[ad_1]

General Z is getting some of the most economical drugs reminiscent of the 2008 and 2001 generations, and that’s why Uprise.

Uprise Financial Tips for General Z. Image thanks Rebellion

Jessica Chen Ryolfi and Chris Goodmacher founded the company in March 2021 as a free financial planning tool for General Zero. At the same time, young people were seen investing in certain stocks or having no education at all – and losing money. With Uprise, you want to provide users with the best experiences and differentiation techniques to invest in more specific goals.

Chen Riolfi knows about this struggle. Her story is based on the user Fintek, a former leader of Robinwood products. She learned a lot about money from her immigrant mother in the United States, and she taught herself about money, passing it on to her son. In response, Chen Ryolfi built Uprise to spread her mother’s knowledge to the masses.

“Like many amazing Fintech companies, you can still solve only your finances,” she told Tech Crunch. People ask, ‘What do I lack?’ ‘How do I manage my money?’ ‘Am I doing this right?’ I feel that it suits us all. There is a desire to make sure everything is in order.

Targeting General Z’s financial markets is not the only violence. Over the past two years, we have covered countless startups around the world, including Twig, Anfin, FamPay and Mitto. The company’s founders also consider their competitors, such as LearnVest and Family Office startup, Harness.

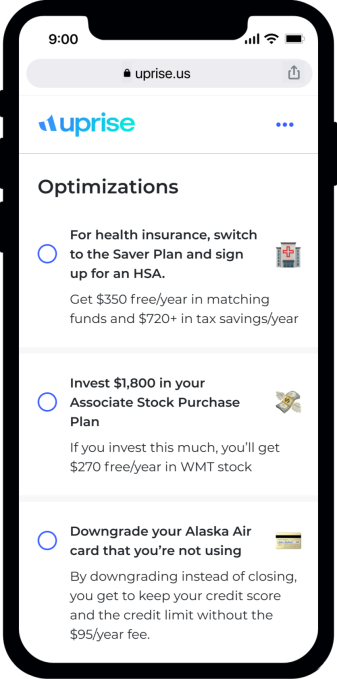

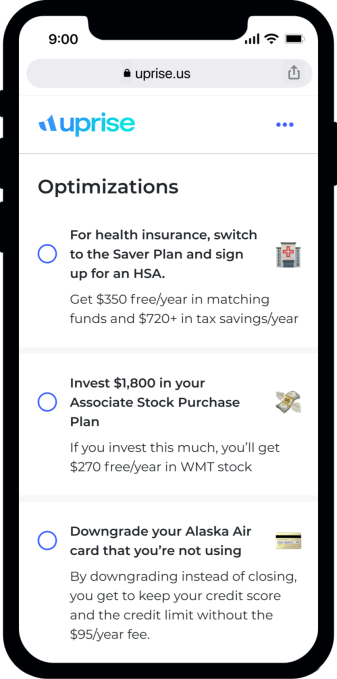

This company considers itself as a family office, but what makes Uprise’s strategy a little different is the full financial picture of the user, including some neglected issues such as employer benefits, and the advice of Uprise’s algorithm and expert review. What to do with their money based on that historical information and best practices.

For example, they may tell you that you have a lot of money in your checking account, so you can move some money to your savings account. Or increase your 401 (k) contribution from 2.2% to 3.6% to use the company match.

“One of the best things about it is that we can get $ 1.5 million in a plan to increase the net value of each customer’s lifetime,” says Chen Ryolfi. Basically, a lot of money that people don’t use is on the table.

That approach has been widely accepted. After the uprising, Chen Riollfi and Goodmachcher, Jr.’s second-in-command and payroll benefits, saw a waiting list for 7,000 people in 33 percent in May.

The company also includes investors from institutions such as Contrary Capital, Hustle Fund, On Deck and Dash Fund and a large group of investors, Sophie co-founder Dan Mackin, Gusto co-founder Eddie Kim, cash app founder and CEO Michael Gills and co-founder and CEO. Sen. Harper.

The riot is still in private beta, but it still has $ 50 million in assets. The company is a pre-earner and will always have an independent entity, but the plans are to make money in two ways: by building a premium level that provides additional features, such as the ability to highlight with your financial advisor and generate some revenue. Financial products recommended by financial advisors.

Chen Riolafi said the new funding will be used to recruit new talent and remove more people from the waiting list and build the merger with one click.

“We have a lot to learn when we make sure we hit the mark,” she added. “We are still focused on making sure our products are worthwhile. Helping people implement the recommendations will be a long journey.

[ad_2]

Source link