[ad_1]

Request a PMI display

Supply constraints that have plagued global electronics manufacturers since early last year worsened in July as demand in key industries weakened. New orders received by electronics manufacturers fell at their fastest pace since mid-2020 following reports of a blanket cut in demand from major Asian manufacturing hubs such as China and Taiwan in Europe and the US, both large developed markets. For electronics companies in key industries like tech and auto, falling sales will add more woes to an already troubled sector.

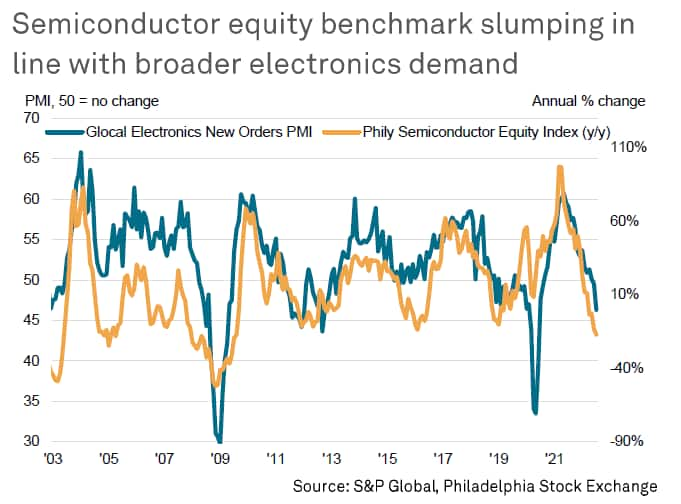

Indicators of proprietary supply shortages and price pressures from S&P Global Market Intelligence’s PMI surveys provide further evidence that a worldwide shortage of semiconductors and continued high inflation are squeezing profitability for chip-based companies. Although these pressures have eased slightly, this is mainly due to declining demand due to worsening global economic conditions. Rising demand for semiconductors has hurt technology stocks, with the Philadelphia Semiconductor Index, which covers 30 of the largest U.S. companies involved in manufacturing, designing and selling microchips, showing a sharp decline so far this year.

A delayed normalization in semiconductor stocks will send price pressures sky high

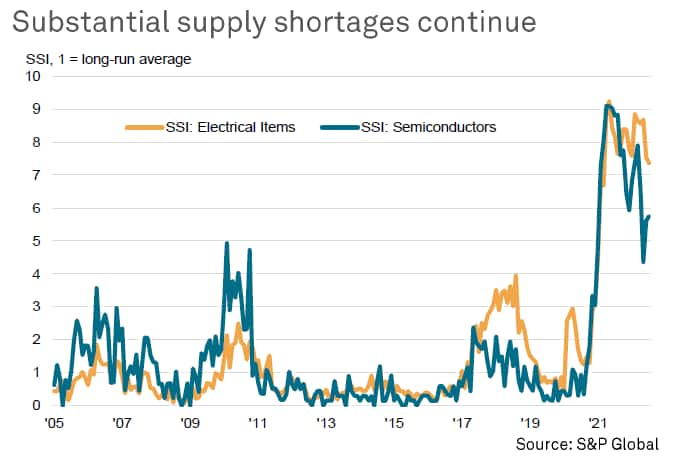

Although we have seen evidence of a decline in the supply of electronic and electrical equipment from last year, our proprietary data suggests that the shortage is still at a high level (see chart). Semiconductor shortages in July were about 6 times the long-term average. New blockades in China and disruptions at Shanghai ports have recently exacerbated the problem, increasing in scale.

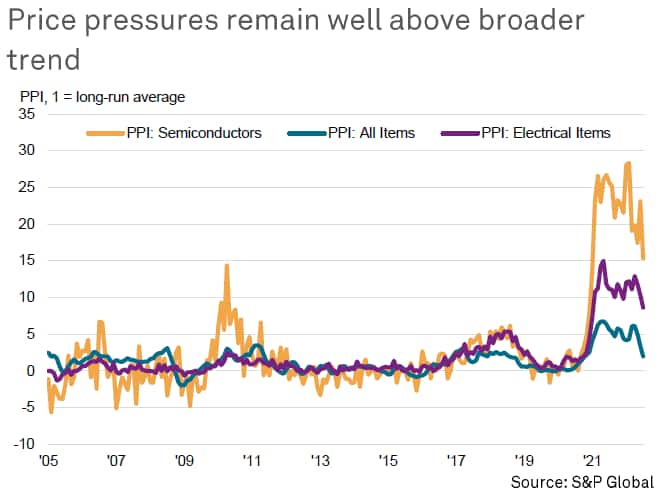

As such, price pressures are high, especially when compared to the broader trend in other commodities included in our tracker (see this note for more details). While price pressures in “all commodities” are about twice what would be considered “normal” levels, semiconductor prices are running at about 15 times their historical average.

Tech, auto and electronics will struggle amid high cost pressures and declining global demand

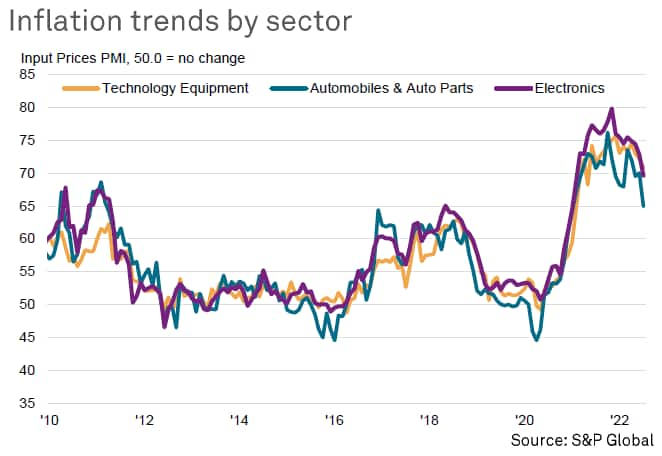

Sectors with strong ties to the semiconductor industry, such as technology equipment, automobiles and auto parts, and general electronics, are experiencing rising input costs and limited production capacity. In addition to the rates of increase seen since the pandemic, input costs at technology equipment and electronics companies are growing faster than at any other time in their respective series histories.

But companies’ ability to share the burden of higher costs with customers has been challenged by weakening global demand conditions. of 2020.

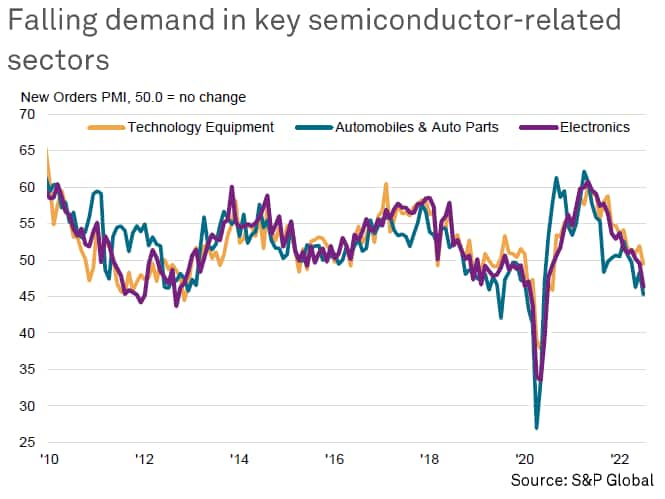

Industries that rely more heavily on semiconductors, such as technology equipment, automobiles, and automobiles and electronics, saw new orders fall in July, underscoring the additional problems these industries could face if semiconductor supplies fail to improve and prices remain too high. Sales trends in every industry have slowed sharply from recent highs seen in the middle of last year as the global economy shifts demand to goods, high prices and slowing global growth.

Semiconductor and technology stocks will suffer.

Next, the outlook for the semiconductor sector looks bleak. The Philadelphia Semiconductor Index, which covers the 30 largest U.S. companies involved in the manufacture and sale of semiconductor products, fell sharply year-over-year in line with the trend in the Global Electronics New Orders Index, with demand concerns weighing in. On a wide range of technology stocks.

However, supply issues have prompted policymakers to take some steps to protect future producers from external shocks. The United States has signed legislation to support domestic semiconductor manufacturing, and other microchip makers are reportedly planning to invest heavily in American production. Other countries may also look to offshoring their supply chains to protect their industries from external shocks.

Joe Hayes, Senior Economist, S&P Global Market Intelligence

Phone: +44 1344 328 099

joseph.hayes@spglobal.com

© 2022, IHS Markit Inc. all rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers’ Index (PMI™) data is compiled by IHS Markit for more than 40 economies around the world. The monthly data is obtained from a survey of senior executives in private sector companies, and is available only by subscription. The PMI dataset shows a headline number, which indicates the overall health of the economy, while sub-indices provide insight into factors such as GDP, inflation, exports, capacity utilization, employment and inventories. PMI data is used by financial and corporate professionals to better understand where economies and markets are headed and to identify opportunities.

Learn more about PMI data

Ask for a demo

This article is published by S&P Global Market Intelligence, not S&P Global Ratings, which is a separately managed division of S&P Global.

[ad_2]

Source link