[ad_1]

In the year In the middle of the 2020 pandemic, Russian entrepreneurs Leo Dovbenko and Stas Seleznev realized that Dubai didn’t have many 15-minute grocery delivery options back home.

“In most of Russia, Europe and the US, 15-minute deliveries – thanks to dark store models – have replaced convenience stores, and that has yet to be replicated in the UAE. It was an open market opportunity,” says Dovbenko. Gulf Edition of your story.

The duo decided to take advantage of the market opportunity and launched a 15-minute grocery delivery platform In the year in 2021. YallaHub will be offered next year as a Quick-Commerce-as-a-Service (QAS) to help other brands with hyperlocal deliveries.

Tap into MENA’s fast-paced business

During the pandemic, the entrepreneurs saw a huge increase in the demand for fast business.

“We’ve seen the markets move from e-commerce to qcommerce,” explains Yalamarket’s co-founder.

report by The MENA region’s fastest growing business market It says it will touch $47 billion by 2030.

Dovbenko said the geographical location of GCC cities is prime for fast trade. “The cities are growing into communities where everything is within 15 minutes.”

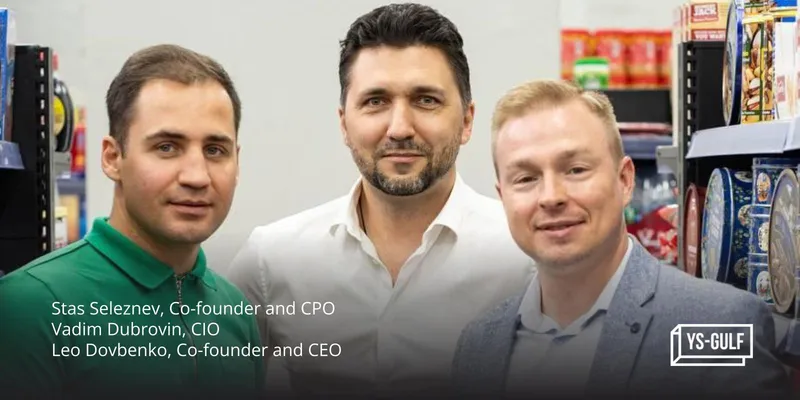

Working in Foodtech, retail and HORECA (hotels, restaurants and restaurants) for a decade and a half, Dovbenko is presented with the right opportunity for fast business in MENA. He collaborated with Seleznev, who has 15 years of experience in product development management. Both worked on IT infrastructure development for restaurants in Dubai.

B2C grocery delivery

YallaMarket enables brands to sell through a B2C grocery delivery app. It is available for both Android and iOS and has over 100,000 downloads on the Google Play Store and a 4.4 rating on the Apple App Store.

“The brands also get access to aggregators and virtual stores. We are equipped to work with marketplaces and aggregators in the UAE, including Talabat, Noon, Careem, Amazon, Instashop, Deliveroo, NowNow etc.

The startup relies on the classic grocery delivery model to fulfill orders for around 3,000 SKUs.

While the delivery fee is not disclosed, YallaMarket says its partnerships with brands allow it to make a profit on every item sold. The average grocery order cost is $20.

Currently, the startup has seven dark stores in Dubai in JLT, Business Bay, DSO, Marina, Deira, JVC and Al Wasl.

It competes with Talabat Mart, Instashop, Midday Grocery, El Grocer and Waitrose.

Enable fast trading

On the other hand, YallaHub serves as a platform for eCommerce businesses to enter and scale the MENA region without involving capital expenditure investments. It allows customers to retain their old sales channels, including websites, apps, aggregators and marketplaces, without opening new stores.

The new vertical will enable businesses and retailers to access 1,000 SKUs, logistics, marketing, payment gateways, customer service teams, access to third-party aggregators and last-mile delivery infrastructure to reach customers in Dubai within 15-30 minutes.

Since its launch in 2022, YallaHub has introduced more than 100 brands in the UAE market, including cosmetics, personal care, food products, accessories and small electronics. They include VkusVill (health food retailer), Pucci Beauty (cosmetics), Mini (jewelry) and Biokera (health and wellness) among others.

We plan to reach $10 million in annual recurring revenue (ARR) for YallaHub. We aim to fulfill 2,800 daily orders, says Dovbenko.

The group charges an undisclosed monthly subscription fee, onboarding fee and commission while managing sales on behalf of the brands.

“The amount of commission to manage brand sales and promotion depends on the number of product locations, the size of the business and the details of the business,” he explains.

YallaMarket and YallaHub raised $12 million last year from Wamda Capital, Doha Tech Angels, Flyer One Ventures and Dubai angel investors. Currently, the team consists of 120 people including 60 riders.

Market and future plans

The online grocery delivery market in the UAE is estimated to reach $6.87 billion by 2032, growing at a CAGR (compound annual growth rate) of 29.18%, according to SPER Market Research. This is mainly due to high internet access, the number of workers and the increasing number of single-parent households.

Fast trade contributes 20% to MENA’s digital economy, which is expected to grow by 24% to $20 billion by 2024, according to Redseer.

Dovbenko and Seleznev believe that the UAE offers a huge market opportunity and is one of the most economically viable markets for e-commerce.

“The GCCC is one of the most urbanized parts of the world, with 85% of the population living in cities, which is a strong foundation for qcommerce,” says Dovbenko.

While the main target is the GCC market, YallaMarket and YallaHub plan to onboard more international customers such as FMCG brands, jewelers and online retailers.

(Cover image designed by Nihar Apte)

For any press related questions or to share your press releases, write to us at

[email protected]