[ad_1]

Happy Fri-yay, health tech readers. You did it.

💊 Situation Awareness: 80% of respondents to a RockHealth survey chose telehealth over in-person visits for medications and minor ailments. IRL methods still prevail for mental health and physical therapy.

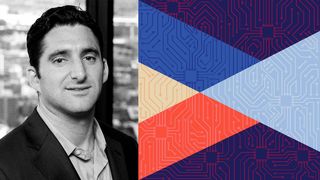

1 Big Thing: Bain Capital’s Darren Abrahamson zeroes in on HCIT.

Photo credit: Sarah Grillo/Axios. Photo: Courtesy Bain Capital

this week, Aaron is speaking with Darren Abrahamson, a partner in Bain Capital’s technology opportunities group, who sees the current challenging macro environment as ripe for engagement.

Why is it important? Bain has closed its second Growth Technology Opportunities fund. At $2.4 billion, a lot is spent specifically on health technology deals.

This interview has been edited for length and clarity.

The health technology market is diverse, and health IT budgets are increasing. What are the three key attractive areas for investment in 2023?

- First, we continue to see attractive opportunities to invest in market-leading practice management and EMR companies – Like HST Pathways and Athenahealth – it’s helping specialty healthcare providers attract and automate their businesses. We think these leading systems of record can use data at scale to deliver valuable insights and new products to customers.

- Second, information is a key area of focus. We’re looking at a number of innovative companies that integrate disparate data sets to improve efficiency for providers, payers and pharmaceutical companies, from measuring patient outcomes to speeding up new drugs to market.

- Finally, in pharmacy, technology is rapidly influencing everything from drug discovery and development to clinical trial management to drug marketing.

We saw a slow start to the year from a consensus perspective as macro pressures persisted. How are you thinking about deploying capital in the current market, and how are you evaluating targets in terms of valuation?

- We look at recent market dynamics and invest in cycles – we continued to invest actively in 2022 and expect to do the same in 2023.

- Long-term global growth trends remain intact, non-traditional tech hubs continue to emerge, and very high valuations have fallen to pre-Covid levels.

- We’re finding that founders and management teams are looking for value-added capital partners to help strike the right balance of growth and profitability in an increasingly volatile market environment where “growth at no cost” is impossible.

What fundamentals or criteria do you look for when considering investing in healthcare software companies?

- We seek companies that have developed innovative technology that is delivering tangible, measurable results.

- That could be improved patient outcomes, operational efficiencies for providers, or speed to market for a life sciences company.

- Health care is also exciting because it is big and still growing, but there are many areas where technology has not yet entered. We’ve found that once you get real traction solving a core problem, there’s often a very long runway for growth and attractive economic models to follow.

Growth Tech Ops Fund II recently closed at $2.4 billion. How much of this goes into health tech deals?

- Healthcare technology remains our fund’s focus, consistent with previous funds. However, we have not set allocation targets mandated by sub-sections. This gives us the flexibility to invest in the most attractive companies at any time and cycle.

[ad_2]

Source link