[ad_1]

I’ve run a startup or two in my time, and I’ve run companies that have struggled to meet payroll from time to time. More than once, running a limited-time sale with a discount saved the company – but doing the math shows how while selling at a steep discount may well improve your bank balance, it’s somewhat disastrous for your bottom line. Here’s why.

People love a discount; and if you’re a customer, it looks so simple – the price goes down by 20%, and you get a good deal. As a retailer or startup, however, the math ain’t in your favor. Let’s walk through it.

Imagine you’re running a small import business. You buy cheap widgets, and you slap a fancy brand on them before attracting customers via Instagram ads and funky lifestyle images. When you buy 5,000 of these units, you can buy ’em at $ 9 each from Alibaba – and that’s a bargain. Well done you.

You order 5,000 units, and you import them. You’ve now spent $ 45,000 on them, you spent another $ 1,500 on shipping, 10% on import taxes, and you discover that 9% of the units don’t work (this is Alibaba, after all). Luckily, as if by magic, you discover this without shipping them to the end customers and having to take them in return for an exchange or a refund.

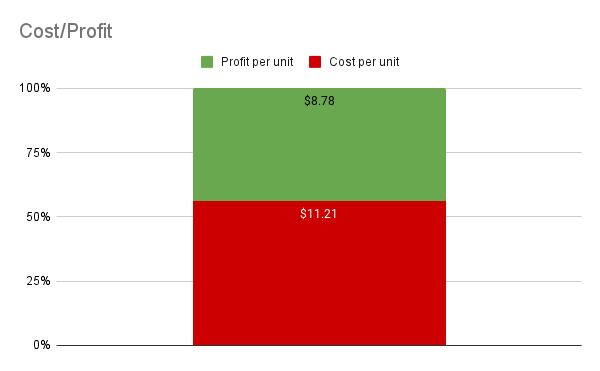

In any case, taking off the units that did not work, and the total spend of $ 51,000, each of the working 4,550 units cost you $ 11.21 each. Let’s take a look at the cost breakdown:

You think you can sell the products at $ 19.99, which gives you a hella healthy profit margin; now all you need to do is sell the ever-living hell out of these things. For every widget you sell, you make a $ 8.78 profit. Impressive; congrats, pat yourself on the back:

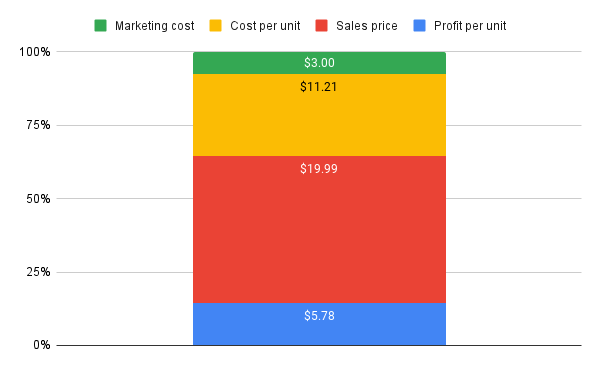

Of course, you’re gonna have to do some advertising, too. You figured out how to acquire a new customer for $ 3. That’s it really impressive, and of course that’ll eat into your profit margin, too:

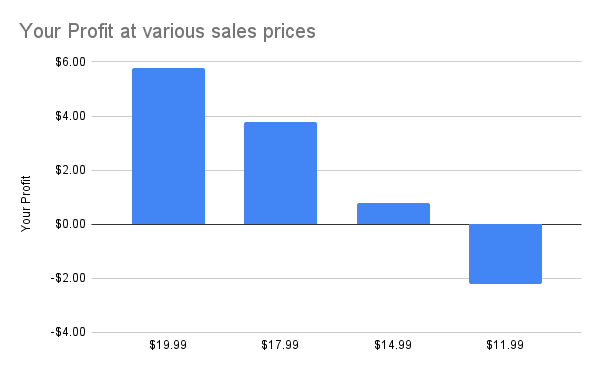

After a few months, sales are slowing significantly, because there are other people entering the market. Not to worryyou think. I have a couple of tricks up my sleeve. And you break out the discounting knife. At first, you try a 10% discount. That works pretty well. You’re making mad dollar here. But of course, the competitors are still at your heels, so you decide to really go for it. First with a 25% discount. Then with a 40% discount. That’ll show them…

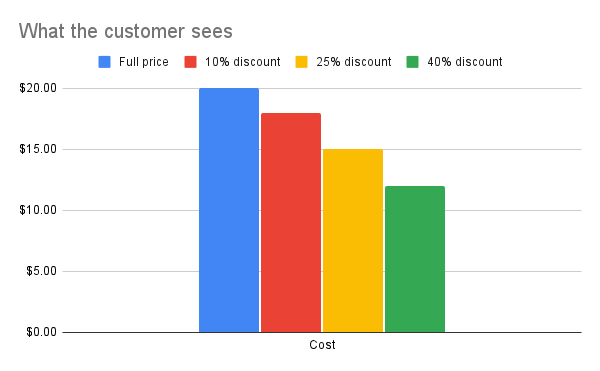

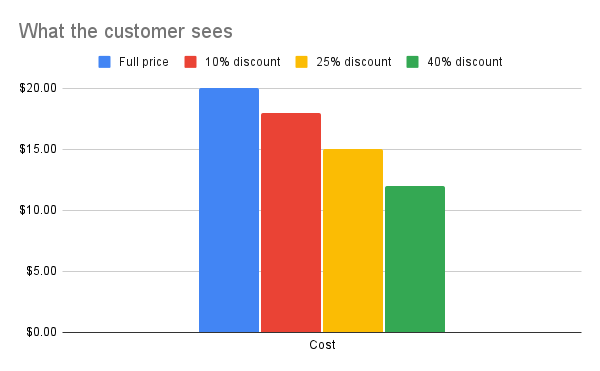

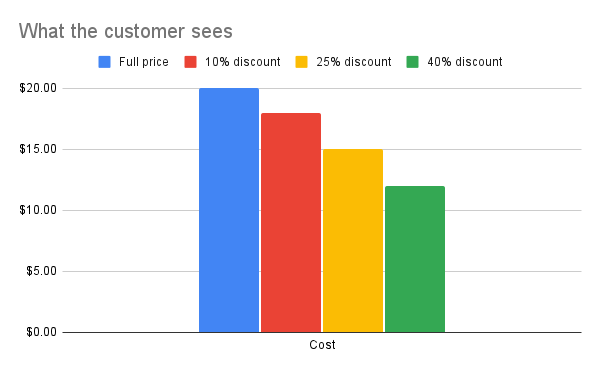

From the customer’s point of view, they are happy. This is all they see:

The customers are noticing that the prices are going down. Awesome! They are buying like crazy.

At some point, you’re noticing something: You’ve only reduced your price by a little bit, but you’re not making nearly as much money. What happened? Well… The thing to remember is that you’re giving discounts not on the sales price; you’re giving your discounts out of your profits. All other costs remain the same.

As soon as you start looking at the numbers more carefully, you see why perhaps the discounting wasn’t such a great idea. Sure, dropping the price from $ 19.99 to $ 14.99 is only a $ 5.00 difference… but your profit has taken a nose dive from $ 5.78 per unit to $ 0.78. That’s… not a business.

Of course, if you do not have physical product logistics, the unit cost is probably less dramatic than these charts – but even in a SaaS business you will have costs; customer support, server costs, etc. Ensure you know what your cost of goods sold (COGS) is before you start slicing your prices.

Also, all of this doesn’t mean you shouldn’t ever do discounts; if you have items in your warehouse and a bill coming up, liquidating it and paying your bills makes more sense than going out of business. Perhaps you want to clear out old stock, maybe you want to reward new customers or perhaps you are trying to entice new customers into the fold. It all makes sense – but bear in mind what it means to your bottom line to give a discount. Break out the spreadsheets, do the math and don’t accidentally end up selling your items at a margin where it doesn’t make sense.

[ad_2]

Source link