[ad_1]

While startup funding globally declined last year, New Zealand venture capital investment is still growing, with NZ$726 million poured into 154 deals by 2022, according to the Technology Investment Network (TIN).

of Technology investment reportkick off As part of Oakland Tech Week 2023, It covers pre-seed to Series C+ funding, tracking funding levels over the past two years. It is compiled with support ASX, NZ Growth Capital Partners (NZGCP) and BNZ, along with local VC and angel investment firms.

In the year While global venture funding is expected to decline between 32-35% in 2022, funding for NZ tech grew by 8.2% last year, driven by offshore-led investment, which exceeded NZ$400 million, up from $288m in 2021.

Offshore investors led 26 of the 154 deals at an average of NZ$15.5m, representing 55% of total capital raised in 2022.

Another $268m was pumped into local tech companies by offshore investors in 102 deals, while undisclosed private investors contributed an additional $59m in the remaining 26 deals.

Deep technology shines.

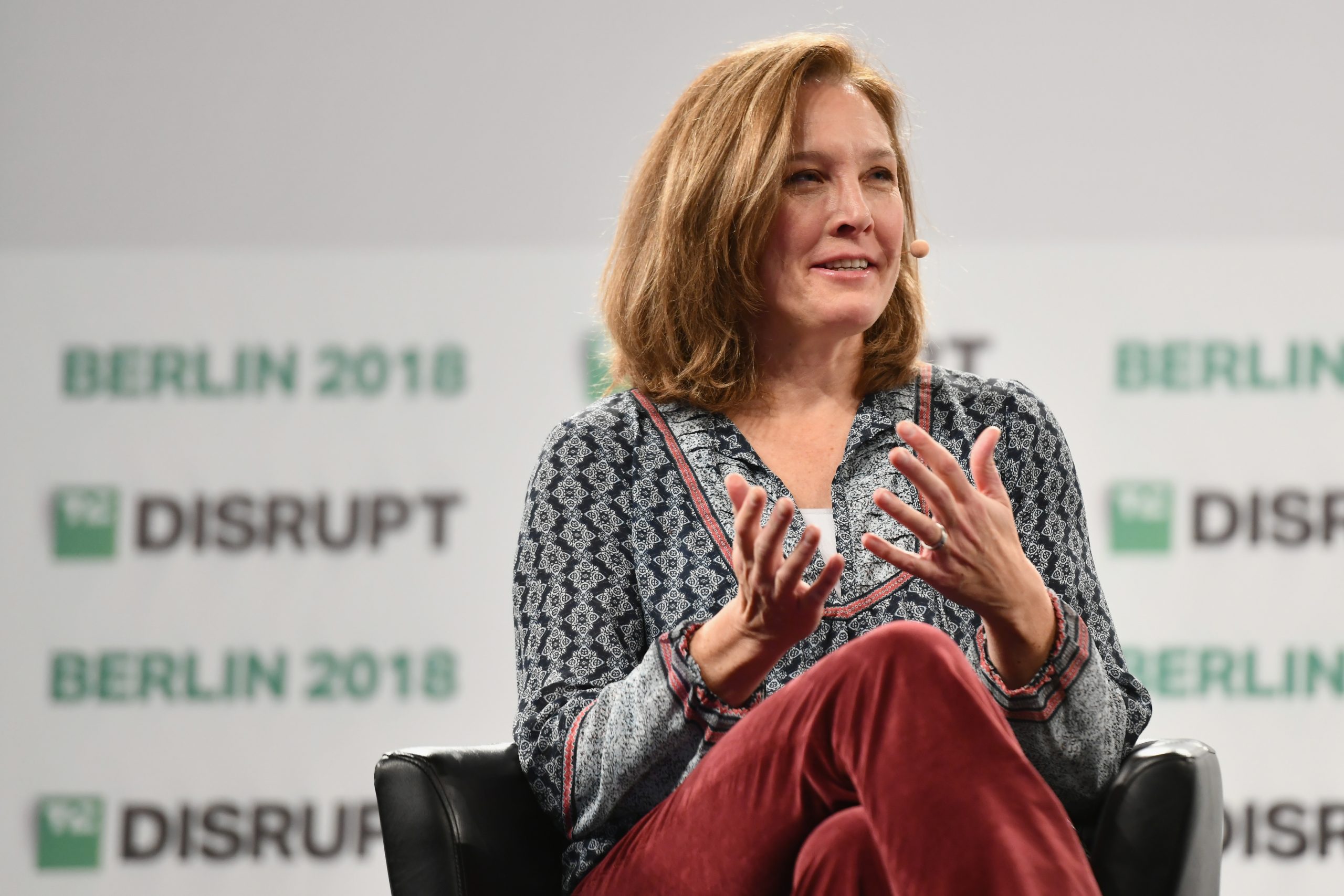

According to Alex Dixon, author of the report and head of research at Tin, the increase in domestic investors over the past year has also been noteworthy.

Tin Alex Dixon

“Historically, access to capital has been a challenge for Kiwi tech companies, but the amount of investment we’re seeing now suggests there’s never been a more exciting time to be part of the ecosystem,” he said.

“There’s no shortage of highly qualified tech startups in New Zealand, and thanks to a vibrant local funding circuit, many can afford to buy into the early stages. That said, our investment pool is still shallow compared to other smaller, more advanced economies – such as Finland, Ireland and Estonia.

“As always, Kiwis must do more to attract the long arms and deep pockets of foreign investors. 2022 will show that even a small number of offshore-backed concessions can turn the dial on the entire ecosystem.”

Dixon said that while software solutions were taking the lion’s share, Ldiptech companies accounted for nearly a quarter (22%) of the capital raised, totaling NZ$162m.

“There is an air of sophistication about homegrown innovation at the moment, with similar encouraging signs from health technology ($71m) and net investment ($27m),” he said.

“As long as capital continues to complement our world-class engineering capabilities and those success stories are exported, there is no reason why New Zealand cannot compete and win at the cutting edge of technology.

He made a promise to women in tech

Women-led tech raised NZ$3.4m per deal in 2022, but that’s more than half of their male-led counterparts, who averaged NZ$5.2m per deal.

The gender imbalance is similar, with female tech founders or founders accounting for over a quarter (27%) of all capital raisings.

But to Aotearoa’s credit, when it comes to established technology, female CEOs lead 16 of the country’s top 200 exporting firms by revenue.

James Pinner, NZGCP’s chief investment officer, believes the current economic climate offers a great opportunity as crises provide the most creative moments.

“Now is the time to create and build the next generation of innovative New Zealand technologies and the country has deep domestic capital pools to support this,” he said.

Still, Pinner was pragmatic about his future prospects for the investment landscape.

“The New Zealand venture capital investment landscape has undoubtedly changed over the past few years,” he said.

“As we have seen globally, the amount of capital available for investment has increased significantly until 2022, but this appears to be the peak and we are certainly in for a very difficult few years.”

Blair Harrison, head of New Zealand listings at the ASX, said the outlook for Kiwi technology companies continued to be bright, driven by investor appetite in Australia, New Zealand and beyond.

“New Zealand’s technology companies are internationally respected, renowned for their innovation and highly skilled and integrated management,” he said.

“The pipeline of technology companies preparing to list on the ASX continues to be strong and we expect to see New Zealand technology continue to grow on the ASX over the next few years.”

Digital copies of the 2023 Technology Investment Report Available through TIN website.

[ad_2]

Source link