[ad_1]

Welcome to The Interchange! If you received this in your inbox, thank you for your subscription and vote of confidence. If you are reading this as a post on our site, please register over here So you can receive it directly in the future. Every week, I look at the hottest fintech news from the previous week. This includes everything from funding rounds to trends to niche analysis to hot takes on a specific company or event. There’s a lot of fintech news out there and it’s our job to stay on top of it – and know about it – so you stay in the know.

hello! I am excited to introduce two new additions to this newsletter. First, the wonderful Christine Hall writes with me moving forward. Christine and I have known each other for 19 years, working together at the Houston Business Journal. She has been covering fintech for the past few years and I am thrilled that she will be working on The Interchange moving forward with me. Second, if you read to the end, you’ll see a logo created exclusively for the exchange by TC’s incredible graphic designer, Bryce Durbin. I’m ridiculously excited about it. – Mary Ann

Thank you so much for that greeting Mary Ann! I’m excited to be working with her to cover the wide world of fintech and look forward to contributing to what I consider to be the industry’s go-to newsletter. – Christine

Now on to the news.

Celebrating female-led careers

I, like most of you I’m sure, have been bemoaning the lack of LP (limited partner) dollars flowing into women-led venture capital firms. So you can imagine my excitement when I got an email about Vesey Ventures, a new venture firm founded by three female former managing directors of Amex Ventures that recently closed a $78 million seed round.

Vesey’s self-described mission is to “transform financial services” companies by seeding them back to Series B levels. He plans to invest $1.5 million to $3 million as initial checks, plus a significant amount for follow-up. Based in the United States and Israel, the fund has backed five startups so far, including Coast, Cyrus, Grain, Eki and Authentic.

The three players wouldn’t say Amex is LP in the new fund, but all indicated there were no hard feelings when they decided to leave (the same time at the end of 2021, mind you). Personally, I love that in addition to getting more money for fintech startups, Dana Eli-Lorch, Lindsey Fitzgerald, and Julia Huang have been working together for ten years and getting along with your colleagues and friends until, oh, let’s do this ourselves.

Apparently, their track record impressed enough LPs – including seven “famous” unnamed financial institutions – that they were able to close the fund in a very difficult macro environment. During his time at Amex, he made investments in companies such as Plaid, Stripe, Melio and Trulio. They’ve also done a lot of work on helping fintechs build partnerships with existing financial institutions — an experience they plan to provide portfolio companies with “strategy sheets” along with contract statements.

Vesey defines fintech in its broadest sense – meaning investing outside of traditional financial services categories such as consumer and B2B. It also looks at vertical software, embedded fintech, futures of commerce and infrastructure coverage – such as cyber security, risk and compliance.

It took me a week to get the chance to report this news, I’m not going to lie. Here’s to more money flowing to female investors and founders too!!

Speaking of which, I covered the $15 million raised for Kindred, a home exchange network. While that company is more proptech than fintech, I’m referring to the women they’ve worked with in the past – in this case at Opendoor – and saw an opportunity to branch out on their own. – Mary Ann

Vesey Ventures Founding Partners Lindsay Fitzgerald, Dana Ely-Lorch and Julia Huang Image Credits: Vesey Ventures

Fintech funding in Q1

This week, we looked at global fintech funding for the first quarter of 2023 and found some notable tidbits.

First, quarterly funding totaled $15 billion, an increase of 55% from the fourth quarter, but it clearly showed a significant market correction by fintech companies that were raised in both 2021 and 2022.

And, it’s important to note that, of the $15 billion, $6.5 billion was a strip increase. Without that deal, CB Insights said funding would have been $8.5 billion, or a 12% reduction in funding from the fourth quarter of 2022.

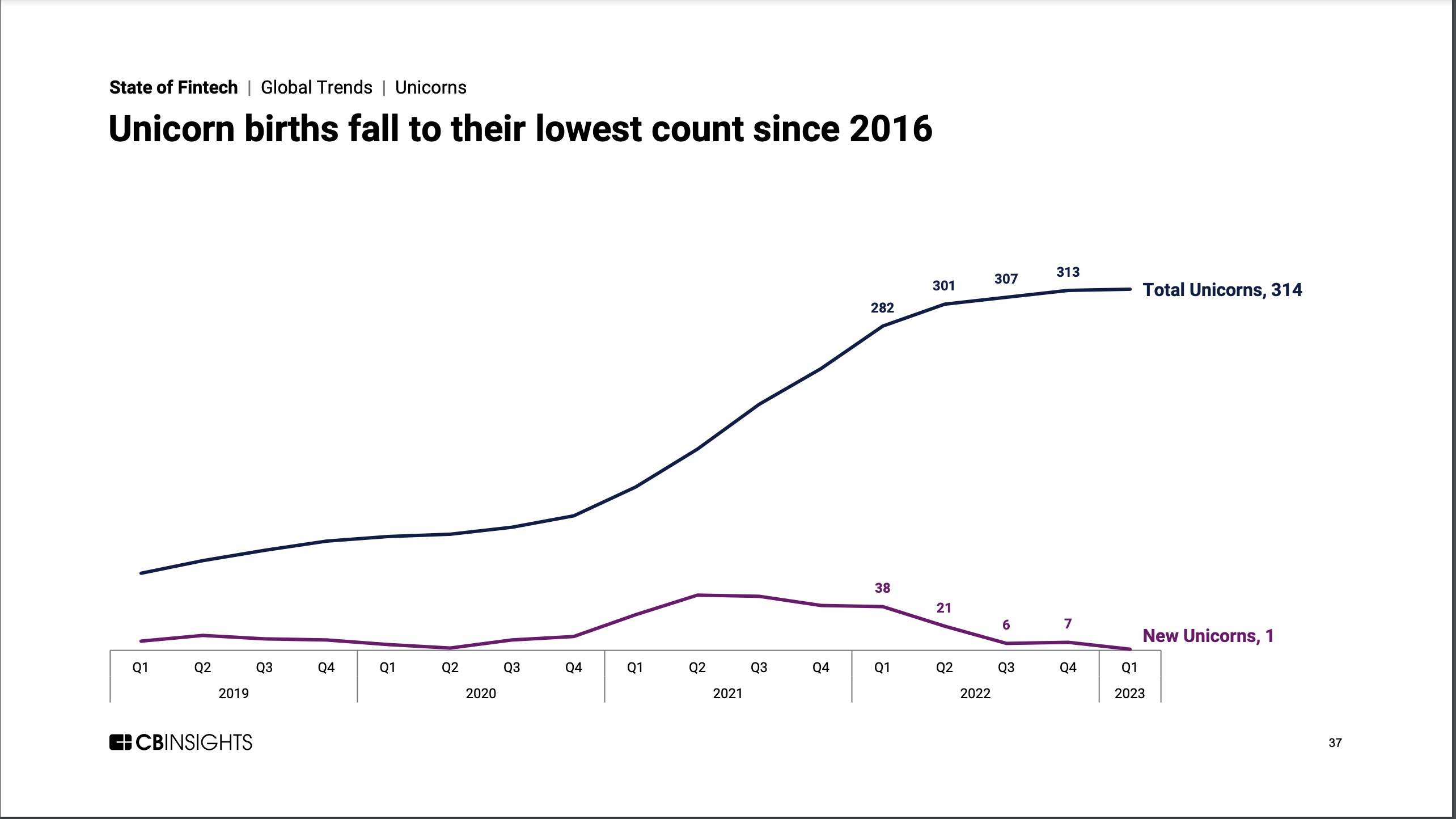

Meanwhile, with 2022 fintech companies reaching unicorn status, there were 72 unicorns that year, and 38 in the first quarter alone. It is likely helped by the large amount of capital flowing into the sector. In the year In the first quarter of 2023, only one fintech company became a unicorn – Egypt-based MNT-Halan, which in early February raised $260 million in equity financing at a value of $1 billion. According to CB Insights’ latest State of FinTech report, this is the first since late 2016.

Although MNT-Hallan was the only company to get a horn, the first quarter was ripe with “megabills” worth $100 million or more. There were 16 such deals, totaling $9.2 billion, a 179% increase over the fourth quarter of 2022 and accounting for 61% of total funding in the first quarter, according to CB Insights. After Stripe’s $6.5 billion deal came Rippling, which raised $500 million in mid-March amid the meltdown of Silicon Valley Bank. Specifically, the deal count is down, down 24% quarter over quarter. – Christine

Image Credits: CB Insights

Apple pushes further into fintech

Does every tech company want to be fintech? As Romain Dillet reports: “Apple Card customers in the US can now open a savings account and earn interest on the Apple Savings Account. Click here to know the difference about Apple’s new offering. When the company announced the new financial product in early October, Apple said it couldn’t share what interest rates would be charged on these accounts because rates fluctuate so much these days. Starting today, Apple is going to offer a 4.15% API. You can read more details on the activity here.

Meanwhile, Moody’s Investors Service released a new report summarizing consumers’ view of the tech giant’s ability to get higher returns on their money with the tech giant’s new savings account (being offered in partnership with Goldman Sachs) — if it’s well integrated into Apple’s ecosystem. “Currently, banks and financial options such as money market funds are credit negative.”

As we know, the new savings account complements Apple’s existing range of financial services products, including a digital wallet, credit card and buy-now, pay-later credit offering, Apple Pay Later. According to Moody’s, “The expansion is in line with the joint technology company’s strategy to increase the scope, service and appeal of its digital platforms.”

“If Apple aggressively promotes its savings product, it could attract a significant amount of savings to the Apple ecosystem and away from traditional banks. Through the partnership, Goldman Sachs can benefit from the broader reach of Apple’s digital ecosystem through depositors,” said Stephen Tu, Moody’s vice president of investor services. They gave a written statement.

Moody’s continued, “While there are many high-yielding financial options available to most consumers, Apple’s above-average interest rate on the account, combined with its simple and easy-to-use ecosystem, may encourage consumers to switch money to Apple.” From the platform of existing financial institutions” – Mary Ann

(Disclosure: My husband works for Apple, but not in any capacity related to this project.)

Other weekly news

Lilly has claimed Super App status with a new accounting platform.

Greenwood — a digital banking platform for Black and Latino individuals and businesses — is now live for all, canceling its waitlist. (TechCrunch pegged the company’s 2021 revenue at $40 million over here.)

UK-based Finastra has partnered with Plaid to give consumers access to fintech applications.

Air Base adds management platform to take out the procurement

Online real estate company Opendoor has cut 22 percent of its workforce (TechCrunch covered the company Early retirement round(which affected 18 percent of their workforce last November).

Matt Harris of Bain Capital Ventures published a piece on how banks should work with startups: Lessons from ancient Rome: Banks can learn how to love startups.

Funding and M&A

Featured on TechCrunch.

Autotech Ventures’ new $230M mobility fund adds fintech, circular economy to its investment strategy.

Accounting automation startup Trullion has received a $15 million investment

And elsewhere

Wealthtech-proptech-fintech crossover Pltify has raised $12.5 million in equity financing.

Actor Ryan Reynolds bought a position in Canadian payments tech company Nuvi

Insurtech Capitola Raises $15.6M Series A from Munich Radio

Clerkie Raises $33M Series A Funding From Top Investors To Solve Broken Debt System

French expense management firm Muncard bags €37M Series C funding

YELO Funding, a college finance startup, announced $1.2 million in pre-seed funding

TiiCKER, a shareholder loyalty and engagement platform, raises $5M in seed round

Residential technology company Hubby receives a $100M credit facility from Victory Park Capital

Waste management payments startup CurbWaste has paid $4M.

Now, here’s the logo I promised! Isn’t it cute?!

Image Credits: Brice Durbin

That’s it for this week. Felt a little slow but hey, sometimes, that’s okay 🙂 Hope you all have a wonderful and fun-filled weekend! See you later. xoxoxo, Mary Ann and Christine

[ad_2]

Source link