[ad_1]

Key events

Filters BETA

Back from holiday. Since Aug 20, prices have:

🔥European gas TTF up ~40%

🔌German 1-year electricity up ~36% (record high)

⛽️Brent crude down ~3%

🏭Thermal coal API2 up ~6%— Javier Blas (@JavierBlas) August 22, 2022

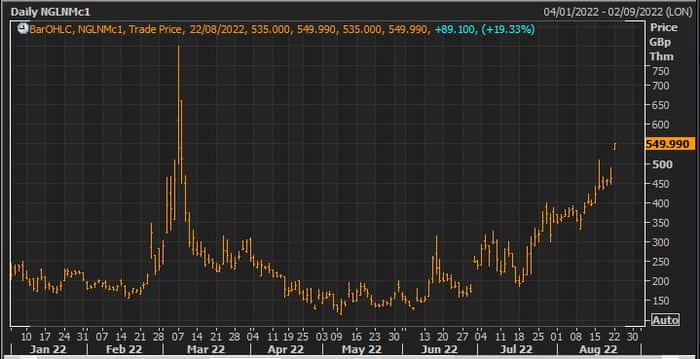

UK gas prices jump on Russia supply fears

UK wholesale gas prices have surged this morning, after Russia announced it will halt supplies through its main pipeline to Europe for three days at the end of the month.

The price of gas for delivery to the UK next month has risen almost 20% to 550p per therm.

That’s its highest since early March after the Ukraine war began.

The day-ahead UK gas price has jumped 27% to 460p per therm.

European gas prices have risen too, with the benchmark September contract up 5%, and the October contract jumping 10%.

The move comes after Gazprom said on Friday it would conduct unscheduled maintenance on a Nord Stream 1 turbine, which pumps gas under the Baltic Sea to Germany.

The move deepens an energy standoff between Moscow and Brussels, at a time when European countries are trying to build up stockpiles for the winter.

Analyst Nathan Piper of Investec says concerns over gas supplies are rising, pushing up prices:

Gazprom announced an unplanned maintenance of a Nordstream 1 turbine. Gas supplies via the pipeline will be shut off for at least three days starting end August.

Russian gas supplies to Europe were already down 75% year on year and this announcement has pushed UK/European gas prices to all-time highs (10x the 10-year average) for five consecutive days.

We anticipate a further surge in spot prices and the forward curve as uncertainties around gas supply increase ahead of winter, when gas demand rises for heating.

Barristers have voted to begin striking indefinitely from next month, in the latest industrial action to hit the UK.

The Criminal Bar Association, which represents advocates in England and Wales, has announced that 80% of voting members had backed escalating their industrial action in their ongoing dispute over government funding.

They will now walk out indefinitely from September 5, the day Boris Johnson’s successor as new prime minister is due to be announced.

Barristers began holding strikes earlier this summer, warning that cuts to legal aid funding were bringing the criminal justice system to its knees.

The CBA says there has been a 28% cut in criminal legal aid fees in the past decade and is demanding a 25% increase.

Germany has been hit by a drop in exports to non-European Union countries last month.

German exports beyond the EU fell by 7.6% on the month in July, the Federal Statistics Office said this morning.

That shows Europe’s largest economy made a weak start to the second half of 2022, after failing to grow in April-June, as the global economy struggled.

Reuters has more details:

The United States remained the most important trading partner for German exporters in July, with exports of goods to the U.S. market rising 14.9% on the year. Exports to China rose 6.1% on the year. Exports to Russia fell 56.0% on the year.

The German economy became more dependent on China in the first half of 2022, with direct investment and its trade deficit reaching new heights, despite political pressure on Berlin to pivot away from Beijing, according to research seen by Reuters

Over in China, the central bank has slashed mortgage lending rates for the second time this year as it battles a liquidity crisis in the property sector.

China’s five-year loan prime rate has been cut to 4.3%, from 4.45%, matching the record reduction made in May.

The moves suggests the People’s Bank of China is worried about problems in the housing market.

Last month, Chinese banks were told to bail out struggling property developers to help them complete unfinished housing projects and head off the growing mortgage strike that threatens to seriously damage the economy.

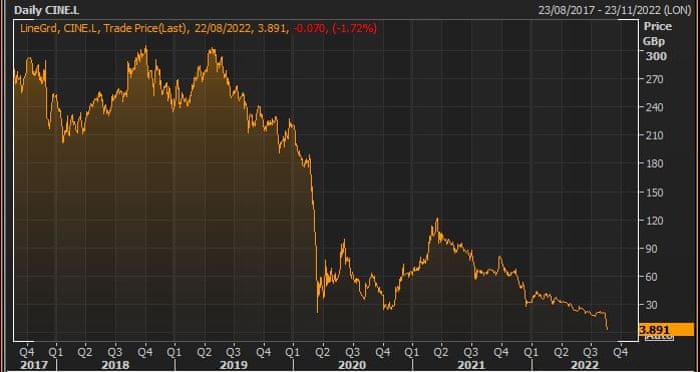

Cineworld’s debt burden has left the company on the brink of collapse, warns Victoria Scholar, head of investment at interactive investor:

The company has been destroyed by the pandemic. Covid meant that cinemas were closed for many months, Hollywood was unable to churn out hits and consumer preferences shifted towards streaming instead which has caused lasting damage for ticket demand even after movie theatres reopened.

On top of that, Sky for example now releases new blockbusters at the same time as the cinemas, again reducing the incentive to leave the house and organise a cinema trip.

Plus, Cineworld has been dealing with problems of its own with its £700m damages bill for abandoning its takeover of Cineplex, landing the embattled cinema chain with an unmanageable debt pile.

Shares have plunged from above 300p before the pandemic to around 4p a share today.

The Felixstowe port strike could add to the UK’s economic disruption, warns Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown:

“The Port of Felixstowe is an essential lynchpin in the UK’s trade operations, and an eight-day strike is likely to result in interrupted supplies for supermarkets as well as exports. It’s a possibility that industrial action could march on through to Christmas, too.

This is the latest unwanted twist in our weekly food shops, with high prices already making the experience more difficult for many shoppers. From an economic standpoint, a disruption to trade is the last thing the UK needs right now. There are already far-reaching productivity problems which keep a lid on economic growth, with an avoidable blip such as port strikes adding insult to an existing injury.

The Times says the strike could disrupt £700m of trade, and have a direct impact on the likes of Asda, John Lewis, Tesco and Marks & Spencer.

Strike underway at UK’s largest container port

The UK’s summer of industrial action is continuing as dock workers in Felixstowe hold an eight-day strike over a pay dispute.

Around 1,900 workers at the UK’s biggest container port began their first strike since 1989 on Sunday, leading shipping companies and union leaders to warn that supply chains could be disrupted.

Workers including crane drivers, machine operators and stevedores will take action after voting by more than nine to one in favour of strikes.

The Unite union said the eight-day stoppage would have a big impact on the port, which handles around 4m containers a year from 2,000 ships.

Robert Morton, Unite’s national officer has told Sky News that Felixstowe workers are seeking protection from the cost-of-living crisis.

“We are trying to keep pace with the inflation rate, yet the employer at Felixstowe has offered a 7% increase as well as a £500 lump sum payment that’s not consolidated within the pay.”

Morton pointed out that the RPI inflation rate is now 12.3%:

“Like all negotiations, you don’t always get what you want.

“However, if we can sit down and thrash this out, there will be a figure between 7% and 12.3% that’s acceptable to my membership.”

In response to the offer being much more than that offered to NHS staff, Mr Morton said:

“I think that the NHS staff should be paid more than anyone else actually, but our members are working (outside) in all kinds of weather, they’re very highly skilled people and I think they deserve more from the company who is making massive profits and is extremely.

“My message to them is ‘if you can pay it, then do so’.”

‘We got you through the pandemic and this is the way you treat us?’

Robert Morton, National Officer for Docks, Unite The Union, says they are ‘genuinely aggrieved’ at the 7% pay rise offer as Felixstowe dock workers walk out for the first time since 1989. pic.twitter.com/vAKjPDuGF6

— GB News (@GBNEWS) August 22, 2022

‘We all struggle…none of us want to strike we’ve been pushed to it.’ Sean, who has worked as a crane drive for nearly 30 years at the port of Felixstowe on why he’s striking over pay. @GMB pic.twitter.com/hqbuHjUh2g

— Nitya Gracianna Rajan (@NityaGRajan) August 22, 2022

After more than halving on Friday, shares in Cineworld are hovering around 4p in early trading.

They’ve lost around 85% of their value so far this year, and were worth around £2 at the start of 2022, before the pandemic hit the sector.

Cineworld has narrowly avoided bankruptcy twice in the past two years, as the Financial Times explained last week:

Cineworld also prepared a Chapter 11 filing in 2020, in case negotiations with its lenders over a debt restructuring fell through.

The company did not need to enter bankruptcy at that time, however, because lenders agreed to provide a $450mn rescue loan that gave the company the liquidity needed to survive in the short term.

But the business’s recovery has taken longer than expected. Another possible option to rescue the chain is a debt-for-equity swap that would give the company’s lenders control of the group. A clutch of lenders took control of rival Vue in a similar deal last month.

News that Cineworld could file for bankruptcy broke on Friday, sending its shares slumping.

My colleague Mark Sweney explained:

Cineworld, which faces an almost $1bn payout for pulling out of a deal to buy its Canadian rival Cineplex, reported a $493m year on year increase in net debt to $4.8bn at the end of 2021.

The group made a $708m loss last year. However, revenues more than doubled from $852m to $1.8bn, thanks to the latest James Bond and Spider-Man films. In 2020, the company reported a record $3bn loss.

“The firm will blame the lack of summer blockbusters as a reason behind its sharp downfall but in reality its aggressive acquisition plan has taken on too much debt and this was always a huge risk as interest rates rise,” said Walid Koudmani, chief market analyst at the financial brokerage XTB.

Introduction: Cineworld considering filing for US bankruptcy

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

Troubled cinema chain Cineworld has confirmed that it is considering filing for bankrupcy protection in the United States, as it looks to restructure its balance sheet and raise extra funds.

In a statement to the City this morning, Cineworld says that its Cineworld and Regal theaters globally are open for business as usual while it considers various strategic options – including a possible voluntary Chapter 11 filing in the US, and similar measures in other jurisdictions.

The world’s second-largest cinema chain is struggling with near-term liquidity following the disruption of the pandemic, and a slower-than-hoped recovery in movie-going, which has left it with debts of more than $4.8bn (£4bn).

The cost of living crunch has added to the leisure industry’s woes, as consumers are forced to cut back.

The company, which operates 751 sites in 10 countries including the Cineworld and Picturehouse chains in the UK, says there wouldn’t be any ‘significant impact’ on its staff if it filed for bankrupcy protection.

Cineworld says it is looking at options to raise “additional liquidity and potentially restructure its balance sheet through a comprehensive deleveraging transaction”.

Any such filing would be expected to allow the Group to access near-term liquidity and support the orderly implementation of a fully funded deleveraging transaction.

Cineworld would expect to maintain its operations in the ordinary course until and following any filing and ultimately to continue its business over the longer term with no significant impact upon its employees.

Cineworld employs around 45,000 peope worldwide, including more than 5,000 in the UK.

Shareholders could see their stakes heavily diluted, Cineworld adds:

As previously announced, any deleveraging transaction would, however, result in very significant dilution of existing equity interests in Cineworld.

Cineworld’s evaluation of these strategic options remains ongoing. A further announcement will be made if and when appropriate.

Cineworld (#CINE) confirms market chat it’s considering voluntary Chapter 11 in the US and similar measures in other jurisdictions. Shares crashed another 58% Friday to 4p.https://t.co/qrmeHefbUK

— Ian Conway (@SharesMagIan) August 22, 2022

Also coming up today

Recession fears are knocking the oil price this morning. Brent crude has fallen over 1% to $95.45 per barrel, on concerns that aggressive US interest rate hikes will hurt an already-weak global economy, and knock demand for fuel.

European stock markets are set for a lower open, as investors await the Kansas City Fed’s two-day annual economic symposium, in Jackson Hole, Wyoming, at the end of the week.

Federal Reserve Chair Jerome Powell will deliver his keynote address on Friday, and could signal how high U.S. borrowing costs may go and how long they will need to stay there to bring down soaring inflation.

UK barristers are waiting for the results of an all-out strike ballot for industrial action next month as part of a row with the Government over jobs and pay.

Members of the Criminal Bar Association (CBA) have been walking out on alternate weeks but have been balloted on an indefinite, uninterrupted strike that would start on September 5.

The ballot closed at midnight on Sunday and the result is expected this morning.

The agenda

[ad_2]

Source link