[ad_1]

Brand ambassador or brand owner?

More and more celebrities are now choosing the latter, potentially more lucrative, avenues, leveraging their wealth, fame, loyalty and consumer awareness for many fashion companies.

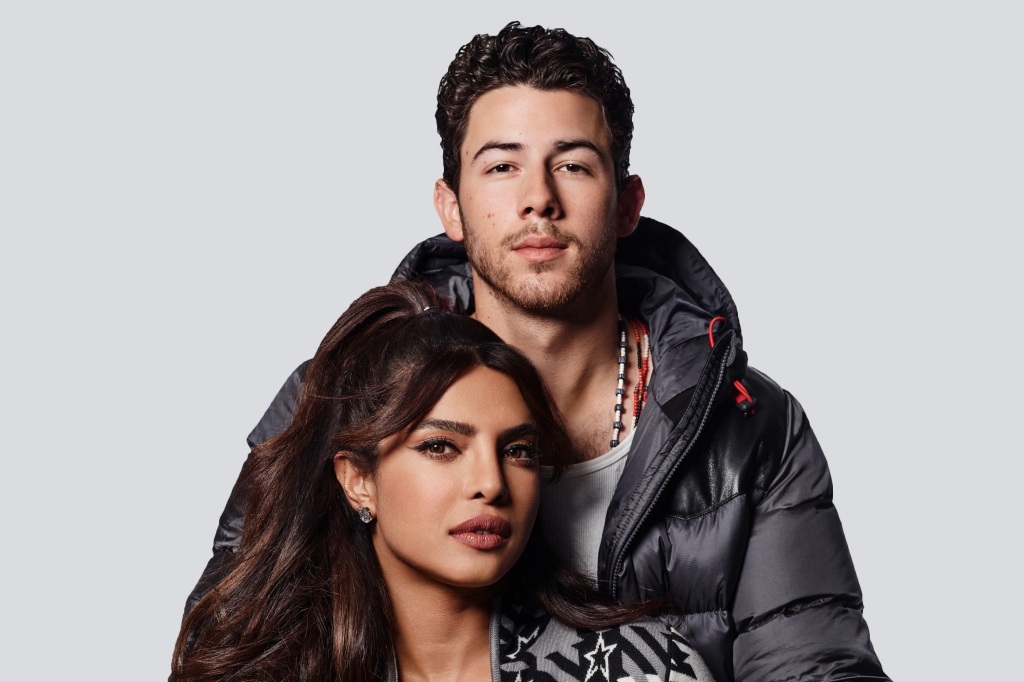

As talent agents and investment specialists, it’s no coincidence that recent months have seen Oprah Winfrey and Reese Witherspoon investing in Spanx. Priyanka Chopra and Nick Jonas in Skater’s Perfect Moment; Beyoncé, Jessica Alba and Rihanna in French accessories Destre; Mila Kunis, Cameron Diaz and Gabrielle Union in Autumn Adigbo, and Mark Wahlberg in Italian sneaker brand P448, to name a few of such transactions.

“We’re seeing interest coming from both sides,” said Michael Blank, head of consumer investment at Creative Artists Agency, one of Hollywood’s biggest talent agencies that is not only finding new roles for its clients, but also making early-stage investments in consumer brands. As a way to diversify their portfolios.

“There’s a growth in ‘equity’ thinking in all parts of the talent ecosystem,” agrees the partner and head of UTA Ventures, a division of United Talent Agency that invests in media, consumer products and technology businesses.

“Talent is willing to invest in terms of their time and capital, even for brands that don’t carry their name. Opportunities to increase financial returns are a key driver of this change, along with pride of ownership and heritage,” Wick says.

Fashion brands looking to jumpstart growth have had access to “abundant capital” in recent years, but they’ve learned that not all capital is created equal, Blank said.

“Many founders are focused on bringing in investors who can add value to the business,” he explains. “This idea was further accelerated by Apple’s changes in privacy and tracking and its impact on mobile ad spending and acquisition costs. These changes have led consumer brands and startups to see the value that celebrities with large social audiences can bring, in addition to the media that come from their associations as investors.”

What makes famous people own brands?

Some points to George Clooney, who became the world’s highest-paid actor in 2017 after he and friend Rande Gerber sold their premium tequila brand Casamigos to giant Diageo for a cool $1 billion.

“The number one thing consumer brands want is exposure, and celebrities can use their image, and the credibility they have to help companies grow faster,” said Ariel Ohana, principal at Los Angeles-based boutique investment firm Ohana & Co. An investor, you should have a very strong opinion on what the consumer wants and many celebrities feel that they understand exactly what the consumer wants because in many cases they shape the wants and desires.

Wayne Culkin, founder and CEO of Italian sneaker maker P448, couldn’t agree more. “They are very intelligent people; They know more about trends than most of us,” he said. “They understand the power of their own brand and want to be involved…. Plus, they feel the same way we do as consumers, which is invaluable.”

He says many celebrities are losing their revenue from music as a result of streaming services, which have changed the economics of the celebrity game.

Ohana says celebrities are being developed to become fair players, not just for hire.

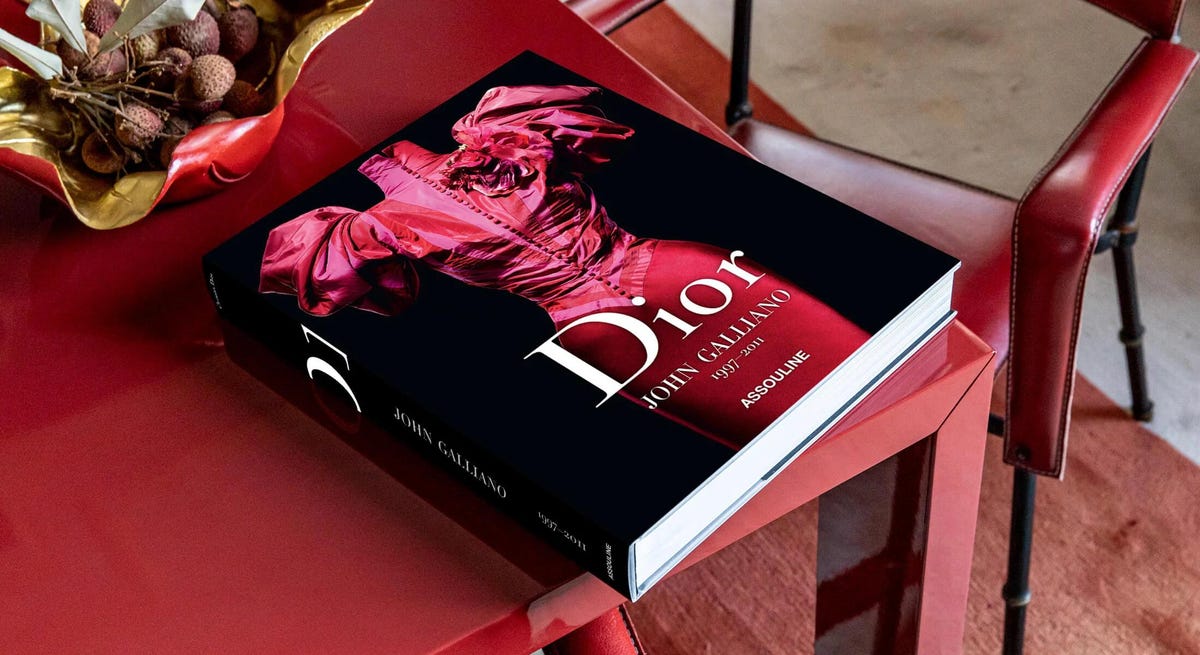

For decades, sponsorship deals have been the norm, and have had big windfalls like Charlize Theron at Dior, or Michael Jordan when he first became an ambassador for Nike. Tom Brady He helped break the mold when he signed with Under Armor in 2010, taking stock options as bonus compensation. Ohana called it “more sweets.”

Serena Williams

Courtesy/Serena Williams Jewelry

Now, celebrities have become such professional investors that some, including Serena Williams and Jay-Z, have their own venture funds, Ohana notes. The former food supplement maker has invested in dozens of companies, including Will, recipe marketplace Foodie and fashion supply chain software Calico. The latter, through Marcy Venture Partners, includes D-to-C brand Andie Swim, massage-gun maker Therobody and underwear company Savage x Fenty.

Earlier this month, Kim Kardashian launched Sky Partners, a private equity fund, with co-founder Jay Sammons, an executive at The Carlyle Group.

In many cases, celebrities invest in consumer brands that reflect their lifestyle, image and expertise, with Ohana as other examples of basketball player Tony Parker investing in sports e-tailer Colizzy and Andy Murray taking a stake in activewear brand Castor.

“You can see an overlap in these where celebrities have credibility or understand what the consumer wants,” he says. If you understand where you are investing and can add value to the business you are operating in, you usually have a recipe for good investments.

Wahlberg, a fitness addict with more than 19 million followers on Instagram, not only flaunts his biceps and six-pack abs on stage, but also his clothing brand Municipal, fast food chain Wahlburgers and now P448 shoes.

Wahlberg posted the outfit last February, which featured black jeans paired with a shocking pink hoodie and matching sneakers, and received 5.6 million likes.

Mark Wahlberg attends the P448 event at Le Bon Marche in Paris.

Getty Images for P448

“He only invests in things he really believes in,” says Kulkin, noting that Wahlberg, the sneaker head, was also an early investor in resale site StockX. “Controlling your own narrative is another reason why a celebrity invests in brands.”

Having a celebrity investor certainly “brings more heat,” Culkin said, describing chaotic scenes at a P448 pop-up in Paris for Bon Marché last June when 1,500 people showed up for a private viewing of Wahlberg. “It was like a rock concert,” he marveled.

Certainly, Los Angeles is a hotbed for fashion investments.

“You have an environment where entrepreneurs, business people, influencers, ambassadors, talent can meet,” Ohana says.

In the year In 2020, CAA partnered with venture capital firm NEA to form an investment partnership called Connection Ventures, primarily in consumer businesses in the content and media space, fashion, health and wellness, e-commerce, consumer products, Web 3 and NFTs.

“As CAA’s clients become more active, early-stage investors and build their own personal portfolios, we plan to share as many co-investment opportunities as possible with Connecting Ventures Investments,” explains Blank. “These clients have been actively seeking investment opportunities either on their own or through the teams they’ve built for their investment work, and Connect Ventures is one way to deal flow for them.”

Recently, several talents – NBA player D’Angelo Russell, influencer Olivia Culpo, actress Sterling K. Brown, YouTuber Lachlan Ross Power, gamer Tyler “Ninja” Blevins and NFL player Christian McFrey – including a pair of iNware with Connection Ventures. , d-to-c brand.

Do celebrities get special attention in conventions?

“When Connect Ventures shares co-investment opportunities, they are direct investments — not sweat equity or partnership deals — that are approached equally with everyone in the round,” says CAA’s Blank. “There are no service obligations for the talent, and the same for the company. That being said, investors – talent and otherwise – have a deep interest in the company’s success and often find ways to support growth initiatives.”

UTA Week’s deal structures are varied, and are constantly evolving, for a number of factors that affect the terms.

“Promotional obligations” are a key focus. “This can vary widely, but possible factors can include exclusivity, reputation and likeness, publicity, social media and in-store visibility,” he explains. “There’s also the possibility of performance-based balls to the aforementioned promotion. Likewise, these terms can generally vary based on category, social reach, and celebrity affiliation or authenticity.”

Pierre Malelevais, associate head of merchant banking at Stanhope Capital in London, points to the rise of ethical investment in “purpose products” that allow cash-rich celebrities to express their beliefs and shine a light on the causes they support.

“The two names that stand out in my opinion are Leonardo DiCaprio, who is a pioneer in supporting environmental projects, and Gwyneth Paltrow, who is seen by many as a priest of healthy living,” he said.

CAA Blank notes that some clients have a special focus on certain categories or causes such as sustainability, environmentally positive companies, women’s empowerment, plant-based foods/food technology, parenting and child care. “Investing in early-stage companies allows all investors, not just talent, to support the future they want to see,” he said.

Culkin, who is passionate about sustainability, says that many celebrities share this mission and help promote these causes by using lionfish skins as sneaker trims on P448 styles as a way to reduce damage caused by invasive species.

“They can give critical weight to a lot of things that need to be done quickly,” he said. “I don’t think they know the power they have. Think how much good one can do with it?

[ad_2]

Source link