[ad_1]

Creator of the financial support circle Sameer Desai In February, he unveiled a new UK fintech startup called SuperPayments, a relatively little-known venture he founded.

There were reports a few months ago that Disney had raised around $30 million for this new company, and today this has been confirmed. Super has raised £22.5 million (about $27 million as of today) in a round of funding led by Accel, with participation from Union Square Ventures, LocalGlobe and a slew of angel investors.

While Super doesn’t open for business until later this year, the company has now initiated a waiting list for consumers and businesses who want to be first in line when things officially get off the ground – which includes an early access program.

So what does Super do? Well, on the consumer side, consumers are promised cashback on purchases they make on apps, apparel and electronics, flights.

Supercharges are in effect.

On the brand side, meanwhile, Super partners with businesses promising to boost sales, and these brands pay Super a commission, part of which is shared with the customer.

So in effect, Super promises to help its customers (businesses) cut out the financial “middleman” of processing fees, which typically charge up to 5% on each transaction.

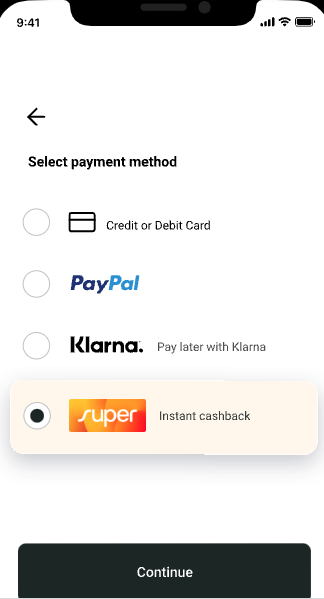

It’s worth noting that Super offers its own payment solution as an option, which appears to be free of charge, and if a brand decides to support it, Super will refund the customer immediately. If the brand does not offer Super as a payment option or the customer chooses not to pay with Super, the customer may have to wait up to two weeks.

Perhaps, the cashback and commission fees vary depending on which payment method the customer uses.

Supercharges: Payment options

Super also promises to help brands gain valuable customers and avoid advertising fees – they don’t pay to feature their products in the app, they simply pay a commission on any sales Super generates.

Desai in the year He co-founded the small business lending platform in 2009 and remained CEO until he stepped down last September after the company’s shares had more than halved their IPO value. While he’s still a non-executive director at Funding Circle, Desai says he now wants to focus on helping businesses and consumers avoid exorbitant ecommerce fees – which is particularly important as the UK teeters on the brink of recession.

“Businesses and consumers have been subjected to too many payments on the Internet for too long, in many cases without even realizing it,” Desai said in a statement. “We believe the simple Super App can save consumers and businesses billions a year. At a time of high inflation and the rising cost of living, the redistribution of large amounts of paid and digital advertising companies to customers can greatly improve people’s lives.

[ad_2]

Source link