[ad_1]

When building a startup, it’s impossible to plan for everything that could go wrong.

A proper founder’s guide should include chapters like “So You Hired the Wrong Person” or “Five Ways to Know if an Investor is Lying to You.”

A proper guide should include chapters such as “So You Hired the Wrong Person” or “Five Ways to Know if an Investor is Lying to You.”

Mentors and mentors come in handy, but startups move at breakneck speed. Investors say they want to add value, but for founders under pressure, it’s hard to know exactly when to ask for help.

Before becoming co-founder and CEO of TigerEye, Tracy Young held similar roles at construction productivity software startup PlanGrid.

Full TechCrunch+ articles are available to members only

Use discount code TCP PLUS ROUNDUP One or two year subscription to save 20%

Although she led the company to $100 million in ARR before it was bought by Autodesk, she “spent years fixing the mistakes I made at my first startup,” she wrote in TC+.

Young looks at the “five key points of failure” that are common pitfalls on every founder’s path, and shares strategic tips for resolving internal conflicts, lack of product-market fit, and other obstacles.

“If these reflections help even one founder make one small mistake, I consider the effort worthwhile.”

On Thursday, January 19th at 10 am PT/1 pm ET, Tracy Young will join you in Twitter Space to discuss how she tackles these and other common founder challenges. Bring your questions and join the conversation!

One final note: TC+ Digest is TechCrunch’s fastest growing newsletter! Thanks so much for reading and subscribing!

Walter Thompson

Editorial Manager, TechCrunch+

@your main actor

3 questions founders should ask investors in Q1 2023

Image Credits: Yago Studio (Opens in a new window) / Getty Images

Money is power, and VCs know it.

It’s one of the reasons why many founders do insufficient due diligence on their investors, says Talia Raffaelli, the leading European VC Fund Compass.

Rather than going into a pitch meeting hoping to find favorable conditions, Raffaelli recommends asking investors direct questions about liquidity, exit expectations and how they intend to add value over time.

“A difficult economic climate does not mean that the power dynamic favors those with money,” she says.

“The best working relationships are built on a fair foundation of honesty and transparency.”

Will the filing of dry powder standards trigger a late burst of startup investment?

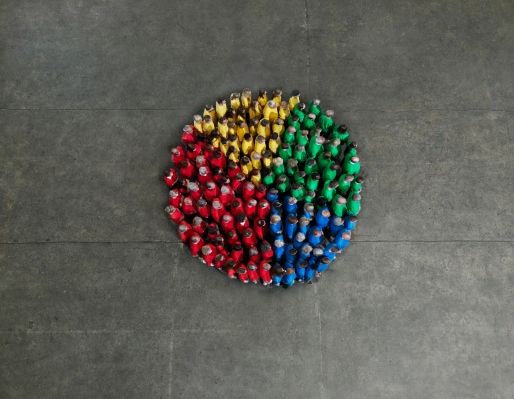

Image Credits: Tim Roberts / Getty Images

There’s a subtext to the bargains and Craigslist ads for discounted office supplies: Tech investors have amassed nearly $290 billion in dry powder.

Raphael Mukomilou and Pierre Bourdon at Picus Capital said: “Despite the recession, strong funding and tailwinds for digitization spending are leading some market participants to believe we are in a strong investment cycle.”

In the year After tracking uninvested capital year by year going back to 2006, the pair noted that “a crisis in the investment landscape has often been followed by years of systematic underperformance and history has a way of repeating itself.”

Oops! Is artificial AI already bubbling?

Image Credits: Getty Images

Generative AI is making a splash with apps like Lensa AI, DALL-E, and ChatGPT, but does that make it a solid investment?

Several VCs who responded to a recent TechCrunch+ survey said “the technology boom reminds them a lot of crypto,” writes Rebecca Szkutak.

“Everybody is piling up faster than they should.”

When will the IPO return? The past may hold some clues.

Image Credits: Rhesus (Opens in a new window) / Getty Images

Natalya Holgado Sánchez, head of capital markets at Secfi, studied the impact of five failures since 2002 to determine how well privately held startups held up and “most importantly, how long it took to reopen the IPO market.”

For each period, Sanchez looked at the triggering events, the similarities and differences between this downturn and past crises, and how startups were affected.

“Based on historical data, the IPO market is opened after an average of 18 to 24 months,” she found. “Given that we are now about 9 months away from our window closing, we could see movement until June 2023.”

Dear Sophie: How can I transfer my H-1B to the new start in 2023?

Image Credits: Bryce Durbin / TechCrunch

Dear Sophie,

I am resolved: this is the year I finally live my dream and create my startup! I currently have an H-1B for a full-time engineering role at another company.

How can I transfer my visa to my starter? How do we structure startups for immigrant success?

– Restless and loose

Teach yourself growth marketing: how to set up a landing page

Image Credits: Lightstar59 (Opens in a new window) / Getty Images

In the first article of a five-part series on the basics of growth marketing, Jonathan Martinez explains how to create an essential part of every company’s sales funnel: the landing page.

This overview includes basic steps for writing clear headlines, providing social proof that builds credibility with visitors, and crafting calls to action that deliver results.

Next week, Martinez, who has helped startups like Uber, Postmates and Chime scale, will share his tips for launching a paid acquisition channel.

[ad_2]

Source link