[ad_1]

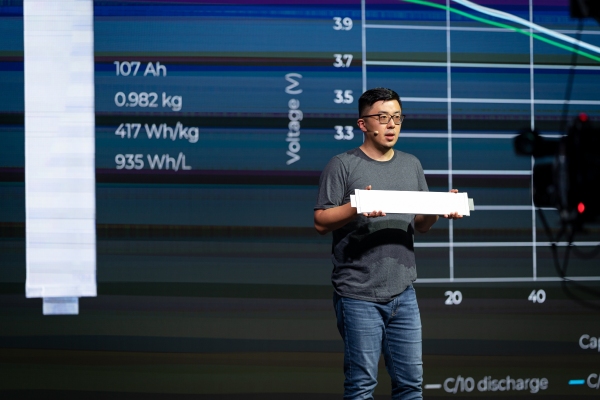

Source: Takealot

The Commission launched its investigation into competition and participation in the online economy last year, citing the growing importance of the online economy and the competitive risks emerging in these markets in other countries. The aim was to enable consumers and businesses using online platforms to benefit from the competition of online platforms and to enable SMEs and historically disadvantaged businesses to participate fairly in the online economy.

The commission’s interim report, released Wednesday, July 15, follows 14 months of evidence-gathering, public hearings and in-camera hearings into online mediation platforms such as e-commerce, app stores, travel and accommodation platforms, catering and online classifieds.

The survey identified the country’s leading platforms in each sector, which receive the highest user traffic, and the findings apply specifically to these platforms. The platforms are listed as follows: Takealot, Apple App Store, Google Play Store, Booking.com, Airbnb, Mr Delivery, Uber Eats, Property24, Private Property, AutoTrader and Cars.co.za with Google Search (including specialist) as Google Shopping and search components such as Google Travel).

Possible changes in Google search results

Internet giant Google was identified in the report as lacking transparency around paid search results.

The commission plays an important role in directing Google search consumers to different platforms, thereby shaping platform competition. “The proliferation of paid search at the top of the search results page is insufficient because advertising increases platform customer acquisition costs and supports large and often global platforms. The preferential placement of their own specific search units distorts competition on Google’s part,” the commission said.

Therefore, the request recommends that paid results be labeled as ads with borders and shadows so that they are clear to users, and that the top of the page is not affected by payment based solely on relevance to organic or organic search results. The Requester allows Google Competitors to compete for prominence in search for Google’s Specialist Units by having their own Specialist Units and without any guarantees.

The question is whether the default location of Google search on mobile devices should end in South Africa.

Fair competition between platforms

Given the competition between platforms, the inquiry makes the following provisional findings and recommendations, including:

• There is no effective competition in software app stores for app developers to pay through in-app payments, resulting in higher fees and app prices. The recommendation is that apps should be able to direct consumers to external web-based payment options, or alternatively, the highest app store commission fees are set.

• Price parity clauses, which are evident in travel and accommodation, e-commerce and food delivery, stifle competition and create dependency, hence the request recommends their removal. “Broader price parity clauses prevent businesses from offering lower prices on other platforms and narrower price parity bars businesses from offering lower prices in their own online channels,” the commission said.

• In property allocations and food delivery, new entrants and local delivery platforms face challenges in registering large national businesses, which hurts their ability to compete. The inquiry has temporarily found in the property category that this is the result of the investment and support of large estate agencies in private property and recommends that they change their share. Optimizing the interaction of listings on leading platforms is an additional tip to support newcomers.

• In food delivery, national restaurant chains often prevent franchisees from listing on local delivery platforms and the inquiry recommends that this practice stop with incentives offered by national delivery platforms.

• In food delivery, the inquiry found that the business model of a high-end diner promotion coupled with high restaurant commission fees results in high surcharges on menu items that are not transparent to consumers and distort competition with local delivery options. The inquiry recommends greater transparency on menu surcharges or the share taken by delivery platforms.

Fair user choice

In light of the competition between platforms and businesses for consumer choice, the inquiry provides the following interim findings and recommendations, including:

• There is a tendency in all platforms to sell top search positions to businesses, which is a form of advertising that is not very relevant to the user and is not transparent. This affects consumer choice and competition, particularly for SMEs that cannot afford to spend as much as large businesses, the commission said. The query recommends that advertising be displayed as such and top results are reserved for organic (or natural) search results.

• The inquiry found that high payment discrimination against SMEs in online placements, catering and, to a lesser extent, travel and accommodation hinders their participation and lacks consistent justification. The recommendation is to set an upper limit on the fee, with the maximum difference between large and small businesses being 10-15 percent. In the case of food supply, it is recommended that there be fairer treatment in terms of marketing commitments for lower commission payments.

• In e-commerce, the question is whether operating a marketplace for third-party sellers and selling your own retail products can lead to conflicts of interest, such as product gating, where retail buyers are given access to seller information. To target successful products, preferred display ads and promotions. Not having a fast resolution process also increases costs for sellers. The inquiry recommends an internal structural condition for the separation of retail from the market in order to implement fair and competitive neutral processes.

• In the software application stores, the inquiry has provisionally confirmed that SA applications face challenges in competing with the world’s largest application development companies. The inquiry temporarily recommends that app stores provide country-specific app recommendations and offer free promotional credits to SA app developers to help them gain visibility.

Participation of people affected by history

Historically disadvantaged parties (HDPs) participation, the digital economy has been found to be significantly less than in many traditional industries, and funding and support, in particular, have challenges stemming from historical disadvantage.

“The general inequality of resources for HDP digital entrepreneurs creates barriers to seed funding from close partners, and the venture capital industry does not offer much at this level. In addition to seed funding, venture capital funds only seek HDP entrepreneurs through SASME funding (a joint government and CEO initiative).” Infrequent investors,” the commission said.

The inquiry recommends the HDP mandate from private investors and the government to provide financial support for HDP digital entrepreneurs to the venture capital sector, along with the requirements to transform the sector.

As for businesses on the platforms, the Commission said the same lack of resources and financial support hinders HDP businesses from getting on board and taking advantage of the opportunities offered by the platforms. The question’s provisional recommendation is that all leading platforms offer HDP businesses personalized onboarding, opt-out of onboarding costs and fees, free promotional credits, maximum payouts, and the opportunity for consumers to discover HDP businesses on the platform.

Finally, the inquiry tentatively recommends that guidelines or regulations be considered to address new lead platforms in established or future new categories.

Call for public opinion, stakeholders

Stakeholders and the public have six weeks to present their findings and recommendations to the inquiry. All submissions must be sent to az.oc.mocpmoc@impio by the close of business on August 24, 2022. The information provided must be supported by evidence if necessary. The inquiry will release another version of the original report in the next few weeks after the wider confidentiality claim is resolved.

The interim findings and recommendations will now be subject to public comment and stakeholder consultation before a final report is issued in November 2022. .

Interim Report on Online Platforms Market Inquiry is available here.

[ad_2]

Source link