[ad_1]

Germany’s flagship carrier Deutsche Lufthansa AGHairs)D: LHAB) seems to be in dire straits as the workers on the ground are on strike causing major disruptions. A “warning strike” by union Verdi demanding a 9.5% pay rise has forced Lufthansa to cancel its entire flight schedule in Frankfurt and Munich on Wednesday 27 July. The 20,000 ground workers were hit hard by the strike. Airline operations amid peak summer travel season. The strike affected an estimated 134,000 passengers at the Frankfurt and Munich hubs.

Lufthansa said it was working to restore normal operations, but the damage caused by the strike could still cause individual flights to be canceled or delayed on July 28 and July 29.

Lufthansa’s operational woes are endless

Lufthansa and other major airlines around the world have been unable to cope with increased travel demand following the easing of restrictions. European airlines have been hit hard by staff shortages and the Covid-19 pandemic.

According to Reuters, earlier this month Lufthansa canceled an additional 2,000 flights from its Frankfurt and Munich hubs this summer. The carrier previously canceled 770 flights scheduled for June and July and another 3,000 scheduled for July and August.

Impact on Lufthansa’s finances

The financial impact of the strike and flight cancellations could be huge for Lufthansa, given the volume of business affected. The company has not yet provided a specific estimate of the financial impact.

Earlier this month, Lufthansa reported its first second quarter results. It returned to profitability in the second quarter, with revenue nearly doubling to 8.5 billion euros from 3.2 billion euros. Adjusted EBIT (earnings before interest and taxes) came in at between €350 million and €400 million, compared to a loss of €827 million in the previous quarter. Lufthansa will report its final second quarter results on August 4.

Wall Street has a sneak peek.

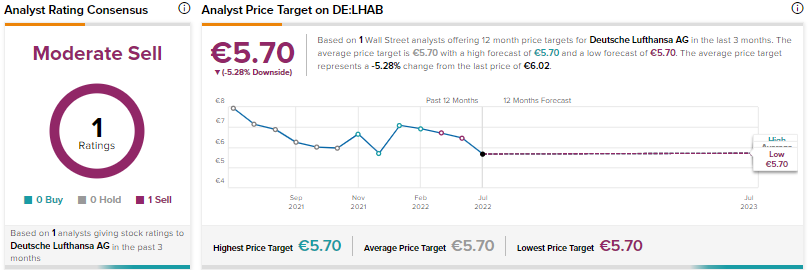

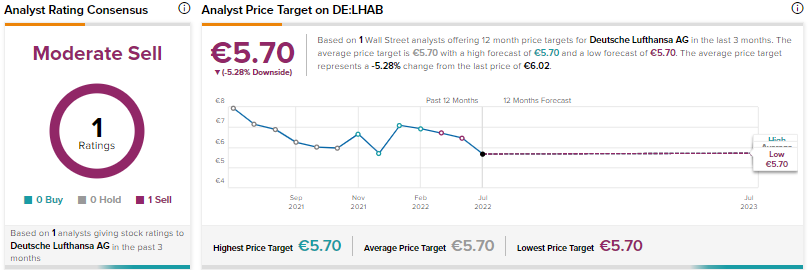

On TipRanks, Lufthansa has scored a medium sales agreement rating based on one recent sales recommendation. Deutsche Lufthansa’s average price target of 5.70 indicates a potential downside of 5.28% from current levels.

Conclusion

Lufthansa has faced significant operational issues due to labor shortages, which are hampering its ability to meet strong travel demand. If the ongoing strike is not resolved amicably, it could be a huge financial loss for the company. It creates a lot of trouble for travelers during the peak travel season.

According to the TipRanks Smart Score System, Lufthansa scores a score of one out of 10, indicating that the stock may underperform the broader market.

Disclosure

[ad_2]

Source link