[ad_1]

Last month, Carey Cherner, a 36-year-old used car dealership in Kensington, Maryland, took less than 12 hours to sell a 2001 Ford F-150 pickup truck with 184,000 miles on the clock. It was for $ 7,500, 50% higher than usual.

Cherner’s experience was not unique to the U.S. used vehicle market, where prices are rising rapidly. Industry is at the center of the country’s growing inflationary pressures and has therefore become a topic of great interest to Washington policymakers.

“There are more people buying cars than cars on the market, which makes him go a little crazy,” Cherner said.

Unusually, officials look closely at used vehicle prices as an indicator of the future path of inflation. If price hikes take root and spread to other parts of the economy, the United States could face a prolonged period of overheating for the first time in decades, posing a great challenge for the U.S. Federal Reserve and Joe Biden’s economic policy makers.

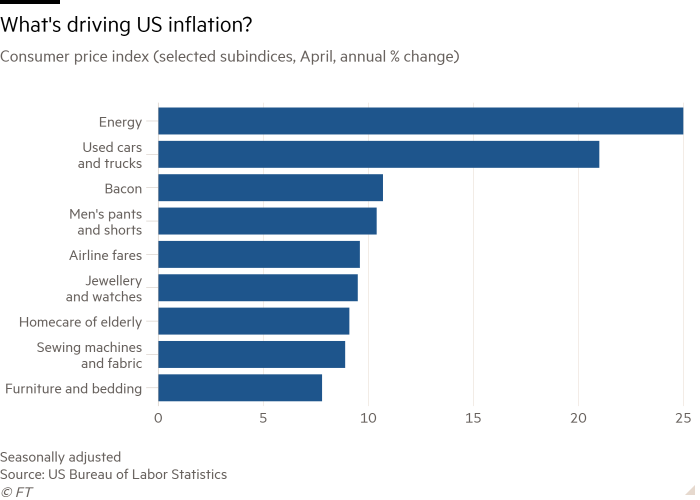

The cost of used cars and trucks increased 10% month-on-month in April and increased 21% compared to a year earlier, making it one of the main engines of 4.2 percent year-on-year increase in the U.S. Consumer Statistics Office’s consumer price index. Core inflation – excluding volatile food and energy prices – reached 3%.

Ernie Garcia, founder of the online used car sales platform Carvana, said: “Prices are certainly higher than they have ever been and they have certainly moved faster than I think they have ever changed. “.

Inflation: a new era?

Prices are rising in many major economies. The FT examines whether inflation has definitely returned.

DAY 1: Advanced economies have not faced rapid inflation for decades. Are you about to change?

DAY 2: Global consensus among central bankers on how best to encourage low and stable inflation has been broken.

DAY 3: The canary in the coal mine by American inflation: used cars.

DAY 4: How a virus can alter official inflation statistics.

DAY 5: Why rising prices in advanced economies is a problem for indebted developing countries.

Politicians insist the pressures will gradually ease, reinforcing their view that the broader inflationary trend will be mainly transient. In a speech Tuesday, Fed Governor Lael Brainard said that while pressures on used vehicle costs “may persist during the summer months, I hope they will fade and probably reverse a bit. in the following quarters “.

But while many economists agree that inflationary pressures are likely to be temporary, they also recognize that uncertainty about the economic outlook is enormous; as the pandemic recedes across America, consumers are on par with government savings and payments, while supply chains are being subjected to bottlenecks.

“We’re seeing a level of stimulus that’s essentially unprecedented in the last 50 years, in addition to other forms of spending support. It’s really unexplored water and we have to be humble,” said Nathan Sheets, chief economist of PGIM Fixed Income and former United States Treasury Secretary. “How sure am I that inflation will dissipate? Probably 80%, but that’s still a pretty fat tail. “

Lael Brainard, governor of the US Federal Reserve, says pressures on the used car market should ease by the end of this year © Taylor Glascock / Bloomberg

The increase in prices is due to the slowdown in the production of new vehicles due to blockages and the shortage of semiconductors.

Also, unusually due to a recession, the number of customers who have defaulted on vehicle financing and recovered their car has declined, cutting off another source of supply for dealers like Cherner.

Meanwhile, demand has grown. Americans ’preferences have shifted away from public transportation because of the pandemic. Stimulus measures have helped them spend. And the rental car companies that sold their fleets when trips collapsed last year are now facing rebuilding them with used vehicles.

“Now it’s incredibly tight: you have more demand. . . this relies on fiscal stimuli, so it’s like a perfect storm. And we’re seeing that clearly in pricing, ”said Laura Rosner, senior economist at MacroPolicy Perspectives.

But Jonathan Smoke of Cox Automotive, a consultant for vehicle dealers, noted that “several key indicators of what’s happening at our auctions” suggest that “the price appreciation streak is likely to end.”

The cost of used American cars and trucks rose 10% month-on-month in April © Justin Sullivan / Getty

This makes U.S. economists and officials consider how long it will take price growth to levels closer to the Fed’s average 2% target, which allows them to be surpassed.

Goldman Sachs predicts core inflation will reach 3.6% year-on-year in June, dropping slightly to 3.5% by the end of the year and averaging 2.7% in 2022.

Fed officials not only observe headline inflation and inflation, but also other measures of price growth.

The core personal consumption spending index, traditionally the Fed’s preferred indicator, rose 3.1% in April, although the Dallas Fed’s cut average PCE indicator rose 1, 8% more modest.

The U.S. central bank has also developed a quarterly index of common inflation expectations to assess whether they are moving away from their targets; its next reading will be in July. Despite these efforts, uncertainty has shaken some economists and investors.

“Overall, our core case on inflation has not changed, but our conviction on this point of view should be lower,” said Lynda Schweitzer, co-head of Loomis Sayles ’global fixed income team. “We need to consider the risks of something more sustained.”

And in Maryland, Cherner is optimistic about the outlook.

“I do not see any sharp drop [in prices] until there is much more supply than demand, “he said.” They still have to build new cars, get the chips and take them out. I just think it will last. ”

[ad_2]

Source link