[ad_1]

Meta forums (Meta -0.21%)Formerly known as Facebook, it has changed its name in 2021 to indicate its focus on all things Facebook. However, that transition was, in fact, a disaster, with stock down nearly 42% after the transition.

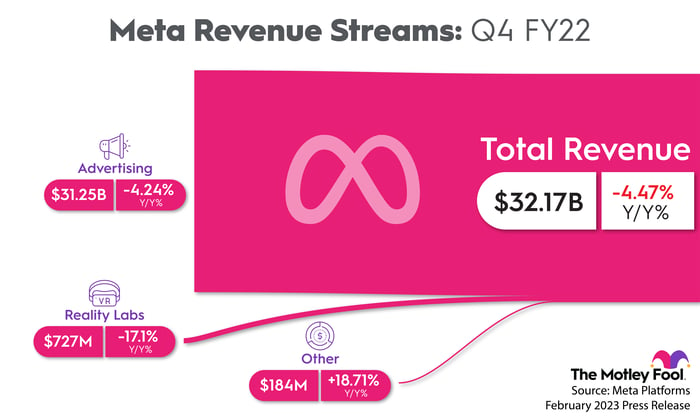

Although the Metaverse segment gets the most attention, it doesn’t account for that much of Meta’s revenue. So let’s dive into meta trading and see if there is a class worth investing in.

Reality Labs covers a lot of costs.

Promotion from Meta’s social media platforms (such as Facebook and Instagram) contributes most of the company’s revenue.

Image source: The Motley Fool

At Realty Labs (Metaverse Division), when it holds a markup of more than 2% of gross revenue, it doesn’t move the needle. But that doesn’t paint the whole picture. When looking at operational costs, Reality Labs plays a huge role.

| Room | 2022 operating expenses | Percentage of expenses | Working margin |

|---|---|---|---|

| A family of applications | 71.8 billion dollars | 82% | 37% |

| Reality labs | 15.9 billion dollars | 18% | (635%) |

Data Source: MetaPlatforms.

This is a problem when a division contributes only 2% of revenue but 18% of operating expenses. Obviously, this meta segment is a big drag on the company and a big reason for the decline in operating profit.

META Operating Revenue (TTM) data by YCharts.

That’s why CEO Mark Zuckerberg has been criticized for focusing too much on Metaverse: It’s not moving the needle and it’s dragging down a pretty solid business.

If you zero in on the Meta family of apps instead, it’s not perfect, but it’s still impressive.

Meta’s stock has risen this year with favorable comments from Zuckerberg

Revenue for the Meta family of apps fell just 4%, year-over-year, in Q4. This is remarkable considering the difficult advertising environment. However, this segment will see rising costs, with this segment declining to 34% this year from 49% last Q4.

That’s pretty low, but a 34% operating margin is still more than most companies can dream of.

Although Zuckerberg is not backing down from the Metaverse, he is focusing on cost-cutting measures. In the year He designated 2023 as the “Year of Efficiency,” which would include eliminating certain programs. We’ll have to wait to see those moves, and all eyes will be on Meta’s Q1 report to see if Zuckerberg is blowing smoke or actually committed to cutting costs.

Judging by the stock’s action, the market believes Zuckerberg. Since the earnings report, the stock is up 21%, bringing its year-to-date gain to 54%.

So do meta platforms even offer a business worth investing in, even in the form of a meta version? i think so.

Meta’s social media platforms offer advertisers some of the best bang for their buck and are likely to continue to do so for some time to come. Additionally, the stock currently trades for 20 times earnings, which is below its long-term average.

META PE Ratio Data by YCharts.

Meta’s revenue is probably at the lowest level they’ll ever reach, especially with Zuckerberg’s focus on efficiency. The stock is attractively priced, at these prices.

However, I distanced myself from the stock because of the dynamic wild symbol. If the investment doesn’t work, Meta has burned billions of dollars chasing something that will never materialize. Plus, if Zuckerberg sticks around, it could become “me against the world” and continue to hurt the stock.

With Zuckerberg owning more than 50% of the company’s voting power, there’s no stopping him from pursuing pet projects.

Meta platforms are still big business and investable, but given the unnecessary emphasis on the metaverse, I’ll pass for now.

Randy Zuckerberg, former director of market development and Facebook spokesperson and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has no position in the mentioned stocks. The Motley Fool has spots and recommends Meta Platforms. The Motley Fool has a disclosure policy.

[ad_2]

Source link