[ad_1]

The BizBuySell Insight Report for 2021 reveals small business acquisitions picked up in 2021. So much so, the sales beat pre-pandemic levels in the 4th quarter. This bodes well for the coming year. And according to BizBuySell, transactions are expected to strengthen in 2022 as more sellers return to market.

2021 BizBuySell Insight Report

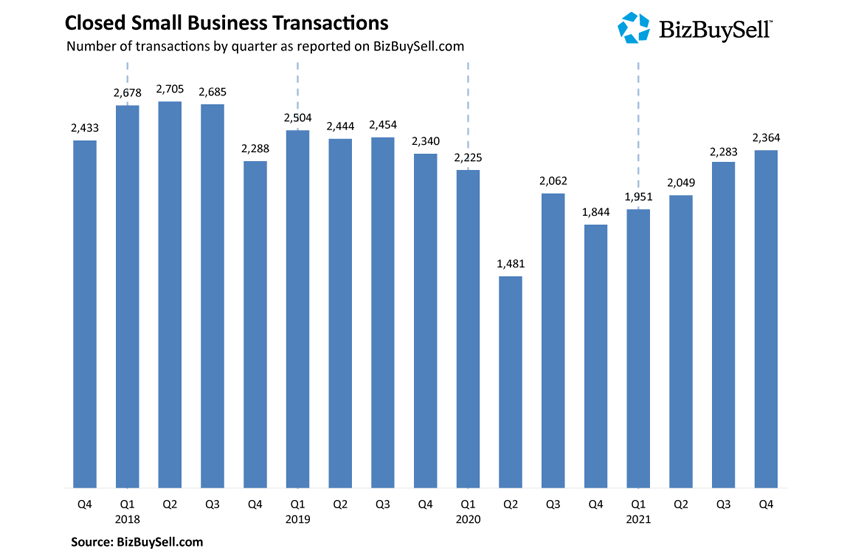

For the year, the report reveals ongoing COVID-19 fallout, hiring challenges, and supply chain disruptions. However, US business-for-sale transactions bounced back 14% in 2021. This comes after moderate gains in the beginning of 2021. Transactions then increased by 28% in the fourth quarter, which surpassed the pre-pandemic 2019 numbers. This has brought optimism for the rest of 2022.

In terms of sales, a total of 8,647 closed transactions were reported in 2021, compared to 7,612 in 2020. Of these 2,364 took place in the fourth quarter. The growth also includes the sale prices of these businesses with a 16% year-over-year jump. This was responsible for an annual record-high sales price of $ 325,500. BizBuySell attributes the high to buyers competing for a limited supply of strong performing businesses.

When it comes to sales, businesses with strong financials continued to dominate. This was responsible for growing the median cash flow of sold businesses to $ 149,099, a 10% growth. If there was poor performance, buyers were looking for discounted businesses as well as prime real estate and other valuable assets

More Business Sales Data for 2021

For the year the median sales price finished at $ 324,500 and the median revenue was up by 2% to $ 625,943. And more than half or 53% of brokers attributed the growth to the demand for businesses that were thriving during the pandemic. Overall sale prices are rising with demand for profitable businesses remaining strong.

Additional data in the report reveals 62% of brokers said they saw higher transactions than in 2020. The transactions were divided into equal percentages at 46%. For those selling it was due to the lack of inventory which was a barrier to market recovery according to the report. And for those who were buying, the increase was due to demand brought on by the Great Resignation, SBA aid programs, and low-interest rates.

Limited Inventory

Even with the record-breaking sales prices, small businesses owners said the pandemic had an impact. More than half or 52% said they were negatively impacted. And for most of these owners, it meant having to wait to recover before their exit. In the report brokers stated pandemic-related issues kept businesses off the market along with low performance (38%), sellers having unrealistic expectations 46%, and financing challenges 15%.

Optimism for 2022

The report says more owners are expected to sell in 2022 even with operational challenges and pandemic burnout. This has resulted in 43% of owners saying they are extremely motivated to sell their business.

Another driving factor in 2022, according to the report, is the pent-up supply of businesses for sale fueled by Baby Boomer retirees. Conversely, brokers are also expecting an increasing number of Baby Boomers to enter the market.

Demand is also going to be driven due to the great resignation. Brokers reported 21% of business buyers said they were part of the great resignation. While another 23% of their inquiries came from newly unemployed seeking ownership or corporate refugees.

BizBuySell’s Insight Report tracks and analyzes business-for-sale transactions and the sentiment of business owners, buyers, and brokers.

Image: BizBuySell

[ad_2]

Source link