[ad_1]

Take and change

The European Commission found that the prohibition of some price equality provisions had an impact on competition. So, perhaps the appointment of Booking.com as a “gatekeeper” may not be the end of online travel as we know it.

Dennis the Jackal

Online travel this week

One can argue about the fear European Commission A decision to designate certain companies as “gatekeeper platforms” is pending to ensure fair competition in hotel bookings between online travel agencies, hotels and metasearch engines.

In the year In 2020, European Commission antitrust czar Margrethe Vestager floated the idea that Booking.com and Google could be appointed as gatekeepers and given specific mandates to limit their power over European hotel bookings.

But at least in the case of Booking.com, a recent European Commission market study on the distribution of hotel accommodation in the EU casts doubt on the importance of such a designation on several levels.

Following are five points from the European Commissioner’s report.

1. Booking.com was the dominant online travel agency but did not have monopoly control

When the European Commission considers designating Booking.com as a competent gatekeeper platform for measures to ensure fair competition in European hotel sales, the Commission will need to consider the question through several lenses.

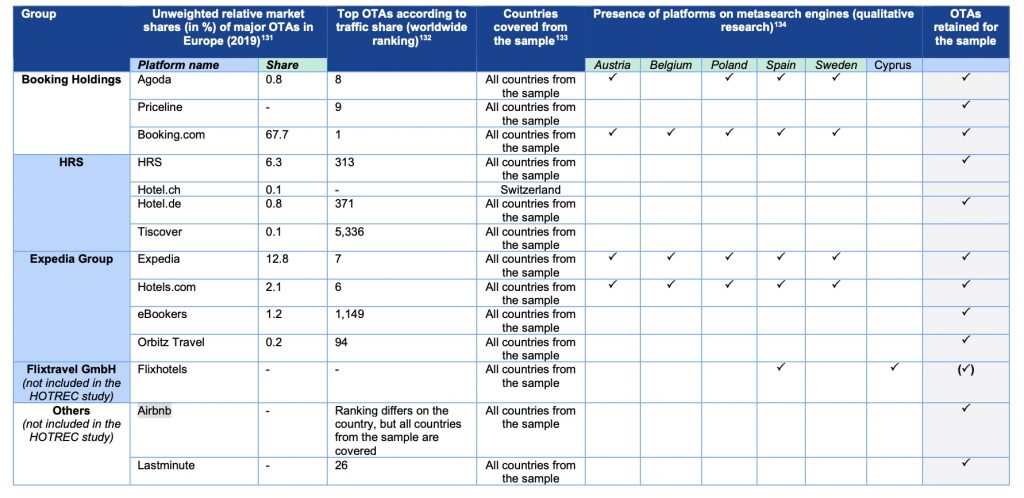

Yes, according to the findings of the European Commission, according to 2019 data, Booking.com commands 67.7% of the hotel reservation market share of the leading online travel agencies. That compares to just 16.3 percent for Expedia Group brands (Expedia.com was 12.8 percent) and 6.3 percent for HRS.

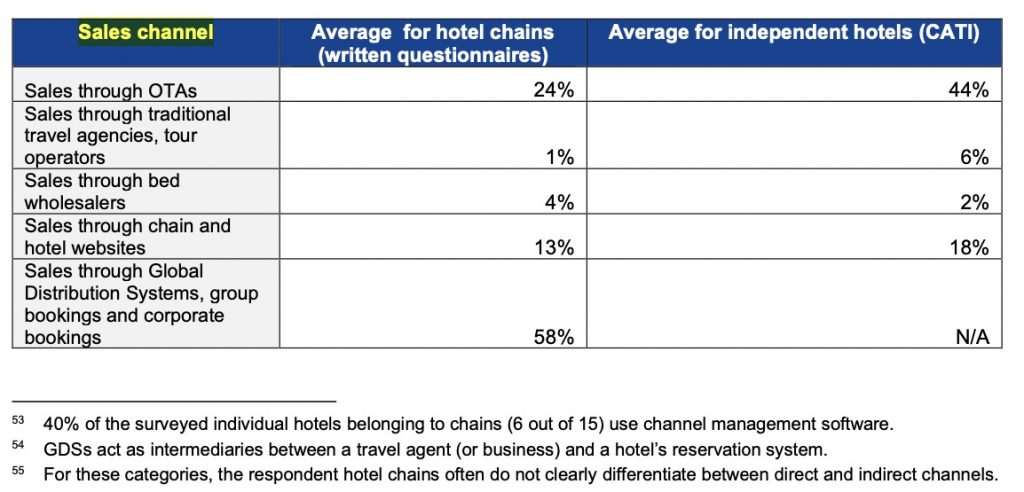

However, the nine properties affiliated with hotel chains that responded to the survey used global distribution systems, corporate or group bookings for 58 percent of their sales in 2021, compared to 24 percent of sales coming through online travel agencies. So Booking.com was not a major supplier to hotel chains.

However, unlike in North America, independent hotels are a much more important part of the European landscape than hotel chains. According to the study, independent hotels will use online travel agencies for 44 percent of their sales by 2021, compared to 18 percent through chain and hotel websites. Therefore, the online travel agent channel was a power broker for independent hotels rather than chains. However, the survey’s sample size – 15 hotels – was clearly limited.

Classifying Booking.com as a gatekeeper platform would theoretically have a significant impact on the brand and its parent company, as the label could require “fair terms” in hotel contracts and a ban on the use of “broad or narrow retail equality clauses or comparable commercial measures,” the European Commission said.

However, it is not yet known what restrictions the European Commission will ultimately place on the fine print of the order.

2. Rate as anticompetitive can be overstated.

The Digital Markets Act, which requires designation of gatekeeper platforms, prohibits gatekeepers from forcing hotels to agree to broad and narrow price parity clauses, if applicable.

They have been critical of price parity provisions that prevent hotels from offering lower prices on their own websites than those offered to online travel agencies. But while Austria and Belgium banned these two basic hotel rate parity, the commission said it did not significantly change the way hotels allocate their rooms.

According to the commission, the hotel will be guided by the pricing and related offers through each sales channel, and the narrow rate will cover only the room rates on the hotels’ websites.

Despite changes to price parity laws that have been in place in Europe since at least 2015, the commission said room rate and availability differences between hotel websites and various online travel agencies had “reduced”.

This reduced variation in room rates and availability, for example, as hotels had more freedom to set discount or lower room rates, but the impact of proportional supplies was reduced.

So if Booking.com is branded as a gatekeeper platform, does it really change the game after the European Commission found that it did not have a wider impact on online travel agent room rates compared to hotel websites? In fact, the Commission found, price disparities decreased across countries where price parity provisions were suspended.

3. Booking.com’s influence remains stable despite calls to limit commission rates.

If hoteliers’ web travel agency prices aren’t as opposed by hotels as they were years ago, one reason is that prices paid to online travel agencies “appear to be stable or slightly lower,” according to the European Commission.

This could be a major talking point as the commission is expected to designate certain companies with significant influence on hotel distribution as “gatekeeper platforms” under the Digital Markets Act in the first half of 2023. Europe in the next few months, and the gatekeepers will be appointed maybe six months later.

4. Google is in the European Commission’s crosshairs.

European Commission survey results show that the majority of hotel respondents cite Google as their top source of hotel bookings through Metasearch. Google in 2010 It offered 400,000 to 600,000 in 2020 – and that was before Google added free links to supplement paid links from advertisers, and this has boosted those property numbers since 2021.

The commission said both hotels and online travel agencies fear that Google’s continued presence as the primary search engine for travel research and its presence on hotel metasearch “could cause harm” to booking sites and hotels.

Google’s move to add free links to links from advertisers could work in its favor when the European Commission rules on gatekeeper platforms.

5. Covid has not upended the competitive balance of travel in Europe.

The early thinking of the epidemic was that the strong would get stronger and the weaker players would disappear. That has happened to some extent where poor online travel companies and short-term rental businesses have fallen by the wayside.

But it was held in 2021 and The report, which covers 2017-2021, says “compared to 2016, there has been no significant change in the competitive landscape of the EU hotel accommodation distribution sector”.

In other words, the leading player in online hotel booking, i.e. Booking.com, has maintained its high market share with second place Expedia and HRS in third place.

At the same time, although the importance of hotel sales channels in Europe varies from country to country, the Commission concluded that compared to 2016, “there is no significant difference in the conditions of OTA competition”.

In terms of competition, according to the European Commission, the world has not changed much.

[ad_2]

Source link