[ad_1]

Microsoft reported the slowest growth in its digital advertising business in more than a year, amid a broader economic downturn that has seen tech giants report declining ad revenue.

Microsoft, which released its quarterly results Tuesday afternoon, said revenue for LinkedIn and Microsoft Search and News Ads was $100 million less than expected in the fiscal fourth quarter, ended June 30. Budgets.

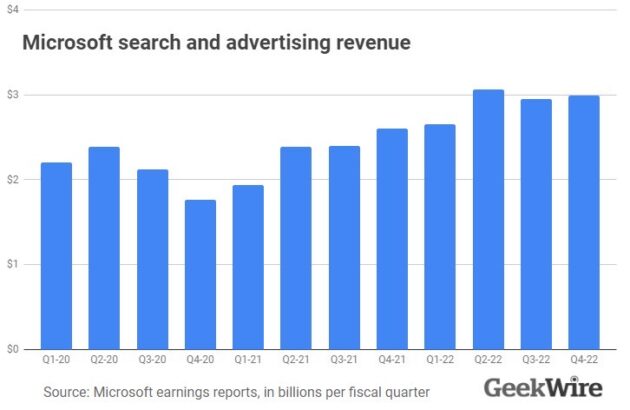

The company’s search and advertising revenue was nearly $3 billion in the quarter, up 15 percent from the same period last year, the slowest quarterly growth in more than a year.

LinkedIn’s total revenue, including ads and subscriptions, was $3.7 billion in the quarter, up 26 percent. Microsoft earned more than $26 billion in business social networking in 2016.

Microsoft’s decline in digital advertising growth is part of a broader trend affecting tech stocks across the board, as macroeconomic factors, including inflation, are causing many companies to cut marketing spending.

Consumers are glued to their computer screens during the pandemic, leading to a huge increase in digital advertising revenue for tech companies. But with the return to normalcy and fears of a looming recession, companies are pulling back on that spending.

“Broadly speaking, despite the headwinds in the advertising market right now, looking at the long term, we’re expanding our advertising opportunities.”

Former Zillow CEO Spencer Rascoff said in an interview with CNBC on Monday that many VC-backed startups are cutting back on paying for ads.

Many companies in his own investment portfolio have significantly reduced or cut their advertising spending altogether, Rascoff added.

In the second quarter of last year, YouTube posted an 84 percent increase in ad revenue. But the company’s revenue grew just 4.8% in the same period this year, the slowest quarterly growth in more than two years.

Alphabet-owned Google’s core ad revenue grew just 11.6 percent in the second quarter, down 69 percent from the same period last year.

Twitter cited a “macro-environmental headwind” in its earnings report as revenue fell 1% from the same quarter last year.

Snap, which relies largely on digital ad revenue, wrote in its latest investor letter that revenue was “flat” so far this quarter, a sign that ad spending growth may be slowing. Snap shares fell more than 25 percent following last week’s earnings report.

Microsoft expects the overall slowdown in the ad market to continue in the first quarter of the new fiscal year, the company’s chief financial officer, Amy Hood, said on a conference call with analysts and investors.

Still, Microsoft CEO Satya Nadella said on the call that the company is doubling down on advertising in search of another source of long-term growth and trying to differentiate itself from other big tech companies with its privacy and data controls.

Nadella cited Netflix’s recent decision to partner with Microsoft at the new ad-supported level as evidence.

“Broadly speaking, while there are headwinds in the advertising market right now, looking longer-term we’re expanding our opportunities in advertising,” Nadella said. “We’re creating a new monetization engine for the web, an alternative that offers marketers and publishers more durable advertising solutions and supports consumer privacy and robust data governance.”

Microsoft recently completed the acquisition of AT&T’s Xander ad technology business. Nadella also plans to use the Edge browser and Microsoft’s Start personalized news feed to further the company’s focus on advertising.

GeekWire co-founder Todd Bishop contributed to this report.

[ad_2]

Source link