[ad_1]

miniseries/E+ via Getty Images

Investment thesis

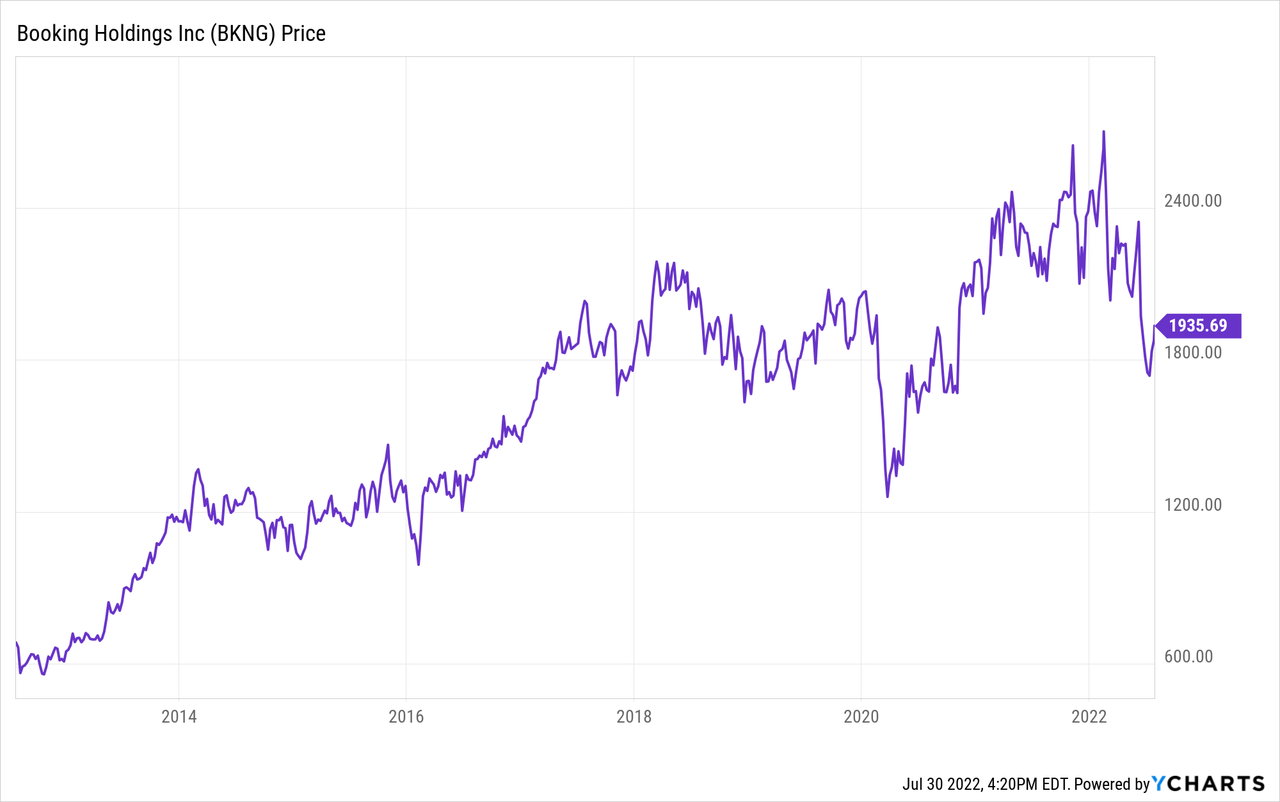

Booking (NASDAQ:BKNG) has grown over 4,000% of its stock price from $50 in 2008 to $2000 in 2020 and is one of the top performers. The company is the world’s leading online travel and related provider. Services. It operates primarily through six brands, including Booking.com, Priceline, Agoda, Rentalcars.com, KAYAK and OpenTable. It is available in over 200 countries with over 100 million active users worldwide. However, in the year An unprecedented pandemic crushed the company in 2020, as the entire travel industry shut down due to global lockdowns. With the company down 30% from its all-time high, I believe this presents a good buying opportunity for investors as the company continues to recover.

As the outbreak subsides and travel restrictions are eased, holdings could benefit greatly from these tailwinds. It is posting strong financial results and has a very strong balance sheet. Other travel companies’ recent earnings also show strong travel demand and spending, despite a weakened economy. The company is currently trading at a historic low. Therefore, I believe Booking Holdings is a buy at current prices.

Strong results

Booking Holdings reported very strong earnings in May, indicating a better-than-expected recovery. The company reported revenue of $2.7 billion, up 136% YoY (year-over-year) from $1.1 billion. Agency revenue was $1.5 billion, up 102 percent, dealer revenue was up $1.1 billion, up 182 percent, and advertising and other revenue was up $195 million, up 282 percent. Bookings showed strong growth, rising 129% YoY to $27.3 billion, the highest quarterly volume in the company’s history. The increase was largely driven by improved overnight trends in the segment (up 100% YoY), increased accommodation ADRs and strong growth in international flight products.

Booking also returned to profitability this quarter. Non-GAAP net income for the quarter was $161 million, compared to a non-GAAP net loss of $(215) million in the prior quarter. Non-GAAP net income was $3.9 per share, compared to a loss of $(5.3) per share a year ago. Adjusted EBITDA went from negative (195) million to $310 million this quarter, representing an 11.5 percent margin. Cash flow improved significantly from negative $(207) million to $1.7 billion. Operating cash flow margin was 63 percent. Unlike other travel companies that are vulnerable due to heavy debt load, Booking Holdings’ balance sheet is very strong. It ended the quarter with $10.1 billion in debt and $10.6 billion in cash, more than enough to cover all of its debt.

Glenn Fogel, CEO, Q1 results

“Despite an uncertain macroeconomic environment, we see global travel trends continuing to strengthen in the second quarter of 2022, and we’re gearing up for a busy summer travel season ahead. I’m encouraged by how well our teams are doing to capture it. In this recovery environment, travel Demand and our progress in expanding our payments platform at Booking.com as we build our connected travel vision.

Income of other companies

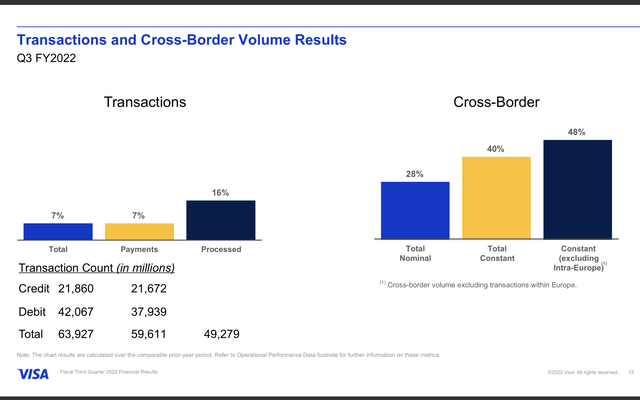

Travel companies’ latest earnings reports indicate strong travel demand and spending as consumers continue to travel overseas after nearly two years of global border closures. Companies like Hilton ( HLT ), Visa ( V ) and American Airlines ( ALL ) all highlighted stronger-than-expected travel volume during their earnings season. Hilton posted revenue of $2.2 billion, up 68.4 percent year-over-year, American Airlines posted revenue of $13.4 billion, up 80.1 percent year-over-year, and Visa’s cross-border volume grew 40 percent. Feedback from management while receiving calls is very positive and encouraging. I believe good guidance from other companies should bode well for Boking Holdings as the company reports earnings on 8/3.

American Airlines CEO Robert Essom on Travel Interests:

Leisure demand exceeded 2019 levels in the second quarter, and customers continue to show increased travel demand. Enrollment in our loyalty program continues at record levels, and spending on our co-branded cards is growing faster than ever before.

Vasant Prabhu, VISA CFO, cross-border travel volume

The strong cross-border travel recovery continues. Indexed to 2019, cross-border travel volume, excluding transactions within Europe, jumped from 94 in March to 112 in June. This was helped by opening in most of Asia earlier in the quarter.

Visa

Compulsory price

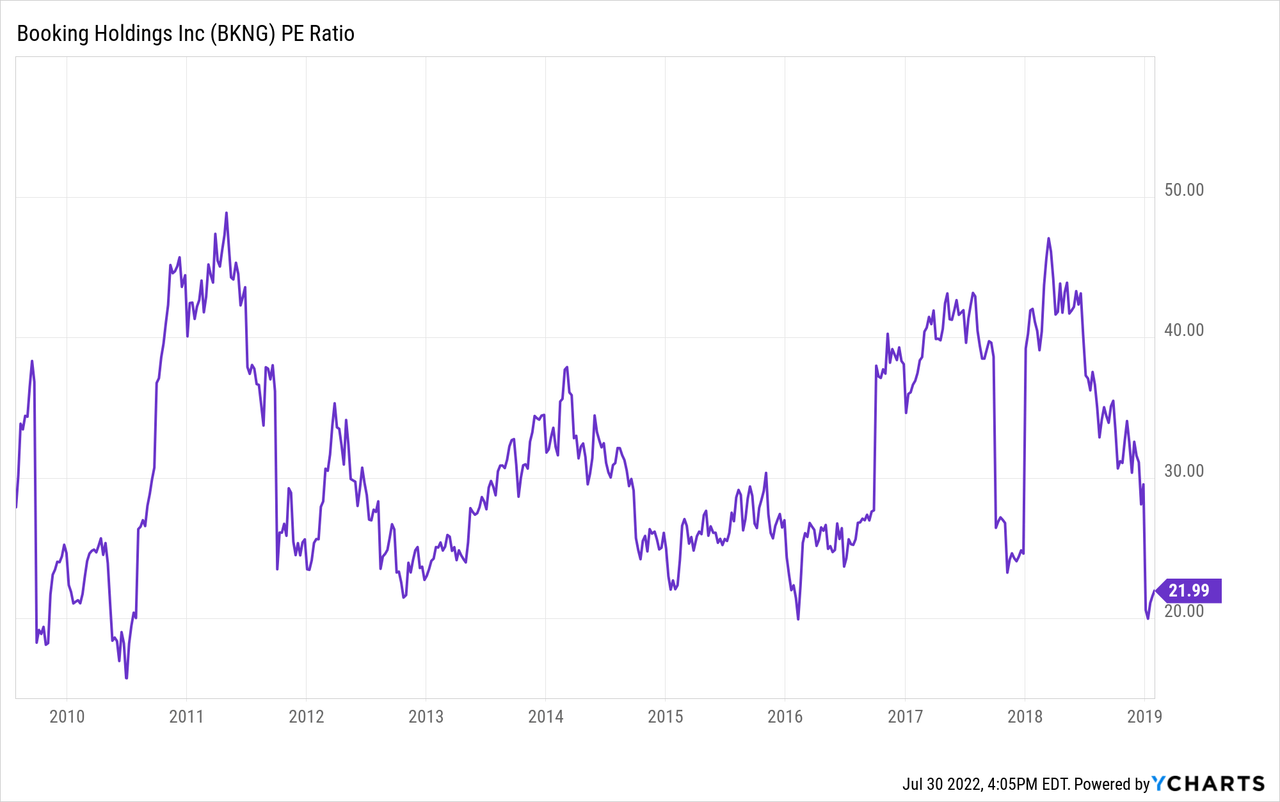

After an all-time high of 30% discount, Booking Holdings is now trading at a very attractive valuation. The current PE ratio looks expensive at 156x, but that’s because it has slowed growth for the remaining quarters this year. If we factor in EPS (earnings per share) growth, the company is actually trading at a FWD PE ratio of 19.6x, which is historically low. From the chart below, since the Great Financial Crisis, the company has traded at an average PE ratio of 25x and has almost never traded below 20x PE.

With sustained travel demand, the company predicts continued strong growth which will further boost its valuation. According to Search Alpha analyst estimates, FWD 23′ PE ratio is forecast to be 15.1x, a significant discount compared to its historical average. The company’s stock price is currently trading at 2017 levels, but this year’s earnings are forecast to be 41.7% higher than 2017. I believe the current valuation is attractive and shows a recent upside of 25%+ inverse to the average PE ratio.

Epidemic of monkey disease

Monkey disease is one of the latest hot topics. The virus outbreak first started in the UK earlier this year and is spreading rapidly around the world. There are currently more than 22,000 cases worldwide, with nearly 5,000 cases in the US alone. Health authorities around the world have been alerted to this and vaccines are now on the way. I believe investors should follow this closely as it could post significant headwinds for Boking Holdings.

On Thursday, San Francisco and New York declared emergencies over the disease, citing a spike in cases over the past month. The declaration will allow local authorities to mobilize additional resources and personnel to respond to the outbreak and expedite emergency planning. Currently, monkeypox is believed to be transmitted through close contact, so no emergency closures or restrictions have been set. The scale and impact of this outbreak is relatively small compared to Covid, but if it continues to spread rapidly, lockdowns or border closures may be possible. This will again affect the company in the near future by shutting down the travel industry. I think this is unlikely to happen, but certainly a risk to be aware of.

Summary

In conclusion, I believe the current decline is unfair and long-term investors should take advantage of this opportunity. Despite its share price down nearly 30%, Bond Holdings continues its strong recovery. It posted the strongest earnings with the highest booking volume in the company’s history. Revenue was triple digits with strong growth across all revenue streams and the company returning to profitability. Results from other travel companies also indicate that travel demand continues to be very strong. The company is now trading at historic lows as it continues to benefit from reopening tailwinds. The recent outbreak of monkey disease may put an unprecedented headache on the company, but the risk of its occurrence is still very low. So I consider it a buy for Boking Holdings.

[ad_2]

Source link