[ad_1]

Investors don’t want to “give up” on technology stocks, but other small-cap stocks look more attractive after the market recently rebounded in this year’s downturn, according to Jefferies analysts.

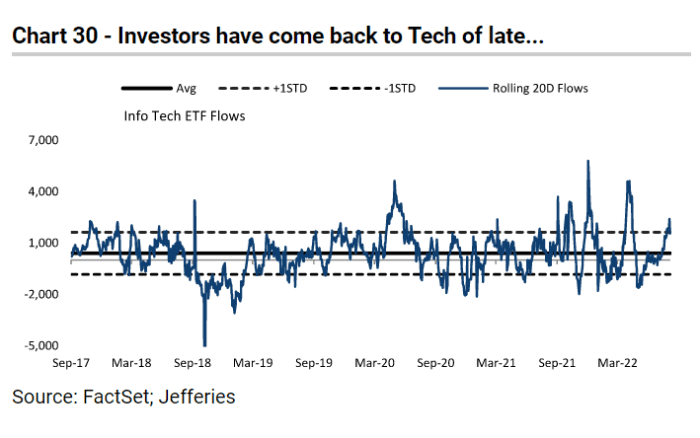

“As we talk to investors, it looks like they’re going back to technology, and we’re seeing an acceleration of flows into ETFs,” Jefferies analysts led by Steven DeSantis said, citing exchange-traded funds. It was focused on the sector. “We don’t think that makes sense.”

Jeffries Note August. 24, 2022

Jefferies is “underweight” small-cap stocks in information technology, saying they are “expensive” due to declining earnings and sales estimates, according to the note. At 3.4 times the long-term average of 2.1 times, sales prices are not cheap, the analysts said.

“Technology has gone from very expensive to expensive,” they said. “We don’t think people want to run a 20-playback book that this team is better at.”

Analysts said there were “too many negatives” among small-cap tech stocks as they tend to “underperform” when the Federal Reserve raises interest rates. The Fed is raising its benchmark rate significantly this year in an effort to combat high inflation.

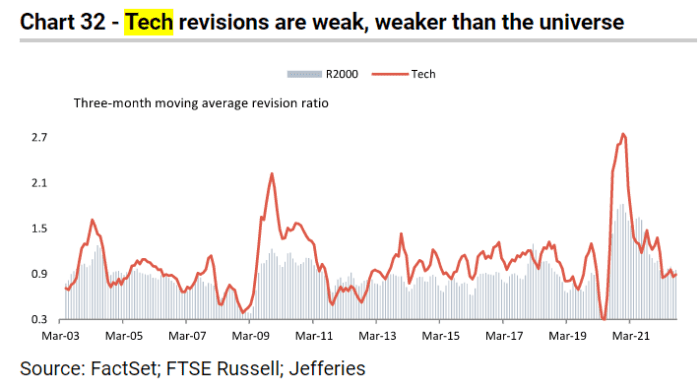

Meanwhile, earnings and sales estimates for 2022 are being cut for small-cap technology stocks, which saw weaker revisions than the broader universe measured by the Russell 2000 index, the report said.

Jeffries Note August. 24, 2022

Small Cap Focused Russell 2000 RUT,

It was up 0.7% Wednesday afternoon, compared with a decline of about 14% in 2022, according to FactSet data at last check.

The measure is slightly underperforming the S&P 500 index SPX;

A measure of large-cap stocks in the US, so far this year. The S&P 500’s They fell about 13 percent in 2022, based on Wednesday afternoon trading, which lifted the benchmark 0.3 percent.

Read: ‘Not comfortable’ with S&P 500 prices? Investors can still find ‘bargains’ in small-cap stocks, says RBC

In small caps, Jefferies likes the health care and consumer discretionary sectors, according to analysts. They have “risen from the ashes,” driving the recent maturity in small stocks, analysts wrote. “We’re going to be over the top of both.”

He said that the cost of health care is not much compared to the performance of the sector. The analysts said, “This group has already covered the price in a severe economic downturn, above the average decline during the bear market.” Meanwhile, merger and acquisition activity has increased in health care, which could help drive performance, as “we are now moving into a period of accelerated deals,” he said.

According to the selection, stocks in the sector are “the cheapest group in the size class,” Jeffries said.

“The sector fell more than the average decline during the bear market, which we thought was too severe,” the analysts said. “The team tends to be better at coming out of bear markets.”

Meanwhile, investors still seem to want to own small tech stocks, seeing the decline at the start of the year as a buying opportunity, Jefferies analysts said. We disagree and don’t think investors should be aggressive in this sector.

Don’t miss it. Hear from Carl Icahn on the best new ideas in money on September 21st and September 22nd in New York. The popular businessman shares his perspective on this year’s wild market trip.

US stocks were trading flat on Wednesday afternoon, with the Dow Jones Industrial Average DJIA;

0.1% and the technology-heavy Nasdaq Composite COMP;

According to FactSet data, it adds 0.5% to the final check.

[ad_2]

Source link