[ad_1]

Artificial intelligence (AI) is left in the race to run a business, with any tech company that even remotely touches AI being rewarded with hype-driven profits. Although the AI business is getting long in the tooth for some obvious plays – think Nvidia (NASDAQ: NVDA) and the significant increase today – I think it’s still worth it with less popular tech companies that could play a big role in the AI race.

There are many ways investors can cash in on the tech-driven trend. The more obvious ways are more expensive and may not be the best plays. From a hardware perspective, Nvidia seems like an obvious play to put in one’s portfolio to get a front-row seat to the AI show. However, NVDA is not the only stock.

So, let’s use Tipranks’ comparison tool to find three “strong buy” tech stocks that could be more upside than Nvidia after a historic one-day gain.

Snowflake stock is melting miserably today after an otherwise good quarter of results. Indeed, the data cloud company has a history of under-promising and over-delivering.

With a usage-based revenue recognition model and an uncertain macro climate, I’d argue it’s smart to be snowflake cautious. At the end of the day, it’s always better to set a low bar if there’s any question mark ahead. I don’t think SNOW stock should have been penalized forever by lowering the bar ever so slightly. As such, I remain energetic.

For the full year, Snowflake expects product revenue to come in at $2.6 billion, just shy of prior guidance of $2.7 billion. Non-GAAP operating margins were also cut from 6% to 5% percentage points. Sure, these are very small downward adjustments, but investors won’t have them — not when other high-tech, AI-driven companies like Nevia continue to defy the laws of gravity.

The actual quarter is covered by the guide. Snowflake posted 48 percent year-over-year revenue growth, beating estimates by $608 million. Along with a nice top-line shot, CEO Frank Slotman made some encouraging comments about AI and its long-term future.

Slotman sees generative AI technologies as providing “higher gravitas” for the company. Indeed, Snowflake can be an AI company like Nvidia, any AI model is only as good as the data.

With the overwhelmingly negative stock price reaction, investors seem to have largely ignored the actual quarterly numbers, Slootman’s comments on AI, and the Neva acquisition.

What is the price target for SNOW stock?

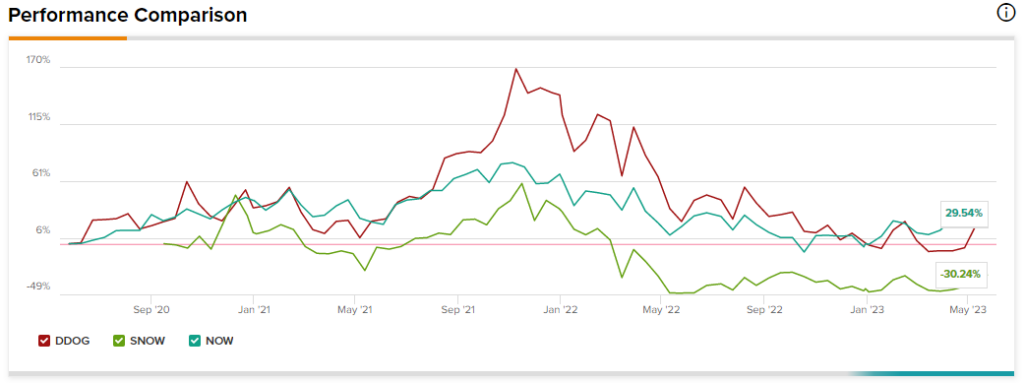

Snowflake comes in at 21 buys, three holds and one sell on strong buys. SNOW’s average price target of $189.95 indicates a potential upside of 29.5%.

Datadog stock is up nearly 50% since its April lows. Undoubtedly, promising first quarter results helped boost the cloud-based data software company. Revenue rose nearly 33% year-over-year to $482 million, ahead of the $469 million consensus estimate. Datadog expects Q2 sales to be in the range of $498 million to $502 million. This is by no means a great guide, but it was still enough to lift the cloud-based SaaS firm.

At the time of writing, DDOG shares are down about 52 percent from their highs. Like Snowflake, Datadog has a lot to gain as AI continues to emerge. Additionally, Q2 guidance appears to be on the conservative side. As such, I wouldn’t be shocked if Datadog is setting itself up for a big hit in a few months. With reasonable and realistic guidance for the next quarter, I should remain firm on the name.

Still, at 12.4 times price-to-sales, the stock is a little on the value side, so it’s a risk worth considering. DA Davidson’s Gil Luria initiated DDOG stock with a “Hold” rating and a $70 price target, which represents a potential downside of 25% from current levels. Until growth has a chance to “re-accelerate,” Luria doesn’t see an upside to Datadog’s already-deployed multiple.

What is the price target for DDOG stock?

Datadog maintains a strong buy rating with 22 buys and five holds. DDOG’s average stock price target of $97.87 indicates a 5.8% upside from this.

ServiceNow’s partnership with Nvidia seems to have investors excited again. Everything Nvidia touches seems to turn to gold. As of writing, NOW stock is up 57% from its October 2022 lows and 25% off its all-time highs.

As the company moves forward with its plan to build enterprise-grade generative AI with NVIDIA, I think the path of least resistance is up. As such, I’ll be looking forward to seeing an enterprise software company punch its ticket to the AI race with one of its leaders.

As of writing, ServiceNow stock trades at more than 270 times price-to-earnings and more than 14 times to sales, which is higher than the software industry averages of 52.9 and 11.4 times.

Like Datadog, ServiceNow needs to ramp up its growth again to gain any traction from this multi-expansion-based platform. In a recession, this can be very difficult. That said, with an AI wild card and a partnership with Nvidia, I see a high road for the IT software kingpin.

What is the current price target for the stock?

According to Wall Street, ServiceNow also comes with a strong buy. There are only 24 purchases and two holds. NOW’s average stock price target of $538.35 indicates only a 1.1% upside potential.

Conclusion

It’s not all about Nvidia. The following tech plays are strong buys that can use AI to their advantage. Analysts say that after the recent collapse, Snowflake has the potential to be very upside down.

Disclosure

[ad_2]

Source link