[ad_1]

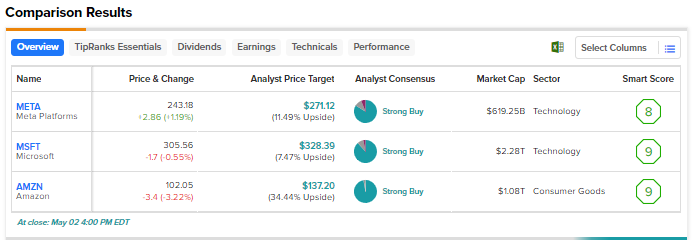

The recently reported earnings reflect efforts by technology companies to cut costs and streamline operations as recessionary risks remain. Despite continued macro headwinds, many tech companies outperformed Street expectations. Here, we used TipRanks’ Stock Comparison Tool to rank the meta platforms (NASDAQ: META), Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ: AMZN) among themselves to choose the most attractive technology stock at the current levels.

Meta Platforms (NASDAQ:META)

The social media giant’s meta platform returned to growth in Q1 2023 after three quarters of revenue declines due to macro pressure on digital ad spending. Revenue rose 2.6 percent year over year to $28.6 billion, while EPS fell 19 percent to $2.20. Both metrics came in ahead of road expectations.

The Q1 bottom line was impacted by $1.14 billion in restructuring costs related to the company’s efforts to streamline operations and reduce costs, including costs related to severance and layoffs.

While the company is cutting costs in certain areas, it continues to build its artificial intelligence (AI) capabilities to support ads, feed and reels, and invest in generative AI initiatives.

Is META stock a good buy?

Last week, Guggenheim analyst Michael Morris raised his price target on Meta stock from $240 to $320 and reiterated a buy rating.

While Morris is focused on improved revenue trends in Q1, he feels accelerated DAU (daily active users) growth driven by AI investments should boost investors’ confidence in Meta to “compete effectively with Tiki Talk and other customer engagements.”

Wall Street’s strong buy consensus rating is based on 41 buys, five holds and three sells. An average price target of $271.42 indicates an upside of 11.5%. The stock is up 102 percent since the start of this year.

Microsoft (NASDAQ:MSFT)

The buzz surrounding Microsoft’s AI initiatives and better-than-expected results in the fiscal third quarter have pushed MSFT shares higher this year. Q3 FY23 EPS increased 10% to $2.45, driven by 7% revenue growth to $52.9 billion.

Top line growth was driven by 16% growth in the Intelligent Cloud segment and 11% growth in the Productivity and Business Processes segment. However, the weakness in the PC market has affected the personal computing segment more. Meanwhile, revenue from Azure and other cloud services rose 27%, better than analysts’ estimates but showing a slowdown compared to Q2 FY23.

Meanwhile, Microsoft is bullish about its AI initiatives and the development potential of its AI-powered devices. The company launched its AI-powered Bing search engine and Edge browser during the quarter, and revealed significant investments in ChatGPT creator OpenAI.

What is the price target for MSFT stock?

Last week, RBC Capital analyst Rishi Jaluria raised his price target on Microsoft stock to $350 from $285, maintaining a buy rating. Jalluria thinks the company’s “incredibly clean” beat-and-boost quarter AI is set to be the next avenue of growth, and should help solve some software problems, including those around cloud computing.

Overall, Microsoft’s strong buy consensus rating is based on 30 buys, three holds and one sell. A price target of $328.39 indicates a 7.5% upside. Shares are up more than 27 percent year-to-date.

Amazon (NASDAQ: AMZN )

E-commerce giant Amazon reported better-than-expected results for the first quarter. However, investors were disappointed by management’s warning that Amazon Web Services’ (AWS) cloud business would continue to slow. The high-margin AWS segment is considered a key growth driver.

Amazon’s Q1 2023 revenue rose 9% to $127.4 billion. The company generated EPS of $0.31, compared to a loss of $0.38 in the year-ago quarter. AWS revenue increased 16% to $21.4 billion, but that was down from the 20% and 28% growth seen in Q4 and Q3 2022, respectively. The impact of macro pressures on IT spending is weighing on AWS performance.

However, the company is positive about future growth based on its streamlining efforts and strategic initiatives in its retail, AWS and advertising businesses.

Buy, Sell, or Hold Amazon Stock?

Amazon’s Q1 results prompted Wedbush analyst Michael Pachter to raise his price target to $129 from $125 and reiterate a Buy rating on April 28. Pachter feels Amazon’s outlook is “much better than feared” despite the slowdown in AWS.

The analyst believes Amazon is well-positioned to continue delivering better-than-expected profitability as inflation moderates and recession fears fade. His optimism is supported by AWS’s high-margin mix, growing advertising business and third-party vendor services.

The analyst pointed to growth in the performance of AWS, its ads and subscription units, as Amazon continues to shrink advertising demand, tighten IT budgets and cut consumer spending.

With 37 buys and one hold, Amazon stock scored a strong buy consensus rating. An average price target of $137.20 indicates a 34.4% upside. Shares are up 21.5% so far this year.

Summary

Analysts are bullish on all three tech stocks discussed here, but they look more bullish on Amazon than at current levels. Despite the slowdown in Amazon’s cloud business in recent quarters, Wall Street remains optimistic about long-term growth potential and AWS’s dominant position. Moreover, they believe in the company’s leadership in the e-commerce space and its ability to meet the expectations of the fast-growing advertising business.

In addition to analysts, hedge funds are bullish on Amazon and increased their holdings by 17.3 million shares last quarter. According to TipRanks’ Hedge Fund Trading Activity Tool, hedge funds have a very positive confidence signal on Amazon.

Disclosure

[ad_2]

Source link