[ad_1]

Shahid Jameel

It’s clear that the United States is home to some of the most innovative and profitable technology companies on the planet. However, when it comes to the semiconductor sector, the two leading companies – in terms of technology – are based in Taiwan and Korea. Taiwan Semiconductor (TSM) and Samsung (OTCPK:SSNLF)(OTCPK:SSNNF), respectively. That being the case, I’ll take a closer look today. iShares Global Tech ETF (NYSEARCA: IXN) to see how technology can be a good addition for investors looking to build and maintain a well-diversified portfolio.

Investment thesis

It is important for investors to understand the differences between companies that are immersed in the “semiconductor sector”. Some of these companies manufacture semiconductor chips (ie foundries), and some of these companies are “fabs” – ie they specialize in chip-design and outsource the actual fabrication of chips to foundries. The third category in the semiconductor sector is semiconductor equipment companies.

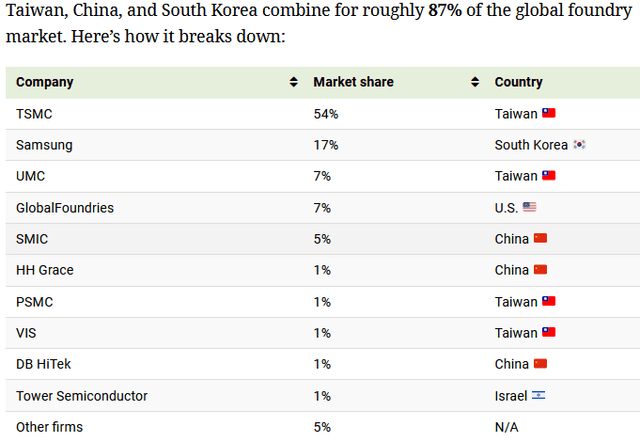

The semiconductor industry originated in the United States (one reason for the “Silicon Valley” moniker), but over time the US has increasingly outsourced its semiconductor needs to Asia. In fact, today the US only produces about 10% of the world’s semiconductor capacity. And in terms of technology, TSMC and Samsung are at the top of the pyramid and are currently creating and supplying high performance silicon to companies like Apple (AAPL) and NVDA (NVDA), which are heavily dependent on foreign semiconductor companies. Their high-end products.

The good news is that the Biden administration recently pushed the “CHIPS & Science Act of 2022” through Congress and President Biden signed it. The CHIPS Act is expected to provide not only $52.7 billion to boost U.S. chip production over the next five years, but an additional 25% investment tax credit for semiconductor factories worth an estimated $24 billion over the next 10 years. However, as most of you know, it takes years to build and bring a new state-of-the-art semiconductor fab online. Meanwhile, the sad reality is that Asia dominates semiconductor production:

Visualcapitalist.com

Source: VisualCapitalist.com

It is clear that semiconductors are the most important sub-sector of technology, but there are many others (software, network, IoT, clean-tech etc.). As a result, investors looking for a well-diversified technology ETF may want to invest in a technology fund — like IXN — globally.

Today I’m taking a closer look at the iShares Global Tech ETF to see if it could be a good tech addition for an investor looking to hold a well-diversified — and global — technology portfolio, and how the ETF has positioned investors for success. .

Top-10 Holdings

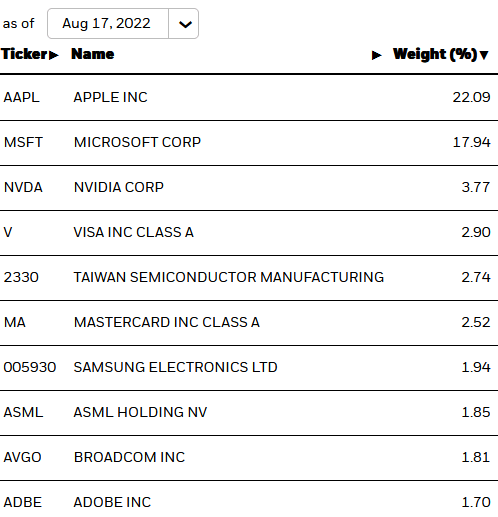

The top-10 holdings in the IXN ETF are presented below and equate to what I consider to be relatively concentrated at 59.3% of the total portfolio.

iShares

Source: iShares IXN ETF website

Not surprisingly, the fund is well represented by US companies and, overall, only the top two holdings – Apple And Microsoft (MSFT) accounts for ~40% of the total portfolio. That being the case, investors interested in diversifying their portfolios, and who already own large stakes in Apple and/or Microsoft, should probably pass on the IXN ETF. That said, it’s hard to argue with these two companies’ long history, high free-cash flow, and very strong market position.

It is the #3 holder with 3.8%. Nivea, an outstanding chip designer (mostly in graphics, networking, and computing) that has also turned into a leading provider of AI/ML technologies. Nvidia recently fell ~50% off its 52-week high. Shares of NVDA fell sharply earlier this month after its quarterly report showed a 19% decline in revenue (-33% yoy) as its gaming-related business disappointed. However, data center revenue grew 61 percent to $3.81 billion. Navia typically orders high-performance chips from TSMC, but in July it was reported that the company was looking to reduce orders for TSMC’s 5nm wafers due to low demand for its GeForce RTX 40 series GPUs.

Payment processing Visa (V) and MasterCard (MA) are the #4 and #6 holdings with a combined weight of 5.4%. Personally, I see these companies as being more in the financial sector than the technology sector, and prefer to see more technology-focused companies in my top 10 holdings.

Finally we come to top semiconductor foundry company TSMC with the #5 case and 2.7% weight. In my opinion, it is good for “Global Tech ETF” to have such a small weight in the most important semiconductor company on the planet. I feel the same way about #7’s minuscule 1.9% weighting for Samsung, the semiconductor company closest on TSMC’s heels in terms of semiconductor processing.

#9 is the handle. Broadcom (AVGO), one of the most popular companies in the technology sector – see Broadcom Cement as the best distributed growth stock. Broadcom I’s the leading high-speed networking development platform (hardware and software), generates plenty of free cash flow, currently pays an annual dividend of $16.40/share and has committed $10 billion in share buybacks this year. . Meanwhile, the company bids for VMware to diversify and grow its high-margin enterprise software division.

Top-10 holdings are rounded Adobe (ADBE), a global software provider that operates a SaaS-based business model, albeit a Creative Cloud subscription service. Like many high-flying software companies, ADBE is down significantly from its 52-week high (~40%) yet trades at a relatively high forward P/E = 32x.

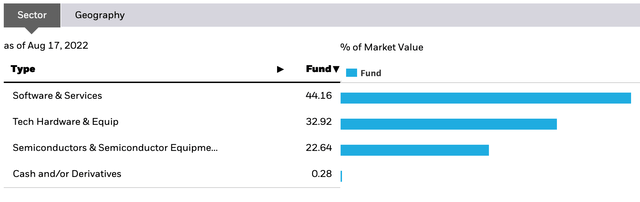

Overall, IXN’s portfolio has the following allocation in the technology sector.

iShares

As can be seen in the chart, the IXN ETF is skewed towards the software subsector, with semis accounting for only 22.6% of the fund.

The following ETF and valuation metrics were taken directly from the iShares IXN ETF website:

- Expense Rate: 0.40%

- Net assets: $3.55 billion

- # Possession: 132

- 30-day yield: 0.64%

- P/E ratio: 27.3x

- Price for book: 6.95x

As you can see, the fund’s expense ratio is high compared to more cost-effective funds, but not excessive considering that the ETF directly invests in foreign currency for foreign companies. The fund holds 132 companies and – with assets of 3.55 billion dollars – and is therefore relatively liquid. Given the relatively low yield, the primary investment objective in the IXN ETF is capital appreciation, not income. Finally, and like most technology funds, the IXN ETF’s valuation metrics trade at a significant premium to the S&P500 (P/E=21.4x, P/B=4.2x).

Performance

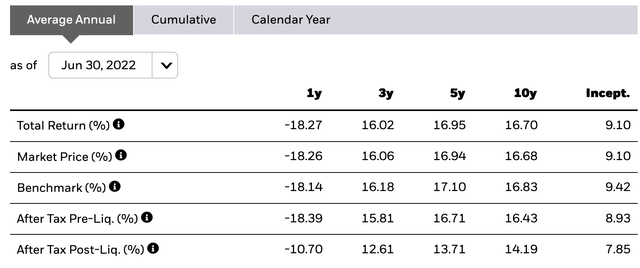

The average annual total returns of the IXN ETF are shown below.

iShares

As can be seen in the chart, and surprisingly, the ETF has performed poorly during the bear market of last year and 2022, yet has a strong average annual return of 16.7% over the past decade.

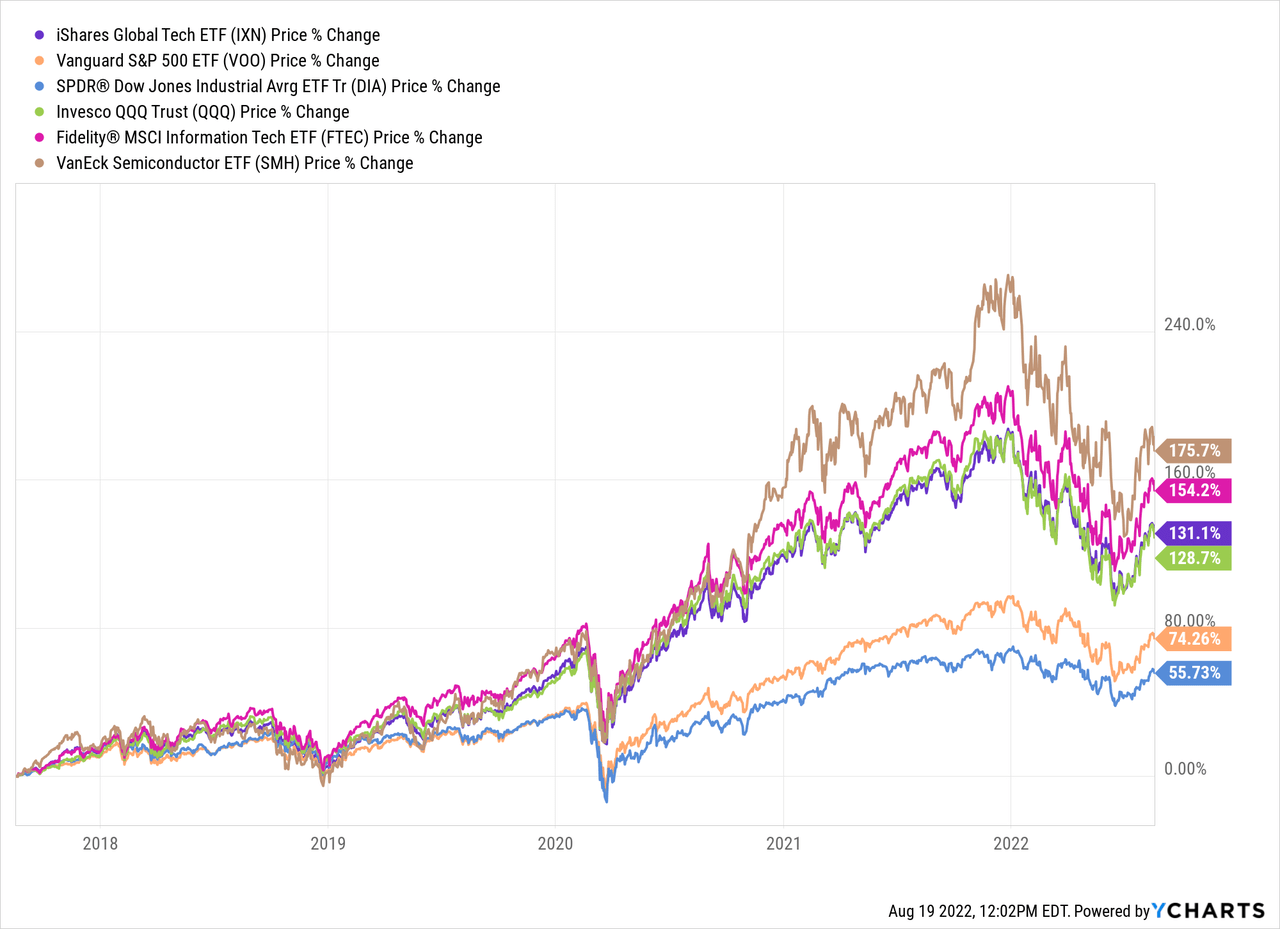

The graphic below shows the five-year relative price returns of the IXN ETF versus the S&P500, DJIA and QQQ broad market averages, as well as Fidelity MSCI Information Technology ETF (FTEC) and VanEck Semiconductor ETF (SMH):

As can be seen from the chart, while the IXN ETF has performed well against the broader market average, the FTEC and SMH ETFs have lagged significantly.

Accidents

IXN is certainly not immune to current macro-level investment risks: high inflation, high interest rates, and the impact of Putin’s disastrous election on Ukraine, effectively disrupting global energy and food supply. supply chains. Any or all of these could result in a global economic slowdown and/or global recession, which, obviously, would put downward pressure on IXN shares.

IXN’s high valuation still represents a high risk/reward opportunity overall for the highly valued software sector compared to the broader market represented by the S&P500. That said, in tech heavyweights Apple and Microsoft generally offset that risk.

For countries like Taiwan and Korea — home to some of the best semiconductor fabs on the planet and owned by a pair of companies in IXN’s top-10 — China’s growing military presence is a continuing threat.

Summary and conclusion

A global technology fund that could invest in the Asian semiconductor sector sounds like a good idea. However, the IXN ETF doesn’t allocate much capital to leading semiconductor companies in Asia, and despite its strong long-term performance history, it doesn’t differentiate itself enough from other tech funds to justify a purchase (at least not for me, personally). Also, I don’t like the heavy weight given to card payment companies like Visa and MasterCard. That being the case, I stick with my core technology ETFs (FTEC and SMH) and pass on the IXN ETF. More importantly, FTEC has a very low expense ratio (0.07%) while the SMH ETF has a 10.6% weighting in TSMC and also a low expense ratio (0.35%). Finally, both of these funds have significantly outperformed the IXN ETF over the past decade. While the IXN ETF isn’t a good fit for my portfolio, and I can’t recommend investors start a position in the fund, if you already own stocks, I’d hold on to them, mainly for the big stocks in Apple and Microsoft. .

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

[ad_2]

Source link