[ad_1]

Sander Pichai Anna cashier

Alphabet (NASDAQ: GOOG)NASDAQ:GOOGL) stock, hereafter referred to as “Google,” has been on the rise lately. The recent earnings release was a bit of a blow, considering it didn’t move the stock much at first. It really got things moving. The Company’s efforts in Artificial Intelligence (“AI”). Google recently stopped the AI event Much better-accepted The company’s Bard is one of the first to demonstrate chatbot functionality. Error. From the second, more successful approach to AI, Google is picking up stock.

What should shareholders make of all this?

First of all, I don’t think the huge amount of money piled up in companies citing AI on earnings calls is being spent well. i think that NVIDIA (NASDAQ:NVDA) is overpriced right now and I think other tech companies are. Being somewhat expensive.

However, even though recent buyers are buying for questionable reasons, I don’t think Google’s price is ridiculous. Going by diversification, GOOG is slightly more expensive than the S&P 500, which is now trading at 22 times earnings. Many other large technology companies trade at a wider premium to the benchmark. For example, NVIDIA is currently trading at 29 times sales and 95 times earnings.

In the year If you’re going to buy a stock that’s caught up in AI mania in 2023, then at least buying one that’s not at ridiculous valuations helps. And I think that logic applies here at Google. The value of the company is fairly rich, but not at a level that defies logic at the current valuation. Additionally, Google still has positive revenue growth, and its revenue did not decline by a significant percentage last quarter. Together, these signs suggest that it is a stronger company than some of its competitors. However, it’s Google’s competitive edge that’s arguably the best value today, and that’s where I’ll spend most of this article.

Competitive landscape

The biggest reason to think that Google is at a reasonable valuation today is that it has a strong competitive position. I tweeted about this a few days ago, I’ve attached it below. I will expand on these points in more detail in the following paragraphs.

First, let’s talk about Google Search. My tweet alludes to this by arguing for Google’s strength even in the face of Bing’s defeat of Bard on the first point.

Bing’s chatbot was seen as a competitive threat to Google until recently. It is built on ChatGPT, only unlike ChatGPT, it has internet access, and can handle real-time situations. This has recently been seen as a major competitive threat to Google because Google is used to extract data and Bing also twists data with AI. AI is very popular today, and just the fact that Bing is combining AI and search was enough to make people worry about Google’s market share.

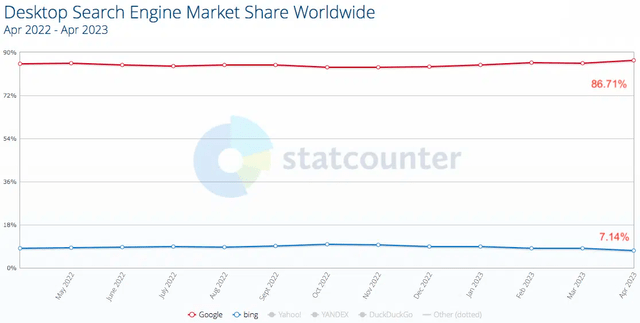

Fortunately, Google hasn’t lost any market share. Bing’s market share peaked in October 2022, with Google making modest gains since then. Google still controls 86 percent of the market. The following stat counter chart shows that Google’s search market share has been growing for more than half a year.

Google market share (stat counter)

The empirical evidence does not support the idea that Bing is an imminent competitive threat to Google. However, let’s not jump to conclusions. Maybe Google Bears is right and Bing will finally beat Google Bard in the war of chatbots.

That could actually happen. Bing is getting better early reviews than Bard, but that doesn’t change Google’s hold on the search market share. Maybe these chatbots aren’t as critical to search as we’ve been led to believe. If so, Google may have an opportunity to quietly push Bard aside and keep people on the main Google search product without even thinking about it. High costs The ones that come with chat bots.

It’s the same story with video. YouTube is currently #1 in online video, with a 75% market share. Time and time again, we have seen TikTok Meta forums (META) Instagram is described as competitors YouTube. And they are partially, but only in short form video. TikTok and Meta both typically feature short videos, with the average Insta reel coming in at seven to 15 seconds. You can take some “eyeballs”. YouTube here and there, but they just don’t compete. YouTube’s bread and butter, long-form video. Average The YouTube video is 11.7 minutes long, which is much longer than what you’ll find on Insta and TikTok. So, if you’re looking for interviews, video essays, and full music videos, you’re on. YouTube. That part of the online video market is Google/YouTube is blocked.

Finally, the smartphone operating system market. Although Google is technically #1 in installations. Apple (AAPL) is #1 by revenue as it generates more sales than the Play Store. Apple dominates the affluent US market, where people are more willing to spend money on apps than the less developed markets that Android dominates.

The point here is that Google has the low-end smartphone market locked down and always seems to be. There are no cheap phones in Apple’s iPhone line, with the iPhone starting at $799. As long as people want smartphones under $800, there will be a market for Android phones.

All this means is that Google’s biggest competitors can profit from it and Google will still be strong. Bing may beat Bard, but Google Search will still be the #1 search overall. Insta and Tik Tok may dominate the short-form video market. YouTube still dominates the long-term video market. The iPhone could strengthen its position in premium phones, and Google will still be the leader in budget phones. It is not difficult for Google to remain a very profitable company as it has many advantages. And that’s not talking about Google Drive, Gmail, the newly profitable cloud division, or any of the company’s “other bets.”

Price

Having looked at Google’s competitive position, we can now turn to evaluation. At today’s prices, Google stock is trading at:

-

27.3 Time Revenues.

-

5.6 Time of Sale.

-

5.5 times book value.

-

6 times working cash flow.

-

25.78 times free cash flow.

Even after Google’s big rally, the stock is generally more valuable than the NASDAQ-100.

Speaking of free cash flow:

According to Seeking Alpha Quant, Google has free cash flow of $4.79 per share. If you discount that by the 10-year Treasury yield (3.68%), you get a price target of $130, assuming 0% growth. Of course, this discounted cash flow rate does not use any risk premium, but on the other hand, it assumes 0% growth. Is the ‘threat’ on Google only growing at 0%? It seems the company just needs to exercise some cost discipline to achieve this kind of growth. Google’s competitive position is very strong, meaning stable revenue and margins should not be an issue. So perhaps only discounting Treasury yields is appropriate for such a conservative scenario.

One risk we should be aware of

As we have seen, Google has an incredibly strong competitive position and is not particularly valued. Depending on whether it can return to positive earnings growth over the next few quarters, the stock could continue to rise. However, there is one major risk that investors may want to watch out for here:

The risk of antitrust. Google has a very strong competitive position, and has often been accused of this fact. As we speak, the DOJ is working on a lawsuit against Google, and the company was recently hit with a $4 billion lawsuit by the European Union. Google lost an appeal against that ruling, so it will likely have several more appeals before it is finally forced to pay. When a company like Google has multiple supervisors, it attracts the supervision of regulators. Therefore, investors may want to be wary of Google’s antitrust threat.

Nevertheless, GOOG is a great stock overall. The company has a very strong competitive position and the valuation is not that bad compared to most of the big tech companies at the moment. I’d say I’ll continue to hold Google stock for the foreseeable future.

[ad_2]

Source link