[ad_1]

Stream company shares year (year -8.29%) The stock price is up more than 40% in the last month because they have been so beaten up in this bear market, but they are still down 85% from their previous high! The company’s most recent fourth-quarter revenue was down and guided for first-quarter revenue of $700 million, down from $733 million in the first quarter two years ago.

So do Roku’s falling earnings and profit margins make the latest share price a selloff? I’m not too sure, and I would caution against rushing to place that sell order.

Here are three reasons why I’m not worried about Roku’s long-term prospects.

1. Roku’s subscriber growth is strong.

Roku’s business model is based on growing its account base. For that, there are two parts at work.

The device segment includes revenue from royalties and other hardware and licensing fees that manufacturers use the company’s operating system for Roku TVs. This Roku business unit has negative gross profit margins. Why does he want this? The company wants to grow its platform audience, so it’s willing to lose money to get those extra eyeballs. Think of it as customer acquisition costs.

And the platform division primarily generates revenue through sales on ad-supported channels like Roku Channel and revenue-sharing deals. Today, the stage room is the main activity. In 2022, it contributed $2.7 billion to Roku’s gross profit and $3.1 billion in total revenue for the company.

Roku’s membership growth could indicate how the business will perform in the future as users earn revenue. Fortunately, user growth remains strong: the company added 4.6 million accounts between the third and fourth quarter.

Its 70 million active accounts are a jump of 9.9 million from last year. Roku TVs (sets that run on the OS) are now the top-selling OS in the United States, Canada and Mexico, and Roku is expanding worldwide. If Roku can replicate its success in North America, there’s plenty of room for account growth.

2. The struggles are not just Roku, they’re industrial.

So is first quarter 2023 revenue (guided by $700 million) expected to be lower than the $733 million it did in 2021 with all these new accounts? Advertisers around the economy are spending less as they fear a recession. There is evidence of this all around Wall Street. example, Meta forums In the fourth quarter, advertising prices fell 22 percent year over year.

Advertising can be considered a cyclical industry because companies spend money on advertising their products and services if they think that only a few people will. Roku barely grew its average revenue per user in the fourth quarter, up 2% year-over-year, and management’s soft first-quarter guidance suggests things could still get worse.

But I’m not worried because as the economic picture becomes clearer, the ad spend will come back. According to a chart on the Statista website, advertising spending on connected TVs was about $18.9 billion in 2022 and could double to $38 billion in 2026. More ad dollars are leaving places like print and traditional cable and going online, where the audience is.

Roku’s strong market share in connected TVs should benefit it from this broad growth in the coming years, despite soft short-term guidance.

3. Strong balance buys Roku time

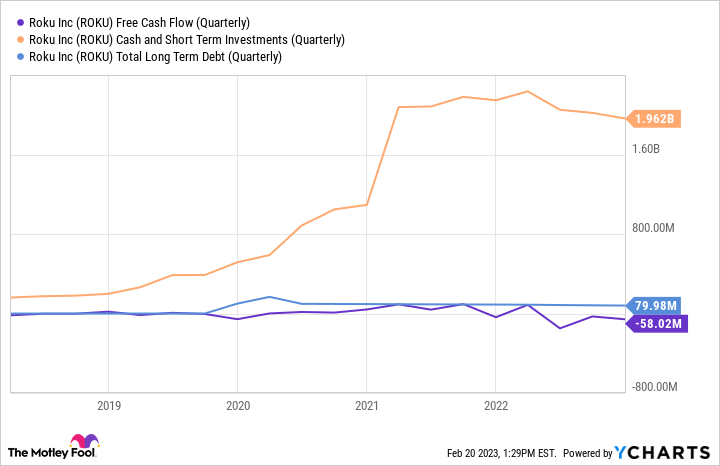

Some have criticized the company for its money-losing devices business, its expansion into smart home gadgets and its investment in content streaming, making Roku unprofitable. But the company has the cash flow to trade short-term gains for long-term growth. The chart below shows that the quarterly cash loss is hovering around $58 million.

ROKU Free Cash Flow (Quarterly) data by YCharts.

But with nearly $2 billion in cash on hand and a negligible amount of debt, it’s clear that Roku can continue on its current path for a while before worrying about needing more money. There is at least a good chance that the business will perform better when advertising budgets are renewed.

Roku is in a strategic position that looks very good in consumer households. TVs are getting smarter and bigger, with better picture quality.

The company is building an ecosystem around a strong segment in most people’s families. That said, the road won’t be bumpy down the road, but it’s hard to ignore Roku’s long-term potential, especially as it continues to grow its audience and remain well-funded.

Randy Zuckerberg, former director of market development and Facebook spokesperson and sister of Meta Platforms CEO Mark Zuckerberg, is a member of the Motley Fool’s board of directors. Justin Bishop has spots in Roku. He has a spot in the Motley Fool and recommends Meta Platforms and Roku. The Motley Fool has a disclosure policy.

[ad_2]

Source link