a flat reading, and last month’s turmoil in the banking sector has failed to halt economic growth in the bloc over a 2022 energy shock.

The survey, compiled by S&P Global, pointed to a widening gap between a strong recovery in the manufacturing sector – particularly in strike-hit France – and the larger services sector.

Cyrus de la Rubia, chief economist at Hamburg’s commercial bank, said that despite a “very friendly picture” of overall business activity, there was “very bumpy” growth amid “partially increasing” services and a “weakening manufacturing sector”.

New orders expanded at the fastest pace in a year in services but fell at the fastest pace in four months in manufacturing. Service sector job growth was the fastest in 15 years, while manufacturing employment rose at a 27-month low.

As companies continue to raise their prices, the rate of increase is becoming more moderate. The “sale price” index fell to the lowest level in two years. Buoyed by strong demand, services companies were able to report “particularly strong” increases in the prices they charge, in contrast to the more modest increases of manufacturers.

“Continued rapid inflation, a still resilient labor market and the economy implying interest rate hikes and a substantial tightening of lending standards raise the possibility that the ECB will tighten more than we expect,” said Melanie Debono, economist at the research group. Pantheon Macroeconomics.

Germany’s two-year borrowing costs, as expected for interest rates, rose after the PMI survey was published and the euro offset some losses against the US dollar.

Investors are betting on a rise in the ECB’s deposit rate from 3 percent to more than 3.75 percent in the coming months. Several ECB rate watchers said the decision on whether to keep raising rates at half a percentage point or increase to a quarter point next month will depend on data including the central bank’s survey of lenders and April inflation – both due early next month. .

Official figures to be published next Friday are expected to show the eurozone economy returned to quarter-on-quarter growth with a 0.2 percent expansion in the first three months of the year, compared with a flat end to last year.

Rory Fennessy, an economist at the Oxford Economics research group, said: “April’s flash PMIs pose more risks to the near-term GDP forecast in the region.” But rising borrowing costs still point to a “weak outlook” for the second half of the year, he said.

[ad_2]

Source link