[ad_1]

hobo_018/E+ via Getty Images

thesis

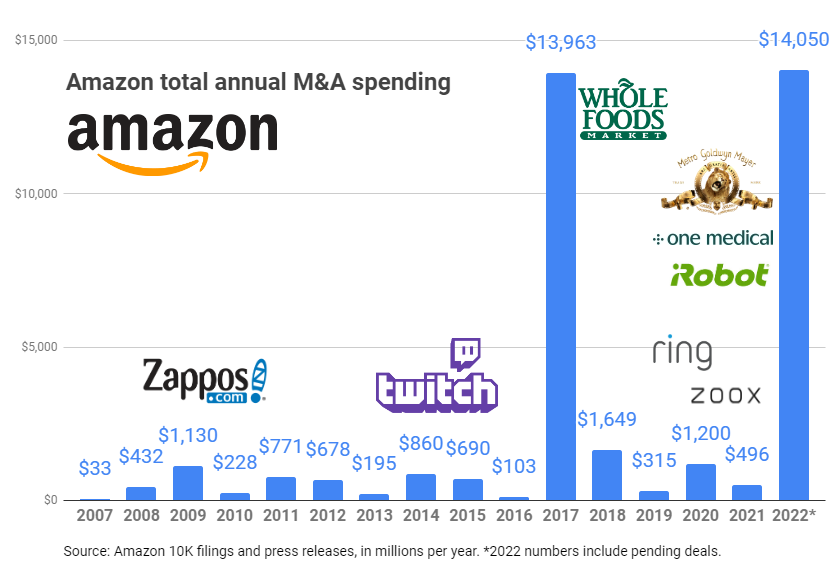

Goldman Sachs Future Tech Leaders Equity ETF (NYSEARCA:GTEK) is an exchange-traded fund (“ETF”) focused on high-growth technology stocks. The money is new when it reaches its peak starting at the end of 2021 Technology stock prices. This is how market peaks are often distinguished – many new funds and products with the same theme have proven to be very successful in previous years. The fund had a rough 2022, down more than -38%.

Markets were led by tech yesterday after the Fed announced their decision to raise rates and issued guidance. A new investor may not realize this, as rising prices often make long-duration technology stocks undervalued. That wasn’t the case on July 27, when investors instead chose to focus on Fed-speak, which felt that rate cuts were coming at some point next year. The idea is that the Fed is committed to imposing all rate increases this year, which will lead the economy into recession (today’s negative GDP publication for Q2 shows that we are in a technical recession as we speak) and this will happen in turn. It results in lower prices on the line. Low prices mean high valuations for tech stocks, so now is the time to buy. After all, the market is looking forward, right? We have a different view.

Rates are expected to remain high this time around, and the Fed is committed to seeing the inflation rate fall significantly before cutting rates, even at the cost of a mild recession. As noted above, we are technically in recession as we speak, with two-quarters of our GDP contracting. However, the labor market is strong, the consumer balance is in good shape, and the political apparatus suggests that the “help needed” signs are not really a failure.

Structural inflation hurts long-term growth, and the Fed knows it. Inflation will not be enough for the moderate Fed to reduce inflation—inflation will have to come down significantly and permanently. We don’t think this will happen in the next few months as the market is expecting.

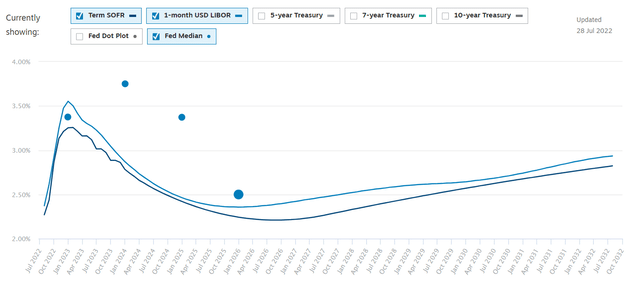

Currently, the forward SOFR and Libor curves look like this:

Curves (Chatham)

We see the market currently seeing high Fed Funds rates at the end of 2022 with a gradual decline in 2023. The graph, courtesy of Chatham, also plots the Fed’s median rate points, although we can’t find them reliably.

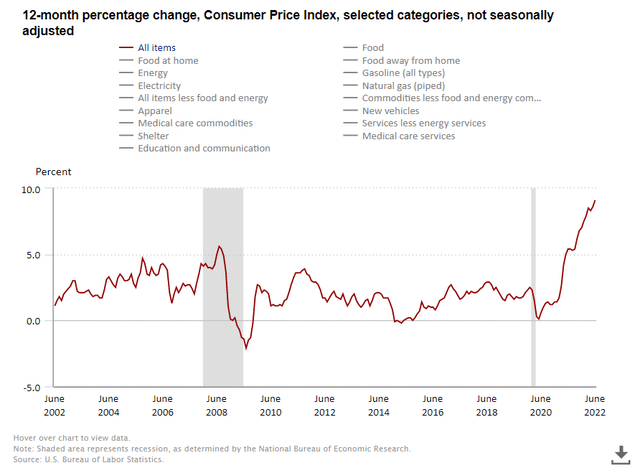

The main measure of inflation, the CPI, is currently running at over 9%.

CPI Measures (Government)

And while the core personal consumption expenditures price index (“PCE”) has been declining, it still needs to come down significantly. Please note that core PCE excludes energy and food, the most volatile components of inflation. Also, declining PCE means that number is still rising, just at a slower rate than before. Returning to our CPI graph, we note that the only time the CPI was above 5% in the last decade was during the Great Financial Crisis, where it took a full year to reach that figure. 2008/2009! Sorting through the same logic and timeframe, we can assume that, in a very aggressive scenario, the CPI will be 5% by early next August. However, the market is seeing a Fed rate cut as early as Q1 2023. In our opinion, something here does not help.

We feel the market is misaligned, clamoring to make the same trades as years past – ie long tech stocks at structurally low rates. We feel, at this point, inflation will be more sticky than expected, and higher rates will last longer than market expectations. We, therefore, think it is too early to consider jumping into GTEK, which is best revisited in Q1 2023, when inflation and federal policies will become clearer over the long term.

Holdings

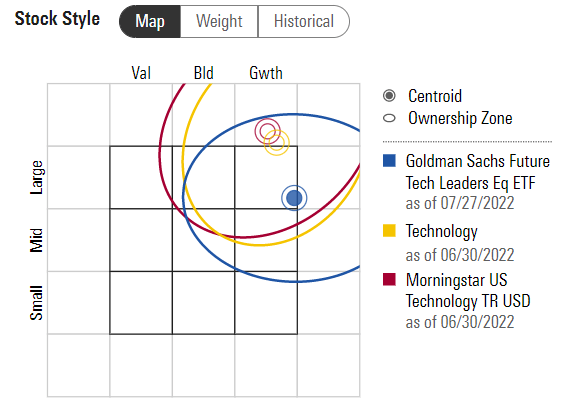

The fund falls into the mid/large cap growth box according to Morningstar:

style (morning star)

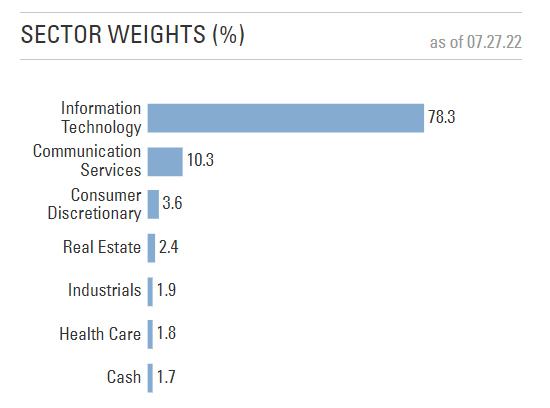

The money is overweighted by information technology names:

Sector Weight (Fund Fact Sheet)

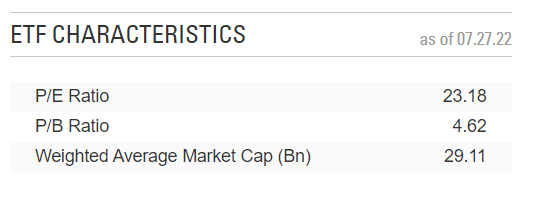

The stocks below still boast very high P/E ratios:

Features (Fund Fact Sheet)

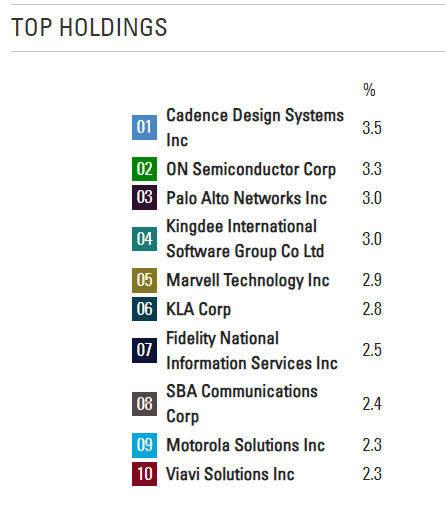

The top names in the fund aren’t your household big-cap tech names.

Top Holdings (Fund Fact Sheet)

Performance

The fund is down more than -38% this year, significantly “outpacing” the downside of the Technology Select Sector SPDR ETF ( XLK ).

YTD Performance (Seeking Alpha)

The vehicle is down more than -40% since its inception, which is good advice for investors buying into a specific market theme.

Since its creation (seeking alpha)

Summary

Being long tech stocks has proven to be a remarkably profitable business over the past decade. Buoyed by low rates and ample liquidity, the business has brought capital to the capitalization spectrum of technology enterprises. The Goldman Sachs Future Tech Futures ETF is an exchange-traded fund focused on high-growth technology stocks. In the year Launched at the end of 2021, the fund’s valuation of technology companies proved to be a high mark. Down more than -38% this year, the vehicle is experiencing a significant decline. After the Fed announced its decision to raise rates on July 27, the market was led by tech, with GTEK up more than 2% on the day. We don’t think technology will experience a V-shaped recovery, and we strongly believe that high rates are here to stay for the long haul. In our view, technology is not a business we want to return to at this stage.

[ad_2]

Source link