[ad_1]

CHICAGO, Sept. 29, 2022 (GLOBE NEWSWIRE) — Data and technology company Numerator, which serves the market research space, has released its monthly Consumer Sentiment Survey, which examines economic risks and their impact on consumer behavior.

After peaking over the summer, overall economic risk appears to be easing, driven by concerns over gas prices.

However, personal finance remains a top concern for US consumers as they plan to cut spending on dining, catering and travel.

Findings of Consumer Economics:

- Personal finance continues to be a top concern for American consumers. Nearly two in five (39%) say personal finances are their top concern for the coming months, up from 36% who said the same in August. These levels are more than 6x higher than the next highest cited concerns (“world events” by 17% of consumers) and concerns related to Covid-19 (6%).

- The percentage of consumers who are very concerned about the economy has declined. Nearly 60% of consumers are extremely worried about the economy, down 13 percentage points from a peak in June 2022 — partly due to concerns about gas prices.

Despite the decrease among the “most concerned,” nearly all consumers (98%) still indicate at least some economic concern. Nearly a quarter (71%) of consumers feel the country is currently in a recession, 77% think inflation will continue to rise, and 70% expect the economy to worsen in the next few months. - Despite the drop in gas prices, higher-than-normal prices continue to weigh on consumers. Nearly seven in 10 (69%) say gas prices are affecting their ability to afford other things.

- All income groups express inflation risk. More than a quarter (76%) of consumers are concerned about rising prices for essential goods and services, 68% are concerned about rising gas prices, and 62% are concerned about rising prices for non-essential goods and services (eg travel, restaurants).

- Low-income consumers worry about cuts to programs. 38% say they are concerned about government benefits being scaled back (ie Social Security, disability payments, SNAP) – the highest concern of any income group. Low-income consumers (19%) also have high job security concerns.

- Middle-income consumers are the group most concerned about housing. 31% are concerned about the housing market – both stability and affordability.

- High-income users are concerned about future savings. More than half (51%) are concerned about the economy’s impact on retirement savings or retirement plans, and 43% are concerned about the stability of the stock market.

- Consumers are still uncomfortable with discretionary spending. Nearly three in four consumers (74%) say they are wary of splurging on premium or luxury goods at this time. Withdrawing money from personal savings or retirement accounts is also uncomfortable for a quarter of consumers (73%), as are spending on non-essential items (61%), investing in the stock market (58%), traveling (57%), and eating out or ordering takeout (46%). %).

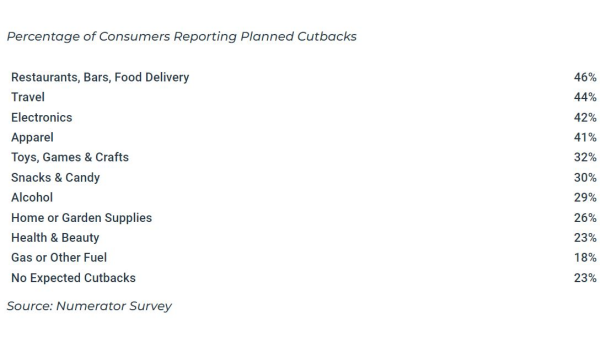

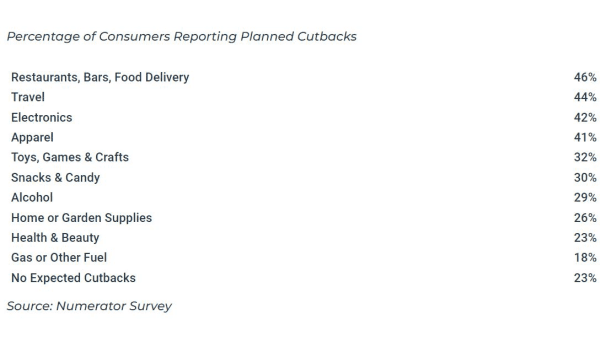

- In response to price increases, consumers know where to cut back on expectations. Dining (46% of consumers), travel (44%), electronics (42%), clothing (41%) and toys and games (32%) are the top areas where consumers plan to cut back on spending in the coming months. However, nearly a quarter (23%) do not expect it to decrease at all, remaining steady from last month, another sign that economic worries are easing.

About Number Counter:

Numerator is a data and technology company that brings speed and scale to market research. Number Saver combines first-party data from more than 1 million US households with advanced technology to provide 360-degree consumer insight to the market research industry that has been slow to change. Headquartered in Chicago, IL, Numerator has 2,000 employees worldwide. Of the top 100 manufacturers of CPG brands, 80 are digital customers.

[ad_2]

Source link