[ad_1]

Among these three related issues, it can be argued that increasing the amount of housing is the primary issue. If people don’t have a place to live, it will be difficult to fill vacancies or expand child care.

In Addison County, Fred Kenney of the Addison County Economic Development Corporation said the area needs more middle-income workforce housing (80-100 percent of the area median income).

He knows the state is working on legislation to expand middle-income housing. Still, it could take years before new units are ready for occupancy.

Kenney believes more money and less regulation would go a long way toward solving Vermont’s housing crisis.

Some organizations, like Middlebury College, are addressing the shortage directly.

To help address the housing shortage, Middlebury acquired a $1.5 million property that Summit Properties aims to focus on workforce, affordability and market housing.

In April, the college announced the purchase of the 35-acre parcel. When the property is developed, the school will sell the land to Summit. Summit plans to build 100 units of one- to four-bedroom apartments. Depending on the final type of housing, the development will accommodate 250 to 350 people.

“Middlebury College’s goal with this project is to support the community’s greatest challenge—affordable housing,” said David Provost, Middlebury’s executive vice president for finance and administration. “The college’s ability to attract and retain faculty and staff depends on the economic growth of the city of Middlebury, Addison County and the state of Vermont. This gives the college, Porter Medical Center and all businesses in the region the start of a solution.

In Addison County, households with incomes between $50,000 and $80,000 are considered to be served by workforce housing.

Also in the works are Firehouse Apartments in Bristol. The Addison County Community Trust and EverNorth are partnering to create 15 apartments for low- and moderate-income families. Another four apartments will be used as supportive housing for homeless or at-risk households.

The new building is part of the Stony Hill Master Development. It includes a new fire station, business park and mixed-income housing.

Realtor Krista Hofsis of Four Seasons Sotheby’s International Realty says there’s a lot to see in the housing market.

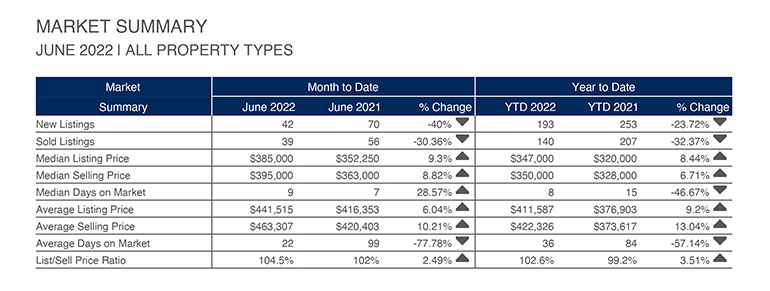

Looking at June data from Four Seasons Sotheby’s, the market appears to be slowing.

Compared to last year, the number of sales and months of inventory decreased. However, the median inventory and sales price increased at the same time.

June marked the first time since January that Addison County had fewer new listings (38) than the month before (May had 48), Hofsis said.

“In the state of Vermont, we still have an inventory challenge, which means there’s not a whole lot of inventory and there’s a lot of buyers,” she said. “That doesn’t mean you can’t have a successful sale, it just means our options are limited.”

Whispers of a recession ending the pandemic seller’s market? Hofsis believes in influencing people’s thinking about the market.

“A few people came up to me last week and said, ‘Oh, it’s not a seller’s market anymore. Now is not a good time to sell,” she recalls. “And that’s not true. But even if that’s what people hear, they may be less likely to list their property now.

She said the county’s one-month inventory indicates a strong seller’s market.

Hofsis said there is a discount as soon as a buyer moves from Chittenden to Addison County. Not so much anymore. This is due to the population’s geographic expansion of the housing market, increased demand and increased remote work.

She noted that the six-month median for homes listed in Addison County was $420,000. Today’s July list price was $480,000.

The condominium market in the county is tight and the office is still seeing an influx of out-of-state buyers.

In her experience, people moving to Vermont are primarily from the West Coast, looking for a dynamic environment with fewer natural hazards.

Hofsis said out-of-state buyers have more flexibility in where they move. Their goal is Vermont.

“They’re looking for the quintessential Vermont home and lifestyle,” she said. “These are unique properties, and I think they’re going off the market very quickly.”

In comparison, in-state buyers usually have more restrictions. They are moving for a specific job and must be within commuting distance.

Unfortunately, many local buyers are being sold out of the market.

“The level of appreciation was great,” she said. “So that particularly affects first-time home buyers in the state.”

Hofsis says the expected rate of appreciation in one year is five percent. By 2021, the state averaged around 20 percent.

That amount of praise shouldn’t go on, she said. Still, between that and rising interest rates, a home is probably out of reach for many first-time buyers.

One positive trend in the current market is that homes that are considered “fixers” are no longer on the market. This trend could mean an overall improvement in Vermont’s housing stock.

“If there’s a silver lining in my mind — and I’m really into historic homes — maybe those are getting some TLC now, and once it’s fixed up, those will be good options,” Hofsis said. .

Olga Peters is a freelance writer from Southern Vermont.

[ad_2]

Source link