[ad_1]

Elon Musk has embodied Tesla for more than a decade, becoming the company’s flamboyant ambassador for the electric car revolution. On Monday, the showman’s chief executive will try to prove to a Delaware judge that, whatever his prominence, he doesn’t control the company.

Musk is the first and most anticipated witness in a lawsuit over Tesla’s acquisition of SolarCity, its high-powered solar power launch that took place just before Tesla rushed to buy it in 2016 for $ 2.6 billion in Tesla shares.

Dissident shareholders of Tesla alleged that Musk designed the purchase not to create an integrated clean power plant as he claimed, but to use the manufacturer’s balance sheet to rescue one of its grand projects.

Although Musk’s economic and voting interest in the company was 22%, the plaintiff shareholders allege that Musk’s personality strength allowed him to dominate Tesla’s board, where they were even independent executives.

Tesla rejects this argument and adds that Tesla’s non-affiliated shareholders voted overwhelmingly to approve the acquisition of SolarCity. In the event that the court finds that Musk acted as a controlling shareholder, Musk will face a higher legal limit by proving that the agreement was reasonable for all shareholders.

The decision could have significant implications as corporate law confronts the implications of all powerful executives on any founders, especially in the technology sector.

“The case has the potential to provide more guidance not only to the courts, but also to the treatment planners, in terms of the factors that the courts can take into account when determining whether someone is a controller,” Ann Lipton said. , a law professor at Tulane University in New Orleans.

SolarCity was founded by Elon Musk and two of his cousins in 2006 © Michael Nagle / Bloomberg

SolarCity was founded in 2006 by Musk and his cousins Peter and Lyndon Rive. The company installed solar panels on the roof for customers who would then pay SolarCity for the electricity generated. In 2016, SolarCity was listed, but the capital-intensive nature of its business model left it with more than $ 3 billion in total debt and it was in danger of breaching minimum liquidity pacts.

Shares of Tesla fell one-tenth on June 21, 2016, the day the merger of SolarCity was announced, with a loss of $ 3 billion in market value, a figure higher than the acquisition price.

Goldman Sachs equities research analysts wrote at the time that the energy company was the company “in the worst position” in the solar start-up segment.

However, later in 2016, nearly 90% of non-affiliated Tesla shareholders who cast ballots voted to approve the deal, supporting Musk’s vision for the combined company. The shareholders ’vote was not necessary to close the acquisition, but Tesla hoped the holding of the vote would inoculate a messy legal challenge.

Opponents of the deal sued anyway.

In early 2018, the vice-chancellor of the Delaware Court of Chancery, Joseph Slights, denied the board’s motion to dismiss shareholder challenges, writing that “it is reasonably conceivable that Musk, as a controlling shareholder, would control the board of directors. Tesla in relation to the acquisition “and that” virtually no steps were taken to separate Musk from the consideration of the acquisition by the board of directors. “

In court documents, Musk’s attorneys wrote: “Trial evidence will show that Musk did not control the Tesla board in connection with the acquisition. Musk was removed from the council votes related to the acquisition and did not exercise actual control over the other board members. In fact, Tesla’s board exercised its independence from Musk. “

The Delaware court has not normally considered a one-fifths share to qualify as a control. But emerging Silicon Valley companies with visionary founding CEOs may turn out to be a unique corporate governance dilemma.

“Shareholders’ lawyers have been creative in pushing for control over shareholder doctrine, and Chancery judges want to increasingly consider the issue, ”said Lipton, the law professor.

Tesla shareholders who have sued have also filed allegations in addition to the controller’s argument that it could force a higher legal rule on Musk. They have claimed that Tesla directors (many of whom had links to Musk through SolarCity or its SpaceX business) were in conflict. They also allege that SolarCity’s serious condition had not been adequately disclosed in SEC requests.

While its lawsuit argues that SolarCity was insolvent and therefore worthless, its commercial value was about $ 2 billion before Tesla unveiled its 2016 offering.

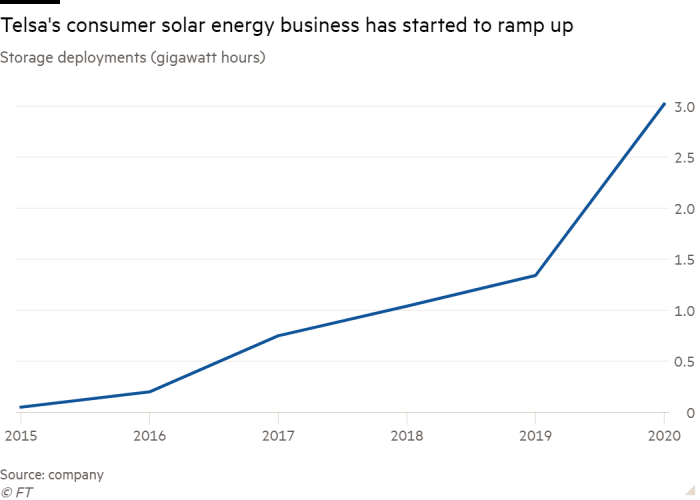

Tesla shares are more than 15 times higher than in June 2016. The company’s volume of solar deployments, measured in megawatts, had increased by almost a fifth in 2020 compared to the previous year.

In January 2020, Tesla directors, in addition to Musk, settled claims against them for $ 60 million, which will be funded by the company’s corporate insurance. Musk remains the only defendant pending.

His testimony could turn out colorful if his deposition in the June 2019 case is an indication.

Musk repeatedly attacked shareholder Randall Baron’s lawyer who questioned him, calling him a “shameful person” who “had no conscience” and a “wear and tear on the economy” that made Musk ” sad for the future ”.

Musk also offered a summary of his legal argument in the deposition. The Tesla / SolarCity deal was a “stock-to-stock transaction” and the lawsuit “tries to assess expert investors on what the proportion of the combination would be,” he said. “To enter [legal] precedent, it would be a disaster for America ”.

[ad_2]

Source link