[ad_1]

Holly Adams

Here in the lab, we have a long-standing buy level on European low-cost operators. This analysis is based on the impact of travel recovery and MICRO on both easyJet (OTCQX:EJTTF, OTCQX:ESYJY) and Ryanair. This week, EasyJet met the first Results for the half ended March-end. Before we get into the details of the analysis, the key points of our parent company are 1) customers’ willingness to pay more after the Covid-19 restrictions, 2) non-performing balances, 3) a’Summer renewal‘ Coupled with high guidance (this follows our last analysis of ‘Time to fly‘)

Previous analysis of Mare Evidence Lab

There is an additional quote that we would like to include in our analysis. Following Deutsche Lufthansa AG’s potential takeover of ITA Airways, we believe the German airline operator will raise ITA’s flight prices and more people will fly low-cost operators. So, low-cost ways Demand increases. This positive confirmation was emphasized by Ryanair Group CEO Michael O’Leary. Looking at Lufthansa’s past, the company will increase traffic in Rome and Milan, as it has done in previous acquisitions with Austrian Airlines and Swissair. And EasyJet could benefit from second priority destinations.

Q1 results

Commenting on the results, EasyJet CEO Johan Lundgren continued to emphasize that the research was on a journey.Demand is a priority for households in discretionary spending.“, with customers looking forward to their vacations and choosing airlines and brands at low prices, they can offer great value for money. According to the CEO, EasyJet’s optimized network will allow the company to handle the summer demand comfortably.

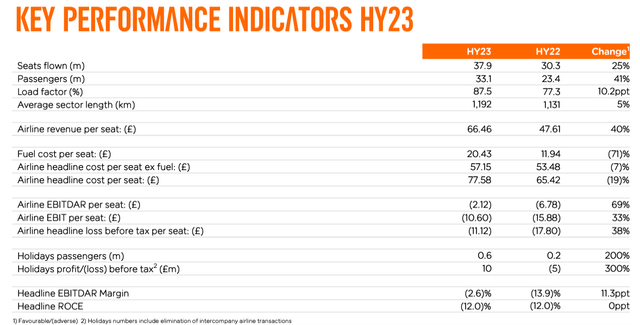

EasyJet’s main KPI

Source: easyJet HY 2023 results presentation

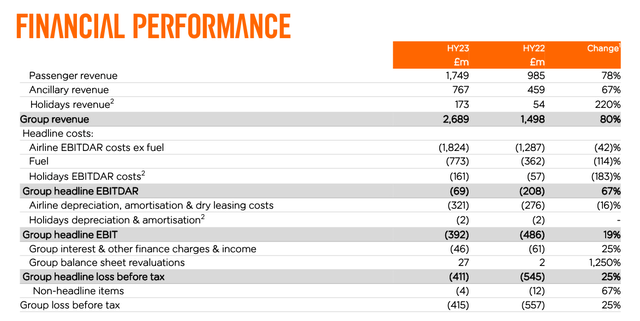

EasyJet reported a first-half loss and net pre-tax profit of £411m. Earnings were driven by strong summer demand. The company’s top online sales rose 80 percent to £2.6 billion, thanks to higher capacity, which rose to 37.9 million seats (up from 30.3 million in H1 2022), but also higher ticket prices. Key to the report was ancillary revenue growth, which grew by 83% to £940 million. Ancillary products have changed EasyJet’s revenue generation. The company now expects full-year profits of more than £80m thanks to its rapid UK growth and entry into the European package holiday market. The Swiss market will be the first of the series.

EasyJet HY 2023 Financials in real time

Moving on to the investment acquisition thesis, in the first half of 2023, EasyJet strengthened its presence in all three Italian bases: Milan Malpensa, Naples Capodichino and Venice Marco Polo. In particular, in Milan, the company carried more than 3.3 million passengers, an increase of 24% compared to 2.7 million in the first half of 2022. More than 1.1 million. In Venice, the company recorded the highest percentage growth, transporting almost 800,000 passengers in six months, an increase of 51% compared to 2022.

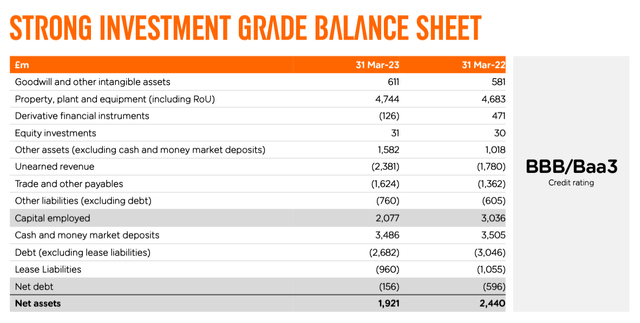

The company was able to maintain a net debt position of £0.2 billion with £3.5 billion in cash and money market deposits. It still showed strong financial strength.

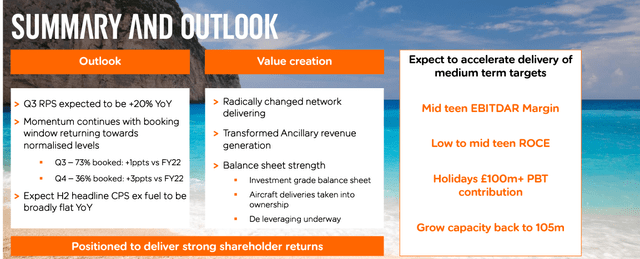

Q3 2023 results are expected to be +20% YoY and bookings will return to normal levels.

EasyJet debt evolution

Conclusion and value

Here in the lab, we expect the cost per seat, excluding fuel, to be largely unchanged from last year. This is mainly due to EasyJet’s hedging policy. However, the company’s business transformation is ongoing and the management team is confident of achieving medium-term targets to increase its capacity to 105 million. As stated in our previous publication, we are above the Wall Street consensus forecast, and with these positive results, we have decided not to change our twelve-month forecast. As for the valuation, we maintain our buy rating and set a target price of 560p per share based on an 8% core operating margin. Accidents are included in our initial coverage.

Easyjet 2023 view

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link