[ad_1]

Jeffrey Lomanto started his career 16 years ago as a mutual fund salesman at an international investment bank in Jakarta. He recalled how difficult it was to educate prospective clients about various investment products. “At the time, market knowledge about investing was very low, so a consultation session could take hours for a client, which was inefficient and expensive. “Clearly, this problem continues even after 16 years,” he said. CASIA In a recent interview.

Recognizing this challenge, Lomanto launched Moduit in 2018, a fintech platform focused on investment and wealth management services. The company aims to streamline the investment management process and support clients’ investment decisions through robo-advisory services and investment advisors.

“As time progresses, the market begins to evolve. In the past, clients could trust whatever their advisers said, but now they need greater transparency, especially in terms of price and risk associated with the products. They are also more selective in choosing products. Therefore, to identify their needs in order to provide personalized solutions to achieve their financial goals We should get to know them better, Lomanto continued.

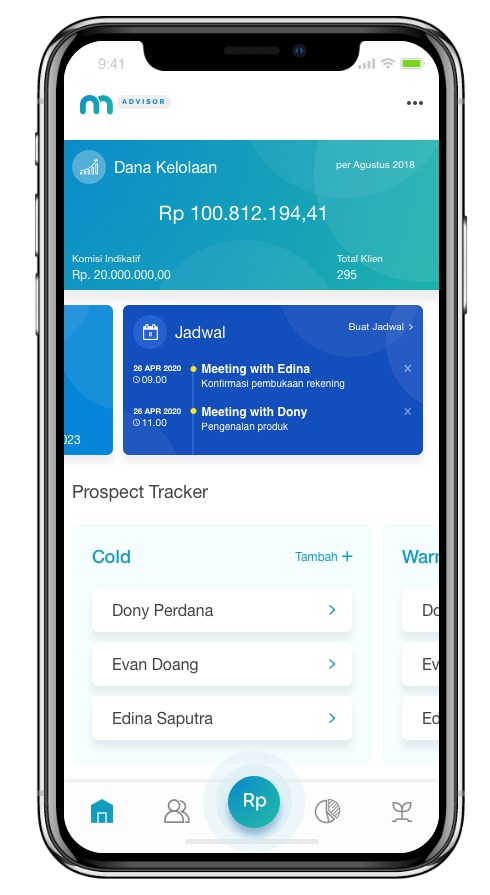

Moduit serves two market segments: Business-to-Consumer (B2C), targeting retail investors, and Business-to-Business-to-Consumer (B2B2C), focusing on mutual fund sales representatives with high-end clients. For B2C clients, the platform uses robo-advisory services to determine the best investment strategies and recommendations, for For B2B2C customers, Moduit provides assistance in the form of sales representatives, called “Moduit Advisors”.

In February, the startup launched an advisor app that includes a client relationship management tool to help the firm’s advisors. Pipeline management, revenue planning, scheduling, training programs, market updates and other services.

Moduit offers nearly 60 mutual fund products in partnership with well-known institutions such as FWD Asset Management, BNI Asset Management and Eastpring Investment Indonesia. It also offers mutual fund investment opportunities in US dollars as well as investment management agreements for clients managed by advisors.

Digital wealth management is still in its infancy in Indonesia, with only a few players in the market. However, Lomanto believes that what makes Moduit stand out among its competitors is its B2B2C offering. Lomanto says there are currently dozens of advisors on the Moduit platform and he expects to recruit more in the future.

“Our B2B2C concept is similar to the agency insurance business, where people can join an insurance company to sell its products. Similarly, anyone can register to sell mutual funds on our platform as long as they are licensed. Some of these advisors join the platform and hire new advisors as an agency.” They can establish and establish,” he explained.

To join the Moduit platform, advisers must be authorized by a mutual fund representative or a broker dealer representative by the Indonesian financial authority OJK.

“Marketing literacy is still low today, so we make sure our advisors are well trusted. We also have an online education center with articles, market updates and insights to educate people about the ins and outs of investing,” said Lomanto.

The platform currently has 20,000 active users and the B2B2C segment accounts for 86% of the total managed funds. Assets under management grew about 40% per month before the Covid-19 pandemic, but that has slowed to a 13% growth rate in the March to June period, Lomanto said.

“The good news is that we are seeing more and more financial advisors joining the platform to earn more. They are generally happy with our service. It has led some to quit their nine-to-five jobs to focus on our platform.

Moduit does not charge any transaction fees from B2C users. The company monetizes its services by taking commission from mutual fund providers. platform He implements a revenue sharing system with consultants, but he gives them away Freedom for clients to set their advisory fees in an appropriate range as specified in the futures of each mutual fund product.

The startup had hoped to raise about $3 million in a Series A funding round that was slated to close this year, but that has been delayed by the pandemic, Lomanto said.

Moduit is preparing to add more investment products to its platform later this year, including bank deposits, insurance, bonds and securities. “We want to offer complete wealth management offerings. Our focus for the next two years is to continue to learn and understand our user behavior to add products based on their needs,” said Lomanto.

This article is part of KrASIA’s “Startup Stories” series, where KrASIA writers talk to founders of tech companies in South and Southeast Asia.

[ad_2]

Source link