[ad_1]

When Chinese leader Xi Jinping, U.S. President Joe Biden, and European Commission President Ursula von der Leyen set out plans to spend billions to reduce dependence on foreign-made computer chips , the global supply chain looked like it would be remodeled.

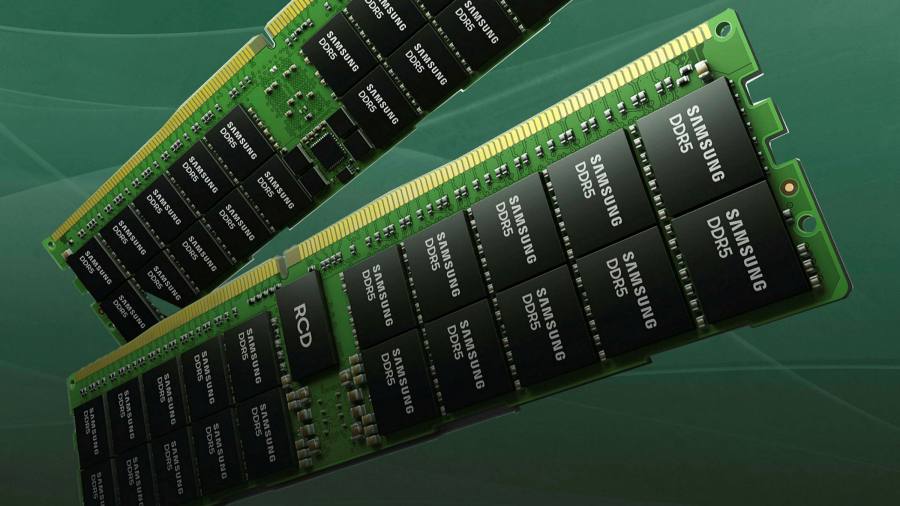

But analysts and Samsung, the world’s largest producer of memory chips, do not expect the South Korean group to be replaced soon.

“For the foreseeable future I think we can maintain our market share, if not increase it,” a senior Samsung executive at a factory south of Seoul told the Financial Times.

The United States, China and Europe are vying to boost investment in the sector after a related pandemic shortage of car chips exacerbated fears of relying on foreign manufacturers of critical technologies.

Biden has proposed a $ 50 billion plan for chip making and research and Xi has promised to spend more than a million dollars in high-tech industries, with special attention to semiconductors.

But analysts said Samsung’s leadership it is unlikely to be challenged imminently.

“If there is a new foundry that will be put online in 2025, you will practically be paving the way by the end of this year,” said Velu Sinha, a partner at Bain & Company. “So the likelihood of something happening now that disappears and modifies the mix in the next two or three years is quite unlikely.”

Samsung has dominated Dram and Nand chip production for decades. The first allows for short-term storage for graphics, mobile, and server chips, while the second allows for energy-free storage of files and data.

But the company’s warning to competitors was not based solely on past performance. Samsung also believes its position is secure both because of its advances in manufacturing technologies and the cost of making chips.

“The pace of this migration is currently accelerating. It is even extremely difficult for headlines like Samsung to continue this research and this investment, ”said the executive. “It won’t be easier for any other provider.”

Since 1974, when Samsung founder Lee Byung-chul and his son Lee Kun-hee he set aside the skepticism of his management teams and funded the company’s first investment in semiconductors: legions of engineers have focused on a singular task: figuring out how to store more data on smaller chips. The company extracts 16 billion cells from miniature-sized Dram chips, a huge improvement from the 64 million bits of the 1990s.

The complexity and scale involved in producing cutting-edge chips poses a serious challenge for any company or government trying to eat up Samsung’s leadership.

Inside an indescribable tower block inside the company’s campus in Hwaseong, south of Seoul, a mechanical arm suspended from the ceiling grabs a plastic container containing a stack of wafers (thin slices of silicon extracted from sand) and drags them to their next destination. For about three months, the wafers will be moved through a series of automated steps, including engraving, cleaning, and circuit drawing. Some of these processes will be repeated hundreds of times.

Samsung accounted for 15 percent of the total global production capacity of these wafers by the end of 2020. This placed the company ahead of Taiwan Semiconductor Manufacturing Company, the global company the largest producer of processor chips, as well as rivals for the Micron and SK Hynix memory chips.

Samsung has also pointed to its leadership in intellectual property and engineering experience as proof that it could defend its position.

The main one is the use of extreme ultraviolet lithography in the manufacture of DRAM chips. EUV is a change from deep ultraviolet lithography, which means that progressively finer chip circuits can be used. The result is greater energy and energy efficiency.

Samsung, TSMC and Intel use EUV technology to Create Advanced Processor Chips But the South Korean company said it was ahead of its competitors in deploying Dram chip technology, leveraging its joint research and development center for both processor chips and memory.

Expenditure on Asia’s largest chip makers has also been lower than promised by Washington, Brussels and even Beijing.

IC Insights, the market research group, said Samsung has spent $ 93.2 billion in its semiconductor business in the past three years, twice as many as all semiconductor suppliers in China put together.

“Governments like the EU, the US and China can. . . catch up [semiconductor] technology career with Samsung and TSMC? Considering how far back they are. . . governments would have to spend at least $ 30 billion a year for a minimum of five years to have a reasonable chance of success, ”IC Insights said.

South Korean policymakers are also drawing up plans for tax breaks and other incentives for their chip-making champions. Analysts expected Samsung to announce an increase in capital spending in its processor chip business this month, including investments in the US.

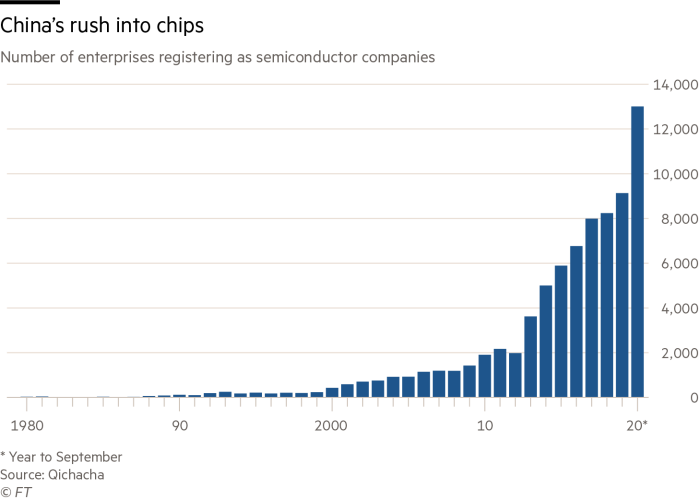

Still, the Chinese challengers are going slow make a profit.

Dan Wang, a Shanghai-based technology analyst at Gavekal Dragonomics, pointed to Yangtze memory technologies and Changxin Memory Technologies, which have cornered about 3% of their respective Nand and Dram markets.

“Both companies have hired a large number of Korean engineers, who make up most of the world’s talent in memory chips. Today, most of the industry expects YMTC to become a significant global player in three to five years, ”Wang wrote in a note.

Sinha de Bain said China’s chip sector was slowly showing signs of weaning from “Western-origin” technologies. But he warned that he did not expect the headlines of the global industry to change in the next 3-5 years.

“There are alternatives that are emerging that will allow the ecosystem in China to continue to develop richly,” he said.

Weekly newsletter

Your crucial guide to the billions that are made and lost in the world of Asia Tech. A selected menu of exclusive news, sharp analysis, intelligent data and the latest technological innovation from FT and Nikkei

[ad_2]

Source link