[ad_1]

For stocks in a bear market, new initial public offerings (IPOs) have dried up compared to 2020 and 2021. As of the end of May, only 114 companies have gone public in the United States by 2022, down 78. % from 2021. With the Federal Reserve raising interest rates, rising inflation and geopolitical tensions, companies are trying to figure out what their stocks will do when they start going public. However, with more than 1,000 companies going public last year, there are still plenty of new entrants to the public markets for investors to watch.

Digital delivery company Proof (Trust -4.10%) It’s my top tech IPO to buy in August. This is the reason.

Strong Q2 results

Remilly was established in In 2011, the aim is to disrupt the international money laundering industry. Remittances — usually from immigrants — must be processed in foreign currency and according to country regulations. Historically, these services have been expensive, with fees of 3%-7% per transfer. But with the rise of smartphones and internet access around the world, companies like Remitly can offer instant digital transfers at a much lower cost.

The break-up has helped Remily beat the volume of remittances over the past decade. This trend continued in the first half of 2022. In the second quarter, active customers grew 43% year-over-year to 3.4 million, billings increased 40% to $7 billion, and revenue increased 40% to $157.3 million. If Remily can hit its full-year 2022 revenue guidance of $627.5 million, revenue will grow at a 71 percent compound annual growth rate (CAGR) from 2019. the world.

But what about profitability? Separated from major IPO costs and marketing expenses, Remitly is now unprofitable, with an operating loss of $39.4 million last quarter. What remains to be seen is, if the company continues to grow revenue at a strong double-digit rate with great unit economics (gross margins around 50%), the company should have no trouble reaching positive operating margins once it does. It will also generate positive operating cash flow of $26 million in the first six months of this year.

A market with a large address

What I like about Remily is the company’s large addressable market. Remittances to low- and middle-income countries (Remilly’s target customers) are approaching $700 billion a year and have grown significantly over the past few decades. Taking Remitly’s $7 billion in Q2 payment volume to $28 billion, the company only has a 4% share of the massive and fast-growing market.

This large market, combined with better payments and a mobile-first approach, as customers continue to grow, is why Remitty’s revenue has grown rapidly in the past and should continue to grow at a strong double-digit rate. predictable future.

Reasonable assessment

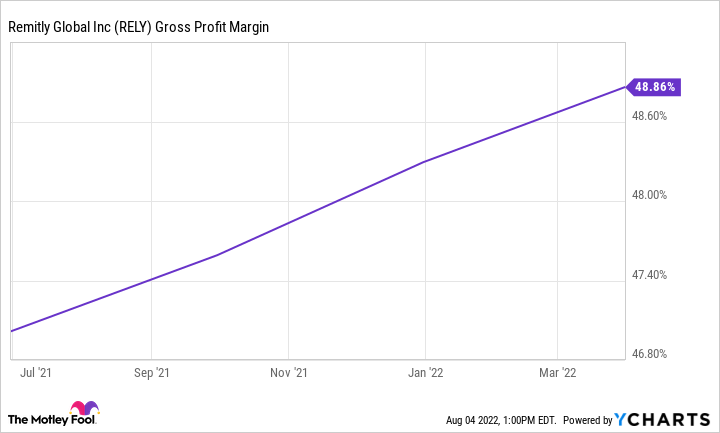

RELY gross profit margin data by YCharts

It’s hard to value the stock because Remitly isn’t profitable. But with a market cap of just $2 billion, the company doesn’t trade at a premium, at least compared to its growth potential. In the year If it achieves revenue guidance of $627.5 million in 2022 and gross margins grow to 50%, Remily will generate gross profit of $314 million this year for a price-to-gross margin (P/GP) of 6.4. This is around the market average, and indicates that investors are not bullish on this business for the next three to five years.

If they believe that Remily can maintain strong growth rates and eventually reach profitability, the stock could deliver excess returns to shareholders this decade.

Brett Shaffer has no position in the mentioned stocks. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

[ad_2]

Source link