[ad_1]

Tech stocks led the broader market lower on Friday, as a pair of government-bond yields rose after Federal Reserve officials weighed in on a rate hike.

of 10-year Treasury yield It rose to 2.998% – its highest level since late July – before ending up 9.4 basis points at 2.974%. (A base point is one hundredth of a percentage point.)

This came after St. Louis Fed President James Bullard – the current Federal Open Market Committee (FOMC) voting member – said in an interview. The Wall Street Journal “It leans toward Thursday,” he said [raising rates] 75 basis points at the central bank’s meeting in September “I think we’ve got a relatively good reading on the economy and we’ve got very high inflation, so I think it’s worth continuing to raise the policy rate, and into a restrictive range,” Bullard added.

And this morning, Richmond Fed President Thomas Barkin said at an event in Maryland that the central bank will “do everything possible” to return inflation to its 2% target. Barkin is not a voting member of the FOMC this year.

Sign up for Kiplinger’s FREE Investing weekly e-letter for stock, ETF and mutual fund tips and other investment advice.

Monthly options also played a role in today’s volatile price action. Susquehanna Financial Group analyst Souhao Yao said options expiration activity could increase liquidity in the market, and could exacerbate price movements in underlying stocks or indexes. Today, more than $2 trillion worth of options contracts have expired.

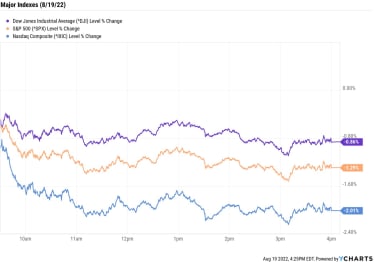

Technology (-1.8%) was one of the weak sectors in today’s selloff, dragging Nasdaq Composite Down 2.0% to 12,705. of S&P 500 index It ended 1.3% lower at 4,228, and Dow Jones Industrial Average It gave 0.9% to 33,706. All three indexes closed lower for the week, with the Nasdaq and S&P 500 snapping their weekly winning streaks.

Other news on the stock market today:

- Small-cap Russell 2000 It fell 2.2 percent to 1,957.

- US crude futures It rose 0.3 percent to end at $90.77 a barrel, but was still down 1.4 percent for the week.

- Gold futures It returned 0.5% to settle at $1,762.90 an ounce. Gold prices fell 2.9 percent for the week.

- Bitcoin It fell 8.6% to $21,349.47. (Bitcoin trades 24 hours a day; prices reported here are at 4 p.m.) “Expectations that higher interest rates may be delayed for a longer period of time have caused weakness to creep into the crypto space, retreating from riskier assets,” said Suzanne Streeter, senior investment and market analyst in the UK. Established financial company Hargreaves Lansdowne.

- Thursday’s confirmation by Ryan Cohen, Stop the game (GME) Board Chair and Chewing (CHWY) founder, sold the entire share Bed bath and beyond ( BBB ) sent its stock into another tailspin today. A regulatory filing shows Cohen sold all of his call options, lowering his total of 8.1 million shares from $18.68 to $29.22 per share. BBBY shares fell 40.5% in response.

- Leg lock (FL) rose 20.0% after the athletic apparel retailer reported earnings. The company reported second-quarter earnings of $1.10, beating the consensus estimate by 30 cents. Revenue of $2.1 billion was in line with expectations. The company announced a C-suite shocker that prompted BofA Securities analyst Lorraine Hutchinson to upgrade the stock from Underperform to Neutral (respective of Hold and Sell equivalents). Ironically, FL’s current president, chairman and CEO, Richard, announced. Johnson will retire from the company and will be replaced by his predecessor Ulta (ULTA) CEO Mary Dillon, the analyst said, “This is a thesis change that, in our view, will change Dillon’s reputation in the industry. She is a highly respected consumer executive and most recently served as CEO of Ulta Beauty for 8 years through June 2021. While at the helm of Ulta, Dillon built an outstanding loyalty program, increasing revenue at a 16% CAGR. Inventory tripled.

Be prepared with your portfolio choices

Wall Street may get more color on the outlook for federal monetary policy next week, as the central bank hosts its annual Jackson Hole Symposium. “A key source of momentum is the relationship between the market and the central bank about how long inflation should last relatively,” said Douglas Porter, chief economist at BMO Capital Markets. “Next week’s topic may focus on this issue,” he added. The theme of this year’s symposium is ‘Reassessing Constraints on Economics and Policy’. The continued strength of underlying inflation will put considerable pressure on the sector to act on both the economy and policy.

So what does this mean for investors? Well, it might be a good time to do a portfolio check, making sure you are positioned for further inflation, further price increases and volatility in the market. Does it include dividends? Is there exposure to companies with pricing power or healthcare stocks, both of which are considered inflationary? Investors seeking broader protection may want to consider these defensive ETFs. The funds presented here use different strategies but share one goal: to create stability in the macro windfall that still affects the markets.

[ad_2]

Source link