[ad_1]

Marko Geber/DigitalVision via Getty Images

Hyatt Hotels CorporationNYSE:H) after suffering a break in the epidemic, it becomes stronger again. His portfolio is now well positioned, with careful expansion, investments and leverage. The move to a fee-based model allows it to facilitate more opportunities. As well as revenge entertainment An increase in travel and business travel may help sustain growth.

Meanwhile, pandemic disruptions remain, reinforced by higher prices. However, with its large working capacity and high liquidity, it can offset the losses. That’s why it’s no surprise that stock prices are in line with bearish market trends. The price remains attractive and lower than the estimate in my previous post.

Company performance

Hyatt Hotels Corporation had a stronger second quarter. Both segments have shown continued and sustained recovery from their rock-bottom in 2020-2021. Although it is still undergoing massive changes, it has a strong market position. In the past two years, he has struggled to maintain interest in certain jobs. But now the possibilities of recovery and growth are more visible and attractive.

Amid fears of Covid-19 and monkeypox, the drive for revenge remains strong. Inflation does not cause significant reductions in leisure and business travel. Americans and Singaporeans are not prepared for travel and leisure cancellations. There was one last month 8% Increase summer travel. The hot season is still at its peak, inflation seems to have slowed down in the summer, at 8.5% compared to 9.1% in June.

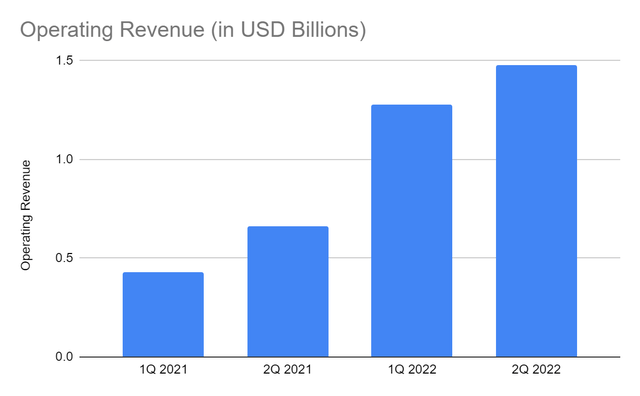

The amount of operating income 1.48 billion dollarsIt showed an increase of 124 percent over the year. It is 16% higher than in 1Q 2022. We can say that the quarterly increase is timely. However, we have to consider the high price increase. Travel plans continue to heat up despite inflation and pandemic concerns. Recent RevPAR continues to accelerate, higher than before the pandemic. The price is also higher than before. Text.

Operating income (MarketWatch)

The main growth drivers are almost the same. It combines the flow of demand with its large working capacity. The addition of Apple Leisure Group (‘ALG’) allows the company to accommodate more travelers. It accounts for 24 percent of total revenue. In 1Q 2021, the percentage is below 26%, but the value is still high. It only shows that the main company is getting faster. Even without ALG, Hyatt itself continues its rapid recovery and sees growth.

Moreover, the adoption of a fee-based business model will improve the market position. Management and franchise fees comprised 14% and 12% of revenues in 1Q 2022. It is more efficient, increasing revenues while controlling costs and expenses. Sales transactions are faster, allowing for more flexible and convenient pricing.

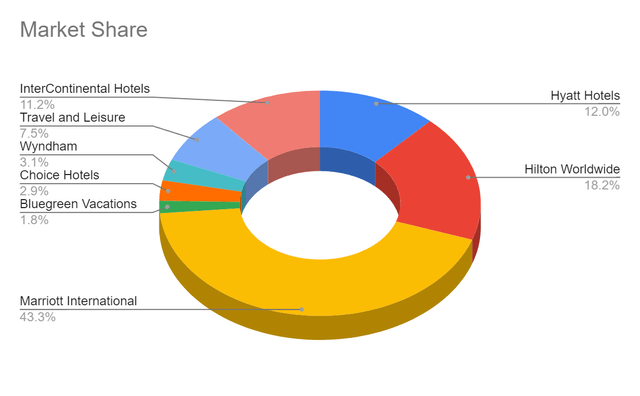

Relative to its closest peers, its revenue growth appears to be higher than the market average. Of course, it still takes more time and effort to become giants like Marriott ( MAR ) and Hilton ( HLT ). These giants have over a million units, so H is less than half way through the journey. Even so, the path is smooth relative to continued expansion. Currently, it has 290,987 units, which is 21% higher than in 2Q 2021. It is also 2% more units than in 1Q 2022.

market share (MarketWatch)

It will hold 12% market share in 2Q 2022 versus 8.4%. Amid the surge in demand, more growth prospects emerge. With greater market visibility, it can attract more travelers. This is possible after the inflation rate has declined and the power to set prices has increased. It can use this opportunity to set more competitive but reasonable prices.

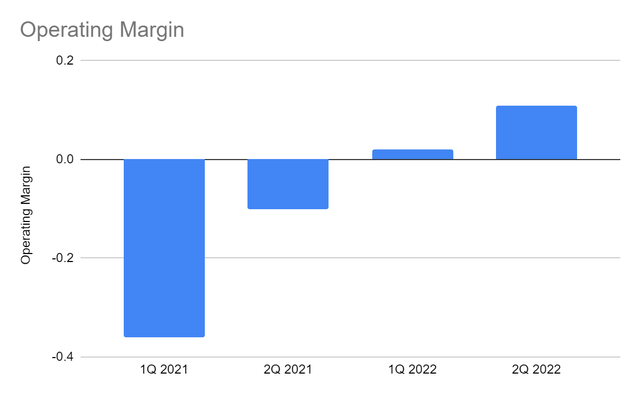

Better yet, its effectiveness is not far behind its peers. Operating margin was 11%, up 2 percentage points from 1Q 2022. Thanks to the huge increase in demand, it helped it to celebrate high RevPAR. Also, adopting a fee-based business model is fast and paying off. This more efficient business model leads to stable costs and expenses in the midst of inflation. As discussed, pricing is more flexible and competitive to offset higher costs and expenses. It appears to be more useful, which helps to continue the expansion.

Working margin (MarketWatch)

Possible opportunities and obstacles

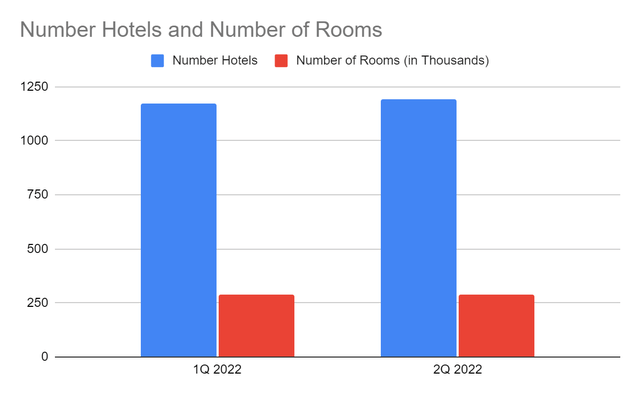

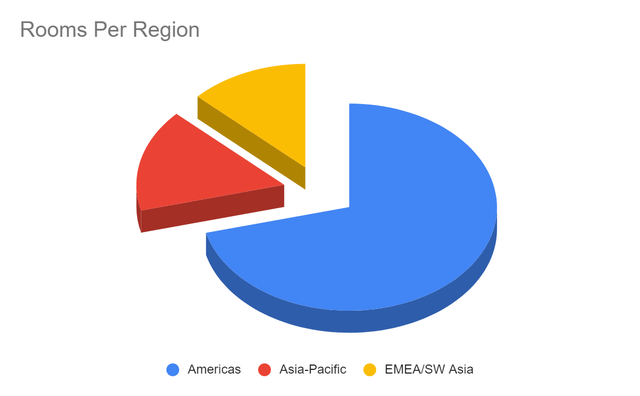

Hyatt is well positioned for these market opportunities. Its continuous expansion and new business model will allow it to accommodate more guests. In 1Q 2021, there were 1,194 hotels with 1,172 with 71% of hotel rooms located in the US vs 68% in 1Q 2022. It’s a great decision as the US, Canada and Mexico are among the top ten summer travel destinations in 2022. Also, Americans can spend almost entirely. 200 dollars billion on summer vacation.

Number of hotels and number of rooms (2Q Financial Report)

Units by region (2Q report)

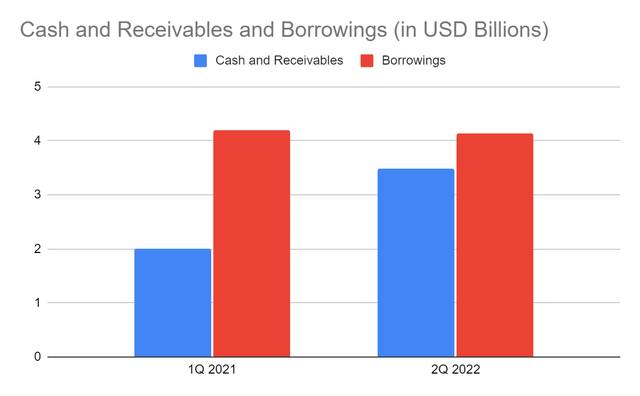

Moreover, Hyatt has the potential to sustain large operations. One of the issues I discussed in my previous post was liquidity. Now the liquidity position is very good with a stellar balance sheet. The higher the financial leverage and the more stable the receivables. From 47% in 1Q 2022, the percentage of cash and receivables to loans is now 84%. Its net debt/EBITDA is 3.53x, which is in the ideal range of 3-4x. So Hyatt earns enough to pay off the loan.

Cash and receivables and loans (MarketWatch)

However, the resurgence of the epidemic in various areas has been an obstacle to the rehabilitation of the accommodation industry. Inflation can affect the cost of travel, making it even tougher. It’s over 50% Travel plans have changed due to high costs and fears of epidemics. Originally, travelers planned to spend $1,636 on a winter vacation. Christmas, 28% Some of them could reduce their travel expenses to $1,000-1,400.

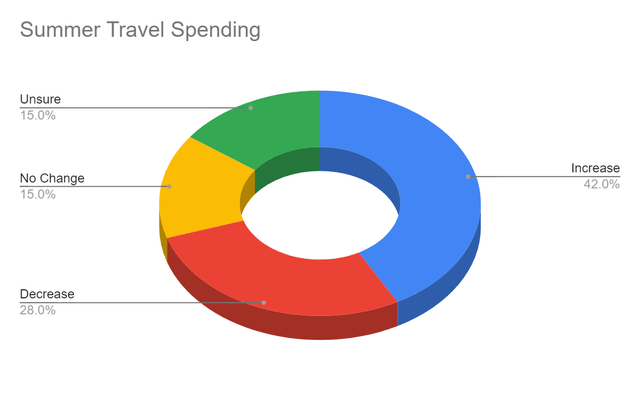

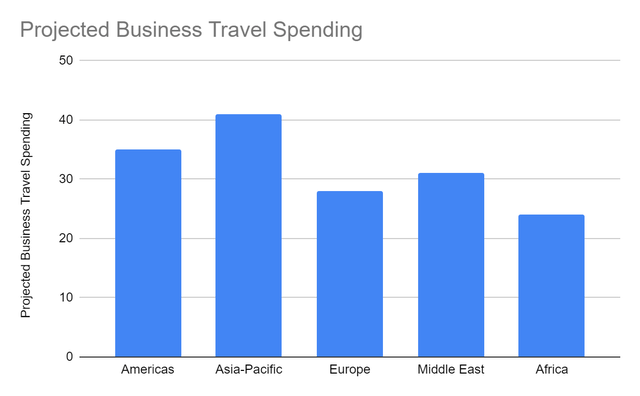

However, nothing can stop the summer travel rush. Canceling a trip is out of the question for many. In Care Of 42% Travelers say they spend more on summer travel. According to another recent study 68% Whatever it is, plan to take a summer vacation. The increase in business travel is also reflected in spending increases in various regions.

Summer travel expenses (Forbes)

Increase in the percentage of planned business trips (HospitalityNet)

Share price

Hyatt Hotels Corporation’s stock price has increased. At $94.13, it is 32% higher than the recent dip in a bearish trend, and was a good entry point before the position. I expect it will come again due to the summer travel rush. That’s why my advice is to take it. The lowest price range lasted from mid-June to the last week of July. I hope readers followed my advice in my previous post not to buy or sell at $93.49.

Among the increases, the P/E and P/B ratios show overvaluation. Even so, the values are better than my previous post. Meanwhile, it shows that the price/cash flow ratio is still favorable. The current stock price is only 0.5% higher than the stock price in my previous article. To better assess the value of a stock, we use EV/EBITDA.

DCF model

FCFF $ 288,000,000

Cash 1,480,000,000 dollars

Senior debt $181,000,000

Constant growth rate of 4.8%

WACC 9%

Common shares outstanding 109,114,000

Share price $94.13

Found value $98.97

EV/EBITDA

EV $ 12,560,000,000

Net debt $2,130,000,000

Common shares outstanding 109,114,000

Share price $94.13

Earned value $96.58

The obtained values of both models respect the attractiveness of the stock price. However, the difference from the current stock price is still low. A 3-5% increase is likely in the next 18-24 months.

at last

Hyatt Hotels Corporation is well positioned for market opportunities and disruption. It is well financed with excellent liquidity. Also, the expansion of travel and the modest decline in inflation may help sustain the industry’s revival. The stock price is in line with strong fundamentals, but I suggest keeping a better entry point. The recommendation is reserved for Hyatt Hotels Corporation.

[ad_2]

Source link