[ad_1]

Although a hedge in some traditional crypto markets, digital assets today share the same risk as products such as oil and gas, and technology and pharmaceutical stocks, according to Coinbase chief economist.

“The relationship between stock and crypto-asset prices has increased dramatically since the 2020 pandemic,” said Cesar Fraracsi, chief economist at Coinbase on July 6.

“During the first decade of its existence, Bitcoin returns were largely unrelated to the stock market performance, and the relationship has grown rapidly since the onset of the COVID epidemic,” says Frakasi.

“Crypto assets in particular today share the same risk profile as oil prices and technology stocks.”

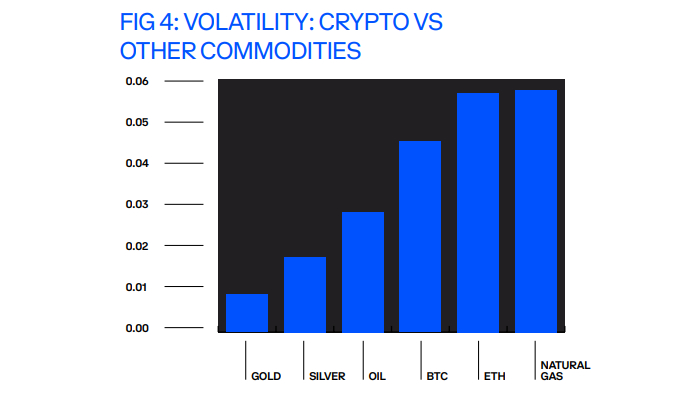

According to the Institute’s monthly Consensus Report in May, Bitcoin and Ethereum have similar volatility in products such as natural gas and oil, which fluctuate between 4% and 5% daily.

Since 2020, the link between the crypto and stock markets has grown and we will see how the market expects more and more integration with the rest of the financial system in the future. (4/5)

– Cesare Fracassi (@CesareFracassi) July 5, 2022

Bitcoin is often compared to “digital gold” and has a much more dangerous profile compared to its real-world precious metals, such as gold and silver, with daily fluctuations between 1% and 2%, according to the study.

In terms of volatility and market capitalization, the most accurate stock compared to Bitcoin is TSLA Economist.

Ethereum, on the other hand, is based on market capitalization and flexibility from electric car manufacturer LCID and pharmaceutical company Moderna (MRNA).

Fracassi says this puts crypto assets in a very similar risk profile to traditional assets such as technology stocks.

“This indicates that the market expects crypto assets to become more integrated with the rest of the financial system and thus be exposed to the same macroeconomic forces operating in the global economy.”

He added that two-thirds of the recent decline in crypto prices is due to macro factors – such as inflation and the looming economic downturn. One-third of Crypto’s depreciation can be attributed to an “old-fashioned” weak-minded attitude.

Matching The crypto industry needs a crypto capital market structure

Crypto experts have found that the failure of crypto-currencies is a positive sign for the industry.

Eric Vorhees, co-founder and CEO of Coinapult and ShapeShift founder, wrote on: Twitter Last week’s current crash was not a major concern for him, as the first crypto crash was clearly “the result of macro factors outside of crypto.”

Alliance DAO Chief Contributor Qiao Wang developed the same Commenting on his Twitter page, the previous cycles were caused by “internal” factors such as the 2014 Matt Gox crash and the first ICO bubble explosion in 2018.

[ad_2]

Source link