[ad_1]

Filevine, a startup offering a software-as-a-service product for legal case management, today announced that it closed a $ 108 million series D round led by StepStone Group with participation from Golub Capital and existing investors Signal Peak Ventures and Meritech Capital.

CEO Ryan Anderson said the proceeds will be put towards pursuing new market opportunities, specifically in the nonprofit, insurance, and public sectors, and “further evolv[ing] the [Filevine platform] to meet changing legal demands. ”

The large tranche is a sign of the strength of the legal tech market, whose growth accelerated as the pandemic led to record demand for legal services and a shortage of qualified talent. For example, according to a report published by the American Bar Association, nearly 10% of lawyers now use some form of AI-based legal tech. In 2021, Gartner predicted that legal tech budgets would increase threefold through 2025 “as general counsel face unprecedented pressure both in terms of managing legal workload and driving efficiency in their departments.”

But some corners of the legal field remain reluctant to adopt new technologies due to strict standards for confidentiality and security and a lack of domain expertise. This frustrated Anderson, a former litigator, whose own struggles with legal tech tools led him to co-found Filevine in 2014 alongside Jim Blake and Nathan Morris.

“The solutions on the market were point solutions focused mostly on defined processes. Nothing captured the actual work of the lawyer, which is, at its core, communication and the exchange of information with many stakeholders, ”Anderson told TechCrunch via email. “[I] built Filevine alongside co-founders to fill this void in the enterprise

software-as-a-service market. ”

Legal tech suite

Filevine provides software designed to help with specific legal workflows, including document management, billing and timekeeping, e-signatures, and lead management. Attorneys can use the platform to assign tasks, upload files or images, and communicate with clients from a centralized workspace.

“Traditionally, legal work is perceived as jobs to be done. Many of the players in legal tech have been focused on how to scale lawyers, how to scale corporate counsel teams, and so on. Filevine looks at legal work differently – we look at jobs to be done and the intersection points of legal work consumption, ”Anderson said. “These intersection points are where the real breakdowns occur with errors, bottlenecks, back and forth, delays. Filevine is focused on scaling legal professionals’ day-to-day and scaling the consumption of legal work that organizations depend on. ”

A newly introduced Filevine feature, two-way folder share, allows stakeholders like outside counsel to collaborate on documents without having to rely on third-party services. Outside users have the ability to upload or add additional documents and files into a shared folder, and every shared document or folder link is password-protected.

Filevine also earlier this year released a document verification service through its Vinesign e-signature subsidiary that leverages blockchain technology to confirm details about documents and their signatures. In a separate expansion, Filevine acquired Outlaw, a contract lifecycle management (CLM) startup, for an undisclosed amount, folding the startup’s tools for drafting, reviewing, and approving legal documents into the broader Filevine platform.

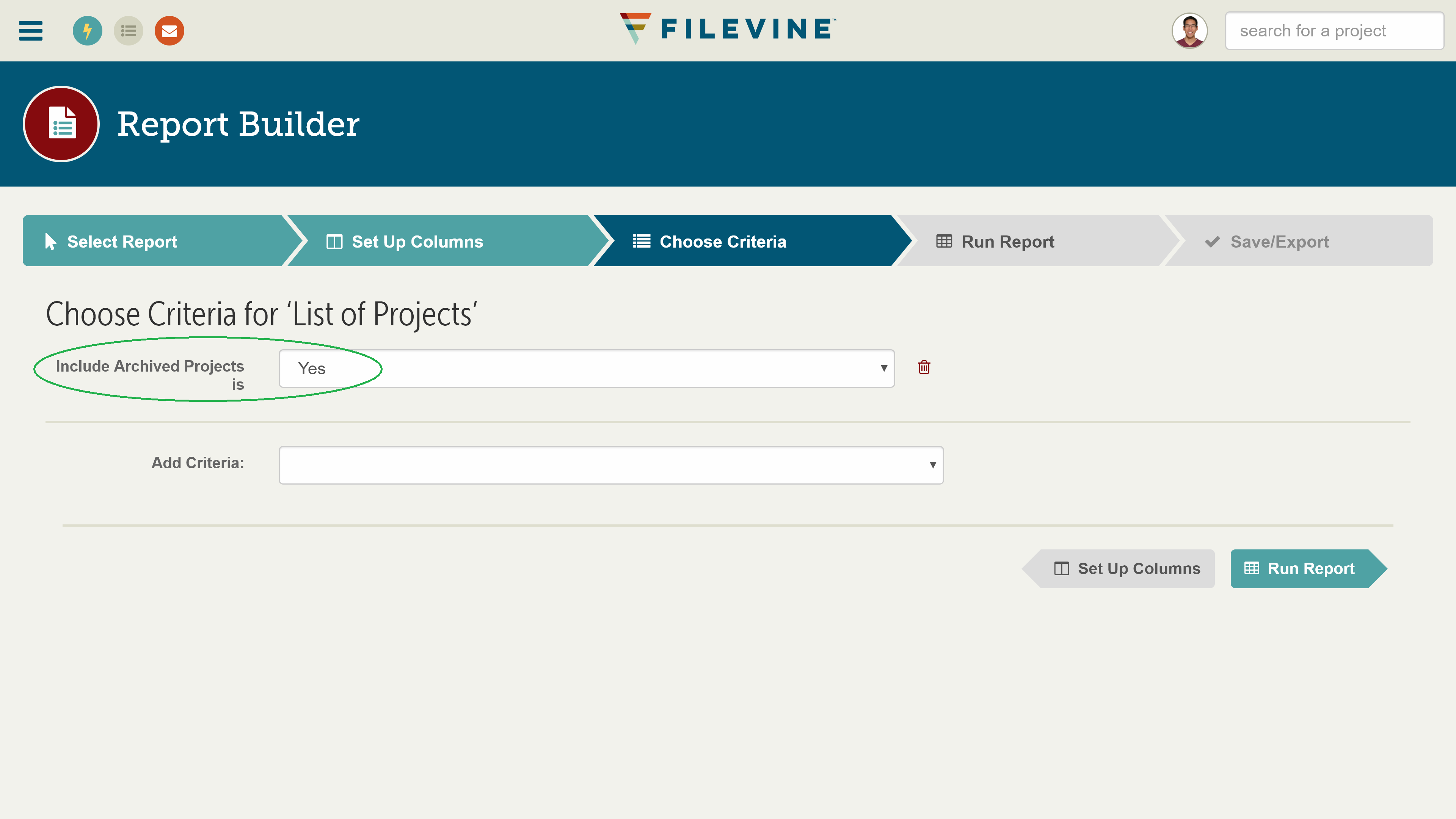

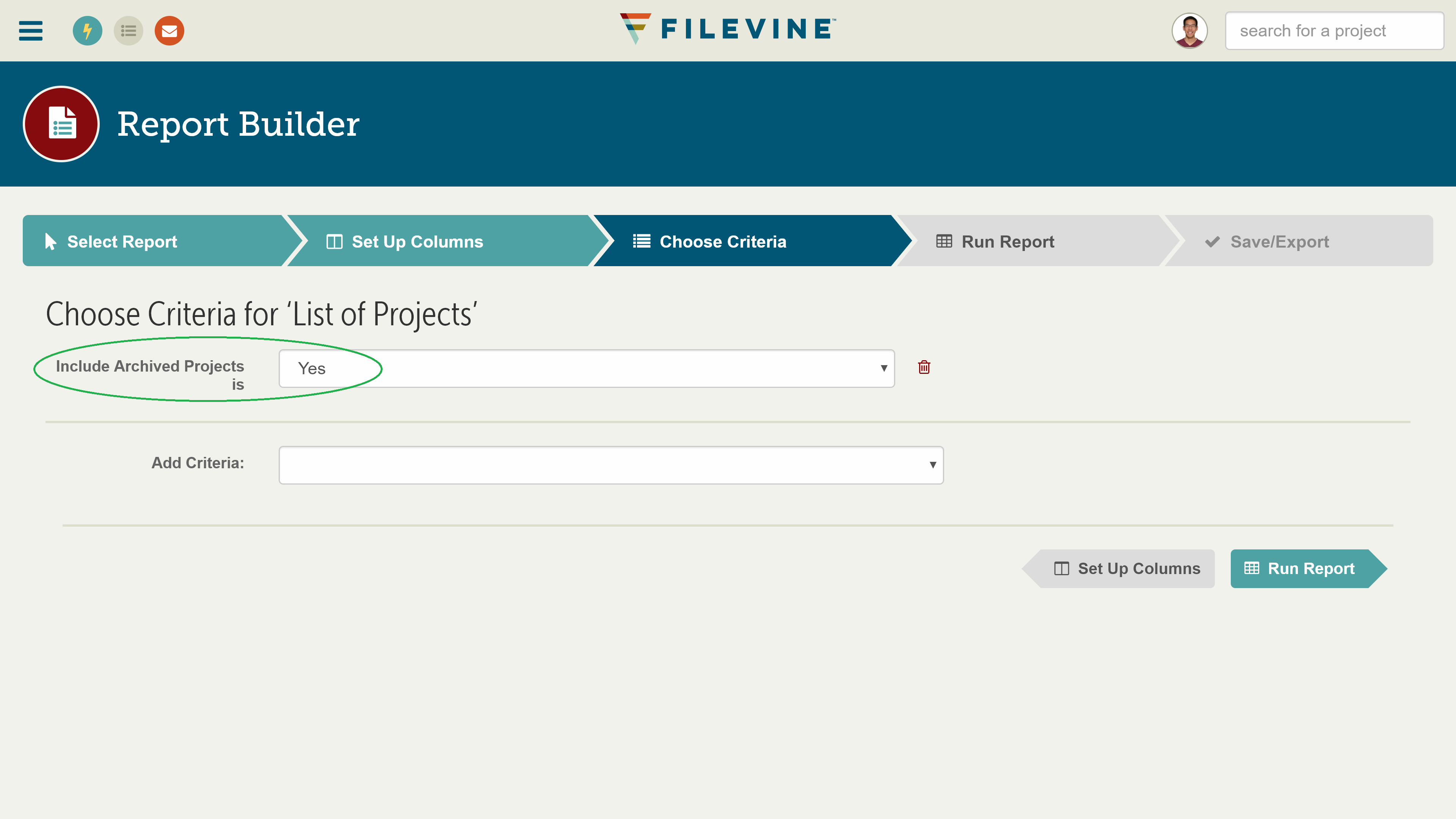

Filevine’s report builder tool. Image Credits: Filevine

Anderson sees Filevine’s CLM features by way of Outlaw as a key differentiator, noting that Outlaw’s annual recurring revenue (ARR) has grown 400% since the acquisition.

“A contract has a lifecycle that can form as early as a negotiation, all the way through to breach or complete fulfillment. Before, after, and during the life of a contract, so many different things can happen: The contract could be breached, amended, litigated, renegotiated, ”Anderson said. “Shifting away from documents and contracts as ‘snapshots in time’ allows legal teams to manage their critical work with the most up-to-date context in every matter.”

Future growth

In terms of funding, 2021 was a record year for legal tech. Roughly $ 1.4 billion was invested by venture firms in the first half of the year, or more than in the entirety of 2021. Companies including practice management software developer Clio, CLM suite IronClad, and digital contract management firm Icertis, which achieved unicorn status. (Anderson also sees Juro, NetDocuments, and Needles as competitors.)

Filevine – whose total raised stands at $ 155 million – has benefited from the boom, notching 198% growth in ARR over the past two years. Anderson expects ARR to reach $ 100 million next year as the company expands its workforce from 473 employees to 530. Current customers include 2,900 corporate and public organizations with 42,000 users combined, Anderson said, including the Utah County Public Defenders Association.

“Over the past few years, the battle for leadership in the legal enterprise market has been fierce. The venture community is starting to realize what the market was already signaling: There is an increasing need for centralized legal work management, ”Anderson continued. “Filevine aims to tear down the silo between the doing of the legal work and the consumption of the legal work. Filevine’s platform serves not only those processing cases, matter, and documents – but critical stakeholders that interface and depend on this work like sales teams, outside counsel, and operations teams. ”

Filevine’s future challenge will be convincing holdouts that the platform is worth their investment. A 2021 LawGeex survey found that nearly half of corporate counsel feel that they don’t have the technology they need to succeed and believe that it’s due to their company’s unwillingness to invest in such technology or see the return on investment for it.

Among other hurdles, Filevine will have to convince skeptical organizations that the inner workings of its platform are impenetrable. A poll from Wolters Kluwer found that while half of the lawyers surveyed expect to see a transformational change involving AI, big data, and analytics, only one out of four claims that they understand these technologies. Anderson touts the simplicity of Filevine, but time will tell whether the software is streamlined enough to win over legacy firms with established processes.

[ad_2]

Source link